Fl Dr700016 Form

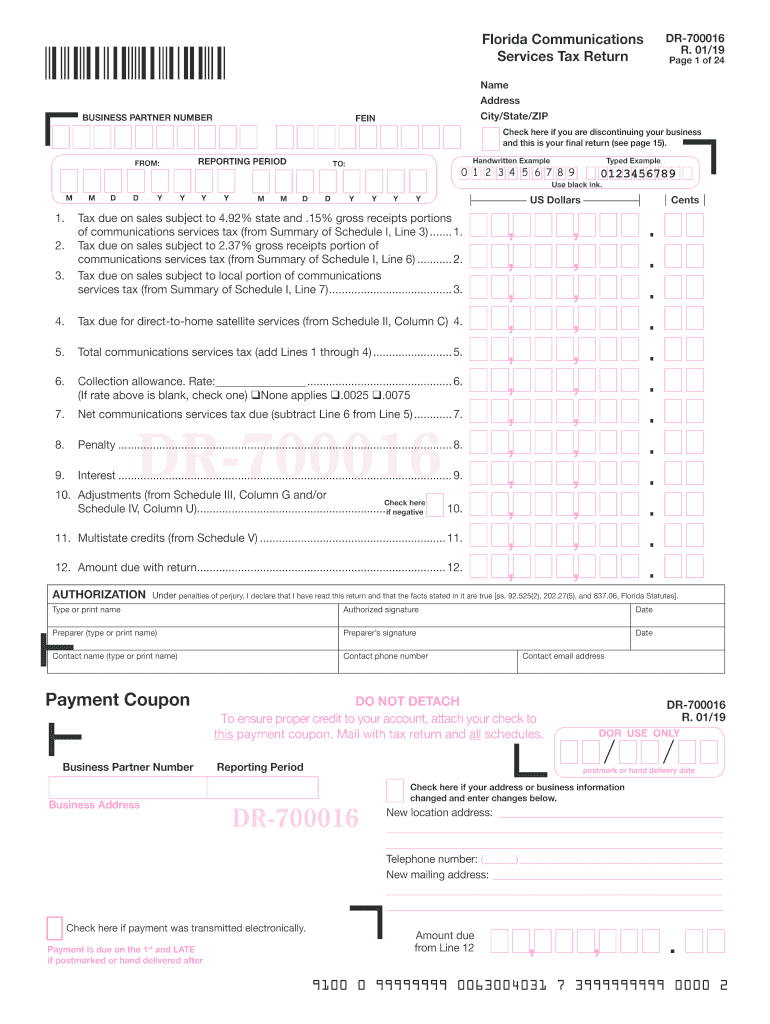

What is the FL DR700016?

The FL DR700016 is a form used in Florida for the purpose of reporting business partner numbers. This form is essential for businesses operating within the state, as it helps in maintaining compliance with state regulations. The information collected on the FL DR700016 is used by state authorities to verify the legitimacy of business partnerships and ensure proper tax reporting.

How to Use the FL DR700016

Using the FL DR700016 involves several straightforward steps. First, gather all necessary information regarding your business partners, including their legal names and identification numbers. Next, accurately fill out the form, ensuring that all details are correct and up-to-date. Once completed, the form can be submitted electronically or via traditional mail, depending on your preference and the requirements set forth by the state.

Steps to Complete the FL DR700016

Completing the FL DR700016 requires careful attention to detail. Follow these steps for accurate submission:

- Collect all relevant partner information, including names and identification numbers.

- Fill out the form clearly, ensuring no fields are left blank.

- Review the completed form for accuracy and completeness.

- Submit the form online or by mail, following the specific submission guidelines provided by the state.

Legal Use of the FL DR700016

The FL DR700016 is legally recognized as a valid document for reporting business partner numbers in the state of Florida. When filled out correctly, it serves as a formal declaration of partnership details, which can be used in various legal and financial contexts. Compliance with state regulations is crucial, as improper use or submission of this form may lead to penalties or legal complications.

Required Documents

To successfully complete the FL DR700016, certain documents may be required. These typically include:

- Identification numbers for each business partner.

