Form 546 IFA Tax Refund of a Life Science Corporation Sbr Gov Bc

What is the Form 546 IFA Tax Refund Of A Life Science Corporation Sbr Gov Bc

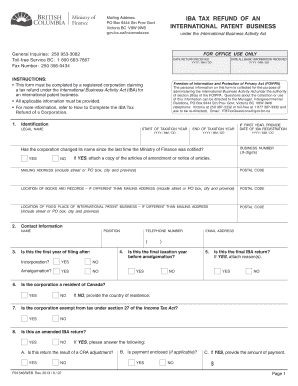

The Form 546 IFA Tax Refund is a specific document used by life science corporations in the United States to apply for tax refunds under the Investment Tax Credit (ITC) program. This form is particularly relevant for businesses engaged in research and development within the life sciences sector. The form allows eligible corporations to claim refunds for taxes paid on qualified investments, thereby facilitating growth and innovation in the industry.

How to use the Form 546 IFA Tax Refund Of A Life Science Corporation Sbr Gov Bc

To effectively use the Form 546 IFA Tax Refund, corporations need to gather all necessary financial documentation that supports their claims. This includes records of eligible expenses and investments made in research and development. Once the form is completed, it should be submitted to the appropriate state tax authority for processing. Understanding the specific requirements and guidelines for submission is crucial to ensure compliance and avoid delays.

Steps to complete the Form 546 IFA Tax Refund Of A Life Science Corporation Sbr Gov Bc

Completing the Form 546 involves several key steps:

- Gather all relevant financial documents, including receipts and investment records.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with supporting documents to the designated tax authority.

Required Documents

When filing the Form 546 IFA Tax Refund, certain documents are essential to substantiate the claims made. These typically include:

- Proof of eligible expenses, such as invoices and receipts.

- Financial statements that reflect the corporation's investment activities.

- Any previous tax filings relevant to the current refund request.

Eligibility Criteria

Eligibility for the Form 546 IFA Tax Refund is primarily determined by the nature of the corporation's activities. To qualify, a life science corporation must demonstrate that it is engaged in research and development activities that meet specific criteria set forth by the tax authority. Additionally, the corporation must have incurred eligible expenses related to these activities within the designated tax period.

Form Submission Methods (Online / Mail / In-Person)

The Form 546 can typically be submitted through various methods, depending on the specific requirements of the state tax authority. Common submission methods include:

- Online submission through the state tax authority's official website.

- Mailing the completed form and supporting documents to the designated address.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete form 546 ifa tax refund of a life science corporation sbr gov bc

Complete [SKS] effortlessly on any device

Web-based document management has become increasingly favored by both businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can obtain the correct version and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest method to alter and eSign [SKS] without any hassle

- Obtain [SKS] and then click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Forge your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to store your adjustments.

- Select your preferred method to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your requirements in document management in just a few clicks from your chosen device. Modify and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 546 IFA Tax Refund Of A Life Science Corporation Sbr Gov Bc

Create this form in 5 minutes!

How to create an eSignature for the form 546 ifa tax refund of a life science corporation sbr gov bc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 546 IFA Tax Refund Of A Life Science Corporation Sbr Gov Bc?

The Form 546 IFA Tax Refund Of A Life Science Corporation Sbr Gov Bc is a specific tax refund application designed for life science corporations in British Columbia. This form allows eligible businesses to claim refunds on eligible expenditures related to scientific research and experimental development. Understanding this form is crucial for maximizing your tax benefits.

-

How can airSlate SignNow help with the Form 546 IFA Tax Refund Of A Life Science Corporation Sbr Gov Bc?

airSlate SignNow streamlines the process of preparing and submitting the Form 546 IFA Tax Refund Of A Life Science Corporation Sbr Gov Bc. Our platform allows you to easily eSign and send documents securely, ensuring compliance and efficiency. This can signNowly reduce the time spent on paperwork and enhance your overall experience.

-

What are the pricing options for using airSlate SignNow for Form 546 IFA Tax Refund Of A Life Science Corporation Sbr Gov Bc?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that support the preparation and submission of the Form 546 IFA Tax Refund Of A Life Science Corporation Sbr Gov Bc, ensuring you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Form 546 IFA Tax Refund Of A Life Science Corporation Sbr Gov Bc?

Our platform provides a range of features designed to simplify the management of the Form 546 IFA Tax Refund Of A Life Science Corporation Sbr Gov Bc. These include customizable templates, secure eSigning, document tracking, and integration with other tools. This comprehensive approach ensures that you can handle your tax refund applications efficiently.

-

Are there any benefits to using airSlate SignNow for the Form 546 IFA Tax Refund Of A Life Science Corporation Sbr Gov Bc?

Using airSlate SignNow for the Form 546 IFA Tax Refund Of A Life Science Corporation Sbr Gov Bc offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform allows for quick document turnaround and easy collaboration among team members. This ultimately leads to a smoother refund process.

-

Can airSlate SignNow integrate with other software for the Form 546 IFA Tax Refund Of A Life Science Corporation Sbr Gov Bc?

Yes, airSlate SignNow seamlessly integrates with various software applications to enhance your workflow for the Form 546 IFA Tax Refund Of A Life Science Corporation Sbr Gov Bc. This includes accounting software, CRM systems, and more, allowing you to manage your documents and data in one place. Integration helps streamline the entire refund process.

-

Is airSlate SignNow user-friendly for preparing the Form 546 IFA Tax Refund Of A Life Science Corporation Sbr Gov Bc?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to prepare the Form 546 IFA Tax Refund Of A Life Science Corporation Sbr Gov Bc. Our intuitive interface and helpful resources ensure that you can navigate the platform with ease, regardless of your technical expertise.

Get more for Form 546 IFA Tax Refund Of A Life Science Corporation Sbr Gov Bc

Find out other Form 546 IFA Tax Refund Of A Life Science Corporation Sbr Gov Bc

- Sign Education PPT Arizona Fast

- Sign Alaska Education RFP Mobile

- How Can I Sign Arizona Education Business Plan Template

- Sign Alaska Education RFP Later

- Sign Alaska Education RFP Now

- Can I Sign Arizona Education Business Plan Template

- Sign Alaska Education RFP Myself

- Sign Education PPT Arizona Simple

- Sign Alaska Education RFP Free

- Sign Alaska Education RFP Fast

- Sign Alaska Education RFP Secure

- Sign Education PPT Arizona Easy

- Sign Alaska Education RFP Simple

- Sign Alaska Education RFP Easy

- Sign Education PPT Arizona Safe

- Sign Alaska Education RFP Safe

- Sign Education Presentation Arizona Online

- Sign Education Presentation Arizona Computer

- How To Sign Alaska Education RFP

- How Do I Sign Alaska Education RFP