Form FIN151 Authorization or Cancellation of a Representative Sbr Gov Bc

What is the Form FIN151 Authorization Or Cancellation Of A Representative Sbr Gov Bc

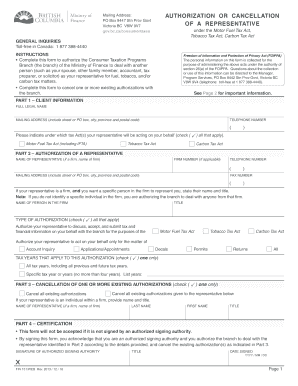

The Form FIN151 is an official document used in the United States to authorize or cancel a representative for tax-related matters. This form allows taxpayers to designate an individual or organization to act on their behalf in dealings with tax authorities. It is essential for ensuring that the designated representative has the authority to receive confidential information and make decisions regarding the taxpayer's account. The form is particularly relevant for individuals who may require assistance in navigating complex tax issues or those who prefer to have a professional handle their tax affairs.

How to use the Form FIN151 Authorization Or Cancellation Of A Representative Sbr Gov Bc

To effectively use the Form FIN151, taxpayers must first complete the document with accurate information, including their personal details and those of the representative. After filling out the form, it should be submitted to the appropriate tax authority. This process ensures that the designated representative can legally act on behalf of the taxpayer. It is important to keep a copy of the completed form for personal records. If the taxpayer decides to cancel the authorization, a new Form FIN151 should be submitted to revoke the previous authorization.

Steps to complete the Form FIN151 Authorization Or Cancellation Of A Representative Sbr Gov Bc

Completing the Form FIN151 involves several clear steps:

- Gather necessary information, including the taxpayer's name, address, and identification number.

- Provide details about the representative, including their name, contact information, and relationship to the taxpayer.

- Indicate the specific tax matters for which the representative is authorized.

- Sign and date the form to validate the authorization.

- Submit the completed form to the relevant tax authority, either online or by mail.

Key elements of the Form FIN151 Authorization Or Cancellation Of A Representative Sbr Gov Bc

The Form FIN151 contains several key elements that are crucial for its validity:

- Taxpayer Information: This section requires the taxpayer's full name, address, and identification number.

- Representative Information: Details about the representative, including their name and contact information, must be clearly stated.

- Scope of Authorization: Taxpayers must specify the tax matters for which the representative is authorized to act.

- Signature: The taxpayer's signature is required to validate the authorization.

Legal use of the Form FIN151 Authorization Or Cancellation Of A Representative Sbr Gov Bc

The legal use of the Form FIN151 is governed by tax regulations that allow taxpayers to appoint representatives for their tax matters. This form ensures that the appointed representative has the authority to receive sensitive information and communicate with tax authorities on behalf of the taxpayer. It is crucial for taxpayers to understand that the authorization granted through this form is legally binding, and any misuse can lead to penalties or legal complications.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the Form FIN151 through various methods, depending on the requirements of the relevant tax authority. Common submission methods include:

- Online Submission: Some tax authorities may offer online portals for submitting the form electronically.

- Mail: Taxpayers can print the completed form and mail it to the designated address provided by the tax authority.

- In-Person Submission: In certain cases, taxpayers may choose to submit the form in person at their local tax office.

Quick guide on how to complete form fin151 authorization or cancellation of a representative sbr gov bc

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among companies and individuals alike. It offers a perfect environmentally-friendly substitution for traditional printed and signed documents, allowing you to obtain the correct version and securely keep it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and electronically sign your documents swiftly without interruptions. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-centric procedure today.

Ways to Modify and Electronically Sign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with the tools that airSlate SignNow specifically offers for that task.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to share your document, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Revise and electronically sign [SKS] to ensure outstanding communication throughout all stages of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form FIN151 Authorization Or Cancellation Of A Representative Sbr Gov Bc

Create this form in 5 minutes!

How to create an eSignature for the form fin151 authorization or cancellation of a representative sbr gov bc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form FIN151 Authorization Or Cancellation Of A Representative Sbr Gov Bc?

The Form FIN151 Authorization Or Cancellation Of A Representative Sbr Gov Bc is a document used in British Columbia to authorize or cancel a representative for various services. This form is essential for ensuring that the right individuals have the authority to act on your behalf in specific matters.

-

How can airSlate SignNow help with the Form FIN151 Authorization Or Cancellation Of A Representative Sbr Gov Bc?

airSlate SignNow provides a seamless platform for completing and eSigning the Form FIN151 Authorization Or Cancellation Of A Representative Sbr Gov Bc. Our user-friendly interface allows you to fill out the form quickly and securely, ensuring compliance with all necessary regulations.

-

Is there a cost associated with using airSlate SignNow for the Form FIN151 Authorization Or Cancellation Of A Representative Sbr Gov Bc?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Each plan includes features that facilitate the completion and eSigning of documents like the Form FIN151 Authorization Or Cancellation Of A Representative Sbr Gov Bc, making it a cost-effective solution.

-

What features does airSlate SignNow offer for managing the Form FIN151 Authorization Or Cancellation Of A Representative Sbr Gov Bc?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools enhance the process of managing the Form FIN151 Authorization Or Cancellation Of A Representative Sbr Gov Bc, ensuring that you can easily monitor its status and maintain compliance.

-

Can I integrate airSlate SignNow with other applications for the Form FIN151 Authorization Or Cancellation Of A Representative Sbr Gov Bc?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the Form FIN151 Authorization Or Cancellation Of A Representative Sbr Gov Bc. This connectivity enhances productivity by enabling data transfer between platforms.

-

What are the benefits of using airSlate SignNow for the Form FIN151 Authorization Or Cancellation Of A Representative Sbr Gov Bc?

Using airSlate SignNow for the Form FIN151 Authorization Or Cancellation Of A Representative Sbr Gov Bc provides numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform ensures that your documents are handled efficiently and securely, reducing the risk of errors.

-

Is airSlate SignNow compliant with legal standards for the Form FIN151 Authorization Or Cancellation Of A Representative Sbr Gov Bc?

Yes, airSlate SignNow is designed to comply with legal standards for electronic signatures and document management. This compliance ensures that your Form FIN151 Authorization Or Cancellation Of A Representative Sbr Gov Bc is legally binding and recognized by authorities.

Get more for Form FIN151 Authorization Or Cancellation Of A Representative Sbr Gov Bc

Find out other Form FIN151 Authorization Or Cancellation Of A Representative Sbr Gov Bc

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later