- Legal names of all partners involved.

- Any previous forms or documentation related to business partnerships.

Form Submission Methods

The FL DR700016 can be submitted through various methods, ensuring flexibility for users. Options include:

- Online submission via the state’s official portal.

- Mailing the completed form to the appropriate state office.

- In-person submission at designated state offices, if required.

Penalties for Non-Compliance

Failure to submit the FL DR700016 or inaccuracies within the form can result in penalties. These may include fines, legal action, or complications in business operations. It is crucial for businesses to adhere to submission deadlines and ensure that all information provided is accurate to avoid such consequences.

Quick guide on how to complete tax rate by zip code coupon getcouponnowcom

Effortlessly Prepare Fl Dr700016 on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents rapidly without any holdups. Manage Fl Dr700016 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Easy Steps to Edit and Electronically Sign Fl Dr700016

- Obtain Fl Dr700016 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of the documents or redact sensitive information with the tools airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign Fl Dr700016 to facilitate outstanding communication at every step of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax rate by zip code coupon getcouponnowcom

How to make an electronic signature for your Tax Rate By Zip Code Coupon Getcouponnowcom online

How to create an eSignature for your Tax Rate By Zip Code Coupon Getcouponnowcom in Chrome

How to make an eSignature for putting it on the Tax Rate By Zip Code Coupon Getcouponnowcom in Gmail

How to make an eSignature for the Tax Rate By Zip Code Coupon Getcouponnowcom from your smartphone

How to generate an eSignature for the Tax Rate By Zip Code Coupon Getcouponnowcom on iOS devices

How to make an electronic signature for the Tax Rate By Zip Code Coupon Getcouponnowcom on Android

People also ask

-

What is Fl Dr700016 and how does it relate to airSlate SignNow?

Fl Dr700016 refers to a specific document management feature within airSlate SignNow that enhances your ability to eSign and manage documents efficiently. This feature is designed to streamline the signing process, ensuring that users can easily send and receive legally binding signatures.

-

How much does airSlate SignNow cost for users interested in Fl Dr700016?

The pricing for airSlate SignNow, including access to the Fl Dr700016 feature, varies based on the subscription plan you choose. We offer flexible pricing tiers that cater to businesses of all sizes, ensuring you get the best value for the features you need, including advanced document management capabilities.

-

What are the key features of Fl Dr700016 in airSlate SignNow?

Fl Dr700016 includes several key features such as customizable templates, automated workflows, and real-time tracking of document status. These features are designed to enhance user experience, making it easier to manage eSignatures and documents securely and efficiently.

-

How does Fl Dr700016 benefit businesses using airSlate SignNow?

Businesses utilizing Fl Dr700016 within airSlate SignNow can signNowly enhance their operational efficiency. By automating document workflows and providing a seamless eSigning experience, companies can save time and reduce paper usage, ultimately improving overall productivity.

-

Can Fl Dr700016 integrate with other software tools?

Yes, Fl Dr700016 within airSlate SignNow supports integration with various third-party applications, enhancing its functionality. This allows businesses to streamline their processes by connecting with CRM tools, cloud storage services, and more, making document management even more efficient.

-

Is Fl Dr700016 suitable for all types of businesses?

Absolutely! Fl Dr700016 is designed to cater to the needs of businesses of all sizes and industries. Whether you're a small startup or a large corporation, airSlate SignNow provides the flexibility and features necessary for effective document management and eSigning.

-

What security measures does airSlate SignNow implement for Fl Dr700016?

airSlate SignNow prioritizes security for all its features, including Fl Dr700016. We employ industry-standard encryption, secure data storage, and compliance with regulations such as GDPR and HIPAA, ensuring that your documents and personal information remain protected.

Get more for Fl Dr700016

- Form pi 232 ampquotpesticide applicator certificationregistration

- Talent management contract template form

- Task order contract template form

- Talent manager contract template form

- Tattoo apprenticeship contract template form

- Tattoo artist contract template form

- Tattoo contract template form

- Tattoo shop contract template form

Find out other Fl Dr700016

- Electronic signature Maryland Roommate Rental Agreement Template Later

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free