Property Tax Form 50 114

What is the Property Tax Form 50-114?

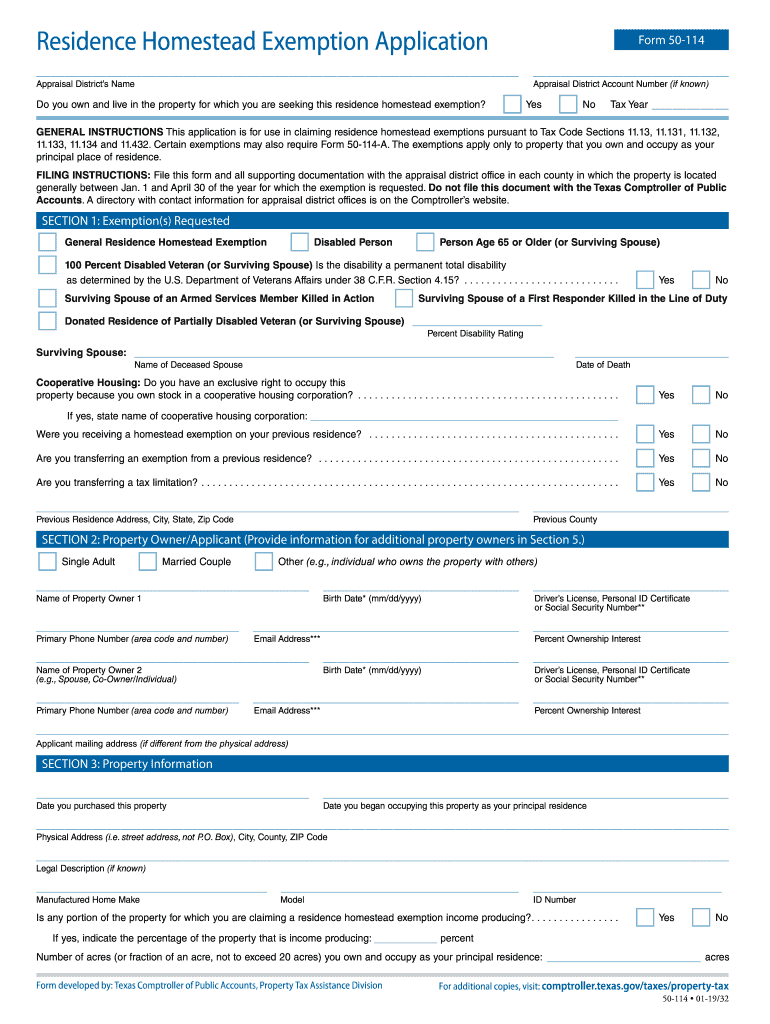

The Property Tax Form 50-114 is a crucial document used in Texas to apply for a homestead exemption. This exemption can significantly reduce the amount of property taxes owed by homeowners. The form is specifically designed for individuals seeking to claim their primary residence as a homestead, allowing them to benefit from tax savings. It is essential for property owners to understand this form to ensure they receive the financial relief they are entitled to under Texas law.

Steps to Complete the Property Tax Form 50-114

Completing the Property Tax Form 50-114 involves several important steps. First, gather all necessary information, including your property details and personal identification. Next, accurately fill out the form, ensuring that all sections are completed, including your name, address, and the legal description of the property. Once the form is filled out, review it for any errors or omissions. Finally, submit the completed form to your local appraisal district by the designated deadline to ensure your exemption is processed.

How to Obtain the Property Tax Form 50-114

The Property Tax Form 50-114 can be obtained through various channels. Homeowners can visit their local appraisal district's office to request a physical copy. Additionally, the form is available online through the Texas Comptroller's website, where it can be downloaded and printed. This accessibility ensures that all eligible homeowners can easily acquire the form and apply for their homestead exemption.

Eligibility Criteria for the Property Tax Form 50-114

To qualify for the homestead exemption using the Property Tax Form 50-114, certain eligibility criteria must be met. The applicant must own the property and use it as their primary residence. Furthermore, the homeowner must not have claimed a homestead exemption on another property in Texas or any other state. Understanding these criteria is vital for ensuring that your application is valid and that you can take advantage of the tax benefits available.

