SMALL BUSINESS TAX WORKSHEET Independent Accountants Form

What is the SMALL BUSINESS TAX WORKSHEET Independent Accountants

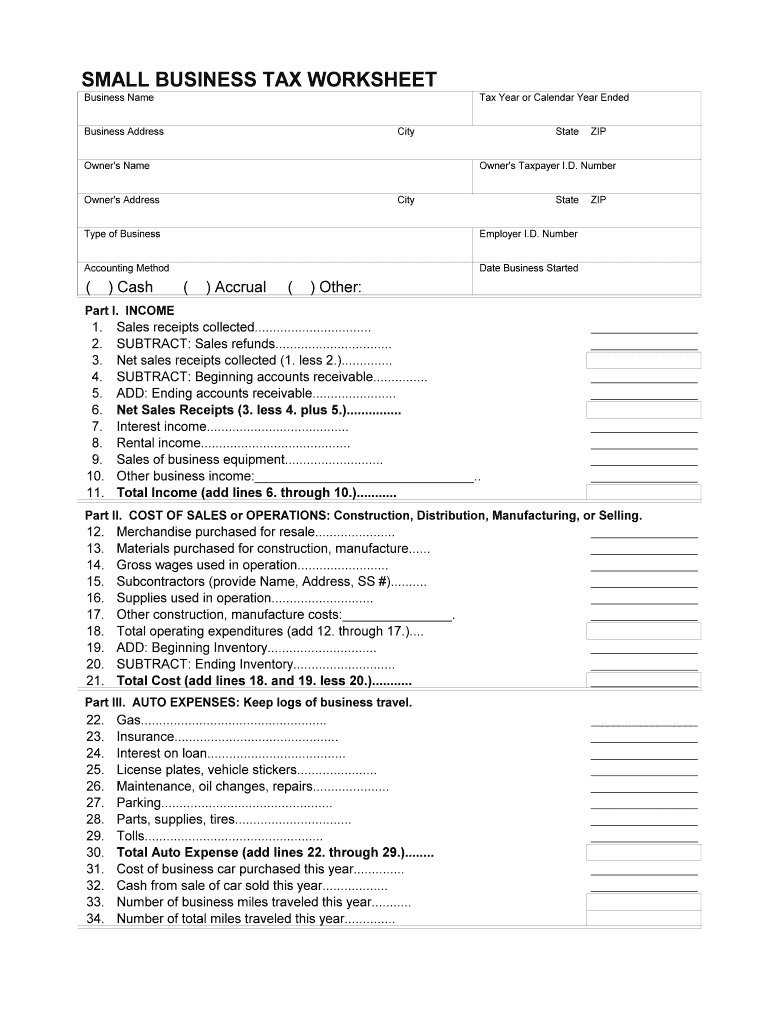

The SMALL BUSINESS TAX WORKSHEET for Independent Accountants is a crucial document designed to assist small business owners in organizing their financial information for tax purposes. This worksheet helps streamline the process of preparing taxes by providing a structured format for recording income, expenses, and deductions. It is particularly beneficial for independent accountants who work with small businesses, enabling them to gather necessary data efficiently and accurately.

How to use the SMALL BUSINESS TAX WORKSHEET Independent Accountants

Using the SMALL BUSINESS TAX WORKSHEET involves several straightforward steps. First, gather all relevant financial documents, such as income statements, receipts for expenses, and previous tax returns. Next, fill out the worksheet by categorizing income and expenses according to the designated sections. This organization helps ensure that all financial information is captured accurately. Once completed, the worksheet can be used as a reference for preparing the tax return, making it easier for accountants to identify deductions and credits applicable to the business.

Steps to complete the SMALL BUSINESS TAX WORKSHEET Independent Accountants

Completing the SMALL BUSINESS TAX WORKSHEET requires careful attention to detail. Begin with the following steps:

- Collect all necessary financial documents, including bank statements and invoices.

- Input total income from all sources into the designated income section.

- Document all business-related expenses, ensuring each is categorized correctly.

- Calculate total deductions by summing up all eligible expenses.

- Review the worksheet for accuracy and completeness before finalizing.

Key elements of the SMALL BUSINESS TAX WORKSHEET Independent Accountants

The SMALL BUSINESS TAX WORKSHEET includes several key elements essential for tax preparation. These elements typically encompass:

- Income Section: A detailed account of all revenue streams.

