Form W 7A Rev January

What is the Form W-7A Rev January

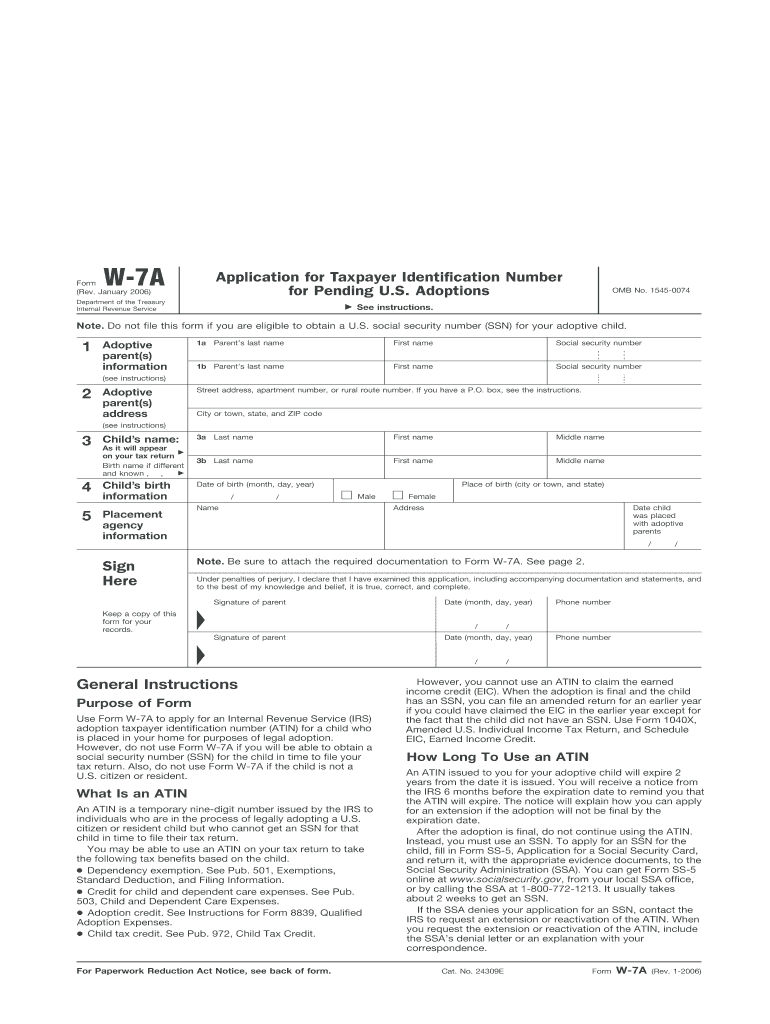

The Form W-7A Rev January is an official document issued by the Internal Revenue Service (IRS) that allows certain individuals to apply for an Individual Taxpayer Identification Number (ITIN). This form is specifically designed for individuals who are not eligible for a Social Security Number but need to file a tax return or are required to provide a taxpayer identification number for certain purposes. The W-7A Rev January is crucial for ensuring compliance with U.S. tax laws and facilitating the proper reporting of income.

How to obtain the Form W-7A Rev January

To obtain the Form W-7A Rev January, individuals can visit the official IRS website, where the form is available for download in PDF format. Additionally, the form can be requested by contacting the IRS directly or by visiting a local IRS office. It is important to ensure that the most current version of the form is used, as outdated forms may not be accepted.

Steps to complete the Form W-7A Rev January

Completing the Form W-7A Rev January involves several key steps:

- Begin by providing your personal information, including your name, address, and date of birth.

- Indicate the reason for applying for an ITIN by selecting the appropriate option from the list provided on the form.

- Submit the required documentation that supports your application, such as proof of identity and foreign status.

- Sign and date the form to certify that the information provided is accurate and complete.

Once completed, the form should be submitted according to the instructions provided, ensuring that all necessary documents are included.

Legal use of the Form W-7A Rev January

The Form W-7A Rev January is legally recognized for individuals who need to obtain an ITIN for tax purposes. It is essential for compliance with U.S. tax regulations, especially for non-resident aliens and foreign nationals who have U.S. tax obligations. Proper use of this form helps individuals avoid penalties related to non-compliance and ensures that they can fulfill their tax responsibilities accurately.

Required Documents

When submitting the Form W-7A Rev January, applicants must include specific documentation to support their identity and foreign status. Required documents typically include:

- A valid passport, or

- Two forms of identification, such as a driver's license or national identification card, along with a birth certificate.

- Any additional documents that may be necessary based on the reason for applying for an ITIN.

It is crucial to ensure that all documents are current and legible to avoid delays in processing.

Form Submission Methods

The completed Form W-7A Rev January can be submitted through various methods. Individuals may choose to file the form by mail, sending it directly to the IRS address specified in the instructions. Alternatively, it may be submitted in person at designated IRS offices. Some applicants may also have the option to submit the form electronically through authorized e-filing services, depending on their circumstances and eligibility.

Quick guide on how to complete form w 7a rev january

Effortlessly prepare Form W 7A Rev January on any device

The rise of online document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Form W 7A Rev January on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to modify and electronically sign Form W 7A Rev January with ease

- Find Form W 7A Rev January and click Get Form to initiate the process.

- Use the tools we offer to complete your document.

- Mark pertinent sections of your documents or redact sensitive information with features specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and electronically sign Form W 7A Rev January to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 7a rev january

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form W 7A Rev January and why is it important?

Form W 7A Rev January is a crucial document used for applying for an Individual Taxpayer Identification Number (ITIN). It is important for individuals who are not eligible for a Social Security Number but need to fulfill tax obligations in the United States. Understanding this form can help streamline your tax filing process.

-

How can airSlate SignNow help with Form W 7A Rev January?

airSlate SignNow provides a user-friendly platform to easily fill out and eSign Form W 7A Rev January. Our solution simplifies the document management process, ensuring that you can complete your tax forms efficiently and securely. This helps you stay compliant with tax regulations.

-

What are the pricing options for using airSlate SignNow for Form W 7A Rev January?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for individuals and teams. You can choose a plan that best fits your requirements for managing documents like Form W 7A Rev January. Our cost-effective solution ensures you get great value for your investment.

-

Are there any features specifically designed for Form W 7A Rev January?

Yes, airSlate SignNow includes features that enhance the experience of completing Form W 7A Rev January. These features include customizable templates, secure eSigning, and real-time tracking of document status. This ensures that your forms are completed accurately and efficiently.

-

Can I integrate airSlate SignNow with other applications for Form W 7A Rev January?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to manage Form W 7A Rev January alongside your existing workflows. This integration capability enhances productivity and ensures that all your documents are easily accessible in one place.

-

What are the benefits of using airSlate SignNow for Form W 7A Rev January?

Using airSlate SignNow for Form W 7A Rev January provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and sign documents from anywhere, making it easier to manage your tax obligations. Additionally, our compliance features help ensure that your forms meet all necessary regulations.

-

Is airSlate SignNow secure for handling Form W 7A Rev January?

Yes, airSlate SignNow prioritizes security and compliance when handling Form W 7A Rev January. We utilize advanced encryption and secure storage solutions to protect your sensitive information. You can trust that your documents are safe while using our platform.

Get more for Form W 7A Rev January

Find out other Form W 7A Rev January

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online