Form Submission Methods for Property Tax Form 50-114

Submitting the Property Tax Form 50-114 can be done through various methods. Homeowners have the option to submit the form in person at their local appraisal district office. Alternatively, the form can be mailed to the appropriate office address. Some appraisal districts may also offer online submission options, allowing for a more convenient process. It is important to check with your local district for specific submission methods and any associated deadlines.

Legal Use of the Property Tax Form 50-114

The Property Tax Form 50-114 is legally binding once it is completed and submitted according to Texas law. This means that the information provided must be accurate and truthful, as any misrepresentation can lead to penalties or denial of the exemption. Understanding the legal implications of this form is essential for homeowners to ensure compliance and protect their rights to the homestead exemption.

Key Elements of the Property Tax Form 50-114

Several key elements must be included in the Property Tax Form 50-114 for it to be valid. These elements include the applicant's name, the property address, and the legal description of the property. Additionally, the form requires the applicant to provide information regarding their eligibility for the exemption. Ensuring that all these components are accurately filled out is crucial for a successful application and for receiving the intended tax benefits.

Quick guide on how to complete appraisal district account number if known

Complete Property Tax Form 50 114 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly solution to traditional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Property Tax Form 50 114 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Property Tax Form 50 114 with ease

- Find Property Tax Form 50 114 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to submit your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Property Tax Form 50 114 and ensure excellent communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the appraisal district account number if known

How to generate an electronic signature for your Appraisal District Account Number If Known in the online mode

How to generate an electronic signature for your Appraisal District Account Number If Known in Google Chrome

How to make an eSignature for putting it on the Appraisal District Account Number If Known in Gmail

How to generate an electronic signature for the Appraisal District Account Number If Known right from your smart phone

How to create an eSignature for the Appraisal District Account Number If Known on iOS

How to generate an eSignature for the Appraisal District Account Number If Known on Android devices

People also ask

-

What is the honmestead form 50 114 a?

The honmestead form 50 114 a is a specific document that allows homeowners to apply for a homestead exemption. This exemption can signNowly reduce property taxes, making it a beneficial application for eligible residents. Using airSlate SignNow, you can easily complete and submit the honmestead form 50 114 a electronically.

-

How can airSlate SignNow help with the honmestead form 50 114 a?

airSlate SignNow streamlines the process of filling out and eSigning the honmestead form 50 114 a. Our platform allows users to complete the form online, gather necessary signatures, and securely submit it, all in one place. This saves time and ensures accuracy across all entries in your application.

-

Is there a cost associated with using airSlate SignNow for the honmestead form 50 114 a?

While the airSlate SignNow platform requires a subscription, it offers a cost-effective solution for managing the honmestead form 50 114 a. Different pricing tiers cater to various needs, making it affordable for both individuals and businesses. Consider the potential savings on property taxes when evaluating the overall value.

-

What features does airSlate SignNow offer for eSigning the honmestead form 50 114 a?

airSlate SignNow offers a range of features for eSigning the honmestead form 50 114 a, including customizable templates, audit trails, and secure cloud storage. These features ensure that your documents are not only signed legally but also organized and easily accessible. Plus, you can track your document's status at any time.

-

Can I integrate airSlate SignNow with other software for the honmestead form 50 114 a?

Yes, airSlate SignNow is designed to seamlessly integrate with various software applications. This capability enhances the management of the honmestead form 50 114 a by allowing forms to sync with your existing business software, enabling easier data transfer and improved workflow efficiency.

-

What are the benefits of using airSlate SignNow for the honmestead form 50 114 a?

The primary benefits of using airSlate SignNow for the honmestead form 50 114 a include increased efficiency and reduced paperwork. The platform makes it easy to complete and submit forms electronically, eliminating the hassle of physical paperwork. Additionally, your documents are securely stored and easily retrievable.

-

How secure is the information submitted via the honmestead form 50 114 a using airSlate SignNow?

Security is a top priority for airSlate SignNow. When you submit the honmestead form 50 114 a through our platform, your data is protected with advanced encryption technologies. You can trust that your personal information and signatures are safe and confidential throughout the signing process.

Get more for Property Tax Form 50 114

- Contractor and subcontractor csc401 nielsen enviro form

- City of fort smith form

- Written employment and education verification bformb

- Registered tow truck operator impounded vehicle hearing request file this request with the districtmunicipal court in the form

- Subleas contract template form

- Subject to real estate contract template form

- Sublet room contract template form

- Sublet contract template form

Find out other Property Tax Form 50 114

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document