Dr1002 Form

What is the Dr1002 Form

The Dr1002 form, also known as the Colorado Use Tax Return, is a crucial document for individuals and businesses in Colorado to report and pay use tax on items purchased outside the state for use within Colorado. This form is essential for ensuring compliance with state tax laws, particularly for those who may not have paid sales tax at the time of purchase. The use tax is designed to level the playing field between in-state and out-of-state sellers, promoting fair competition.

How to use the Dr1002 Form

Using the Dr1002 form involves several straightforward steps. First, gather all necessary information regarding your purchases, including dates, descriptions, and costs. Next, accurately complete the form by entering the total amount of taxable purchases made during the reporting period. Be sure to calculate the use tax owed based on the current Colorado tax rate. Finally, submit the completed form to the Colorado Department of Revenue by the specified deadline, ensuring that you include any payment due.

Steps to complete the Dr1002 Form

Completing the Dr1002 form requires careful attention to detail. Follow these steps for accurate submission:

- Gather your receipts and records of purchases made outside Colorado.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- List each purchase, providing details such as the item description, purchase date, and amount.

- Calculate the total use tax owed based on the applicable tax rate for Colorado.

- Review the form for accuracy before submission.

Legal use of the Dr1002 Form

The Dr1002 form is legally binding and must be completed accurately to comply with Colorado tax laws. Failing to report use tax can result in penalties and interest charges. It is essential to understand that this form serves as a declaration of your taxable purchases and is subject to audit by the Colorado Department of Revenue. Proper use of the form ensures that you meet your tax obligations while avoiding potential legal issues.

Filing Deadlines / Important Dates

Timely filing of the Dr1002 form is crucial to avoid penalties. The filing deadlines typically align with the state's tax calendar. Generally, forms are due on the last day of the month following the end of each quarter. For example, the first quarter's filings are due by April 30. It is important to stay informed about any changes to deadlines or requirements to ensure compliance.

Required Documents

To complete the Dr1002 form, you will need specific documents to support your claims. These include:

- Receipts or invoices for all taxable purchases made outside Colorado.

- Records of any sales tax paid at the time of purchase.

- Your previous tax returns, if applicable, for reference.

Having these documents ready will facilitate a smooth completion process and help ensure accuracy in reporting.

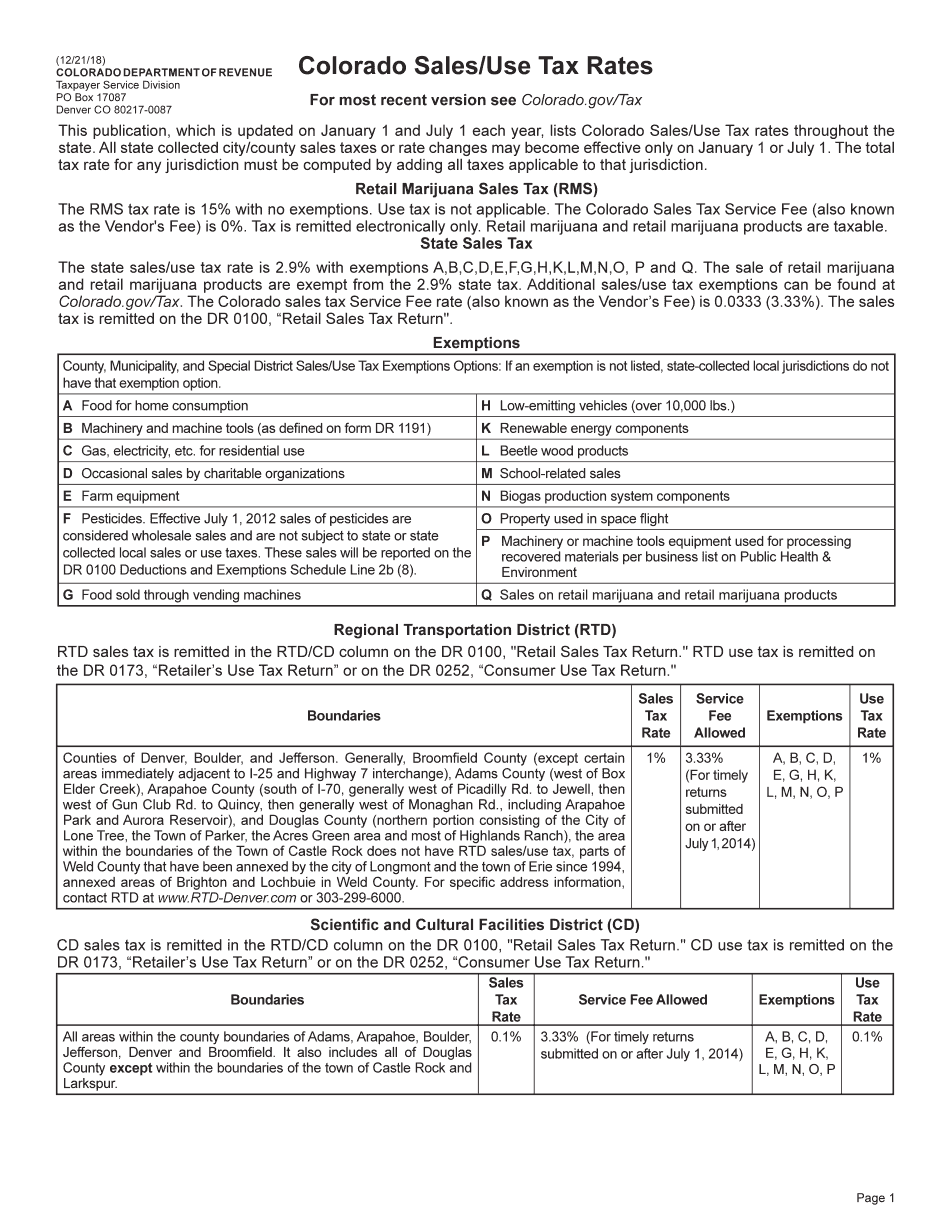

Quick guide on how to complete this publication which is updated on january 1 and july 1 each year lists colorado salesuse tax rates throughout the

Effortlessly prepare Dr1002 Form on any gadget

Digital document oversight has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to acquire the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents quickly without any hold-ups. Manage Dr1002 Form on any gadget using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Dr1002 Form with ease

- Obtain Dr1002 Form and then click Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Mark signNow sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that function.

- Generate your eSignature with the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Adjust and eSign Dr1002 Form and ensure outstanding communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the this publication which is updated on january 1 and july 1 each year lists colorado salesuse tax rates throughout the

How to make an eSignature for your This Publication Which Is Updated On January 1 And July 1 Each Year Lists Colorado Salesuse Tax Rates Throughout The online

How to create an electronic signature for the This Publication Which Is Updated On January 1 And July 1 Each Year Lists Colorado Salesuse Tax Rates Throughout The in Chrome

How to generate an electronic signature for putting it on the This Publication Which Is Updated On January 1 And July 1 Each Year Lists Colorado Salesuse Tax Rates Throughout The in Gmail

How to create an eSignature for the This Publication Which Is Updated On January 1 And July 1 Each Year Lists Colorado Salesuse Tax Rates Throughout The from your smart phone

How to make an eSignature for the This Publication Which Is Updated On January 1 And July 1 Each Year Lists Colorado Salesuse Tax Rates Throughout The on iOS

How to generate an electronic signature for the This Publication Which Is Updated On January 1 And July 1 Each Year Lists Colorado Salesuse Tax Rates Throughout The on Android devices

People also ask

-

What is airSlate SignNow and how does it co use with our business workflows?

airSlate SignNow is a powerful eSignature solution designed to streamline document management. It allows businesses to co use digital signatures within their existing workflows, enhancing efficiency and reducing turnaround times. With airSlate SignNow, you can easily integrate eSigning into your daily operations.

-

How does the pricing for airSlate SignNow work for businesses looking to co use its features?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. By co using the platform's features, companies can choose a plan that suits their needs and budget effectively. Each plan provides access to essential eSigning capabilities, ensuring you get the most value for your investment.

-

What features does airSlate SignNow provide to help teams co use it effectively?

airSlate SignNow includes a range of features such as customizable templates, automated workflows, and real-time tracking. These tools enable teams to co use the platform effortlessly, maximizing productivity while ensuring compliance. The user-friendly interface makes it easy for everyone to get started.

-

What are the benefits of using airSlate SignNow to co use eSignatures in our organization?

By co using airSlate SignNow for eSignatures, organizations can signNowly reduce paperwork and speed up document approval processes. This leads to faster deal closures and improved customer experiences. Additionally, the security features ensure that all signatures are compliant with legal standards.

-

Can airSlate SignNow co use with other software tools our business currently uses?

Yes, airSlate SignNow can co use with various software tools, including CRM systems and document management applications. This integration enhances your existing software ecosystem by adding eSigning capabilities without disrupting your current workflow. The API allows for seamless connectivity between applications.

-

Is it easy for new users to co use airSlate SignNow for the first time?

Absolutely! airSlate SignNow is designed to be user-friendly, making it easy for new users to co use the platform without extensive training. With guided tutorials and responsive customer support, anyone can quickly learn how to send, sign, and manage documents efficiently.

-

How secure is airSlate SignNow for co using confidential documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance with regulations like GDPR and HIPAA. When businesses co use airSlate SignNow for sensitive documents, they can trust that their information is protected and secure. Regular security audits further ensure the platform's reliability.

Get more for Dr1002 Form

Find out other Dr1002 Form

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later