- Expense Categories: Sections for various types of expenses, such as operational costs, salaries, and utilities.

- Deductions: A summary of all deductions that can be claimed to reduce taxable income.

- Net Profit Calculation: A formula to determine the overall profit after deductions.

IRS Guidelines

It is essential to adhere to IRS guidelines when using the SMALL BUSINESS TAX WORKSHEET. The IRS provides specific instructions regarding what constitutes deductible expenses and how to report income. Familiarizing oneself with these guidelines ensures compliance and minimizes the risk of errors during tax filing. Accountants should regularly check for updates to IRS regulations that may affect the information recorded on the worksheet.

Filing Deadlines / Important Dates

Filing deadlines are critical for small business owners and their accountants. Generally, the deadline for filing federal income tax returns for most small businesses is April 15. However, this date may vary based on the business structure, such as partnerships or corporations. It is advisable to mark important dates on a calendar to ensure timely submission of the tax return and avoid potential penalties.

Quick guide on how to complete small business tax worksheet independent accountants

Prepare SMALL BUSINESS TAX WORKSHEET Independent Accountants effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals. It offers an excellent eco-conscious substitute for traditional printed and signed paperwork, as you can easily locate the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without hindrances. Manage SMALL BUSINESS TAX WORKSHEET Independent Accountants on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven task today.

How to alter and electronically sign SMALL BUSINESS TAX WORKSHEET Independent Accountants with ease

- Acquire SMALL BUSINESS TAX WORKSHEET Independent Accountants and select Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of your documents or black out sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal authority as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and electronically sign SMALL BUSINESS TAX WORKSHEET Independent Accountants and guarantee excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the small business tax worksheet independent accountants

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SMALL BUSINESS TAX WORKSHEET Independent Accountants?

The SMALL BUSINESS TAX WORKSHEET Independent Accountants is a comprehensive tool designed to help independent accountants manage their clients' tax documentation efficiently. It simplifies the process of gathering necessary financial information, ensuring that all relevant data is organized and easily accessible for tax preparation.

-

How can the SMALL BUSINESS TAX WORKSHEET Independent Accountants benefit my practice?

Using the SMALL BUSINESS TAX WORKSHEET Independent Accountants can signNowly streamline your workflow. It allows for better organization of client data, reduces the risk of errors, and saves time during tax season, ultimately enhancing your service delivery and client satisfaction.

-

What features are included in the SMALL BUSINESS TAX WORKSHEET Independent Accountants?

The SMALL BUSINESS TAX WORKSHEET Independent Accountants includes features such as customizable templates, eSignature capabilities, and secure document storage. These features ensure that you can efficiently collect, sign, and store tax-related documents in one place.

-

Is the SMALL BUSINESS TAX WORKSHEET Independent Accountants easy to use?

Yes, the SMALL BUSINESS TAX WORKSHEET Independent Accountants is designed with user-friendliness in mind. Its intuitive interface allows independent accountants to navigate the tool effortlessly, making it accessible even for those who may not be tech-savvy.

-

What are the pricing options for the SMALL BUSINESS TAX WORKSHEET Independent Accountants?

Pricing for the SMALL BUSINESS TAX WORKSHEET Independent Accountants varies based on the features and number of users. airSlate SignNow offers flexible pricing plans to accommodate different business sizes, ensuring that independent accountants can find a solution that fits their budget.

-

Can the SMALL BUSINESS TAX WORKSHEET Independent Accountants integrate with other software?

Absolutely! The SMALL BUSINESS TAX WORKSHEET Independent Accountants can seamlessly integrate with various accounting and financial software. This integration allows for a smoother workflow, enabling independent accountants to synchronize data across platforms effortlessly.

-

How secure is the SMALL BUSINESS TAX WORKSHEET Independent Accountants?

Security is a top priority for the SMALL BUSINESS TAX WORKSHEET Independent Accountants. The platform employs advanced encryption and security protocols to protect sensitive client information, ensuring that all documents are stored safely and securely.

Get more for SMALL BUSINESS TAX WORKSHEET Independent Accountants

Find out other SMALL BUSINESS TAX WORKSHEET Independent Accountants

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe