Form N 30x, Rev , Amended Corporation Income Tax Return Forms

What is the Form N-30X, Rev, Amended Corporation Income Tax Return Forms

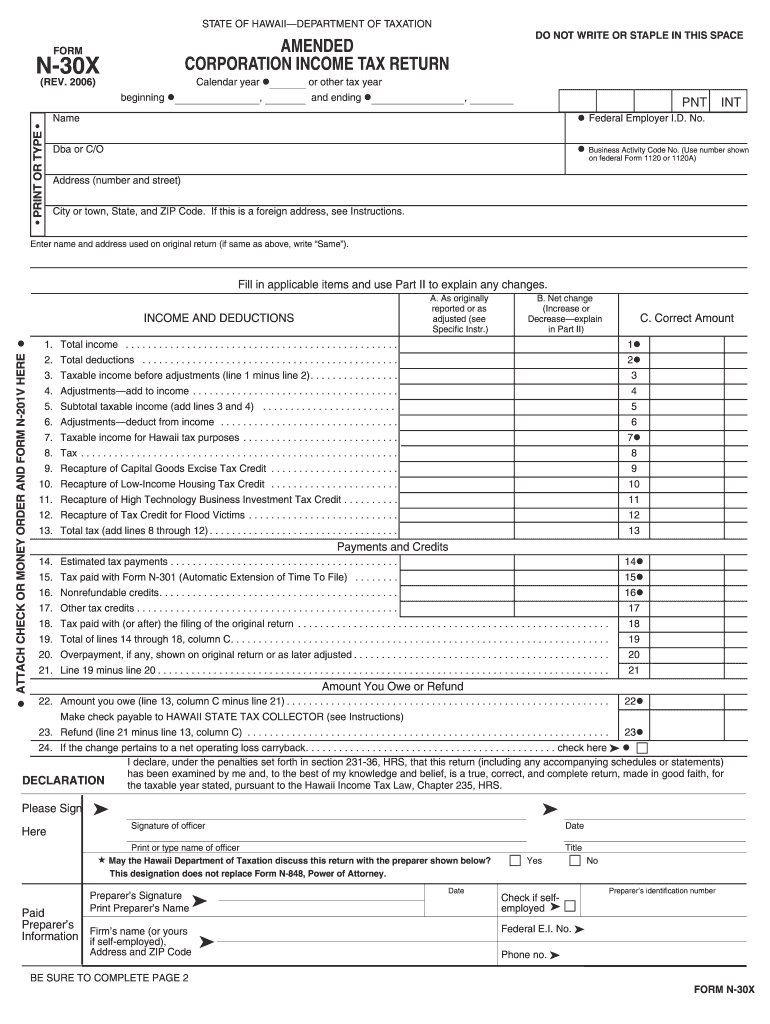

The Form N-30X, Rev, is an amended corporation income tax return form used by businesses in the United States to correct previously filed corporate tax returns. This form allows corporations to make adjustments to their income, deductions, and credits, ensuring compliance with federal tax regulations. It is essential for corporations that need to amend their tax filings due to errors or changes in financial information. By using this form, corporations can rectify mistakes, claim additional deductions, or report changes in income that affect their tax liability.

How to use the Form N-30X, Rev, Amended Corporation Income Tax Return Forms

To effectively use the Form N-30X, Rev, corporations must first gather all relevant financial documents that support the amendments being made. This includes previous tax returns, financial statements, and any documentation related to the changes. After completing the form, it is crucial to review all entries for accuracy. Once verified, the form can be submitted to the appropriate tax authority. It is advisable to keep copies of the amended return and any supporting documents for future reference.

Steps to complete the Form N-30X, Rev, Amended Corporation Income Tax Return Forms

Completing the Form N-30X, Rev, involves several key steps:

- Gather all necessary documentation, including prior tax returns and financial records.

- Carefully fill out the form, ensuring that all fields are completed accurately.

- Indicate the specific changes being made and provide explanations where required.

- Review the completed form for any errors or omissions.

- Sign and date the form before submission.

Legal use of the Form N-30X, Rev, Amended Corporation Income Tax Return Forms

The legal use of the Form N-30X, Rev, is governed by IRS regulations. Corporations must file this form to correct any inaccuracies in their previously submitted tax returns. Failure to file an amended return when necessary can result in penalties and interest on unpaid taxes. It is important for corporations to understand the legal implications of their amendments and ensure that all changes comply with tax laws.

Filing Deadlines / Important Dates

Corporations must be aware of specific filing deadlines associated with the Form N-30X, Rev. Generally, the amended return should be filed within three years of the original return's due date. Additionally, any tax owed as a result of the amendments should be paid by the original due date to avoid penalties. Keeping track of these deadlines is crucial for maintaining compliance with tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The Form N-30X, Rev, can be submitted through various methods. Corporations may choose to file electronically, which is often the fastest option. Alternatively, the form can be mailed to the appropriate tax authority. In some cases, in-person submission may be available, depending on local tax office policies. Each submission method has its own processing times and requirements, so corporations should select the option that best suits their needs.

Quick guide on how to complete form n 30x rev amended corporation income tax return forms

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and safely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and without complications. Manage [SKS] across any platform using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to Modify and eSign [SKS] with Ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and then hit the Done button to finalize your changes.

- Select your preferred method of delivery for your form, whether by email, SMS, invite link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and guarantee excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form N 30x, Rev , Amended Corporation Income Tax Return Forms

Create this form in 5 minutes!

How to create an eSignature for the form n 30x rev amended corporation income tax return forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Form N 30x, Rev , Amended Corporation Income Tax Return Forms?

Form N 30x, Rev , Amended Corporation Income Tax Return Forms are used by corporations in Hawaii to amend their previously filed income tax returns. This form allows businesses to correct errors or make changes to their tax filings, ensuring compliance with state tax regulations. Utilizing airSlate SignNow can streamline the process of completing and submitting these forms.

-

How can airSlate SignNow help with Form N 30x, Rev , Amended Corporation Income Tax Return Forms?

airSlate SignNow provides an easy-to-use platform for businesses to complete and eSign Form N 30x, Rev , Amended Corporation Income Tax Return Forms. With its intuitive interface, users can quickly fill out the necessary information and securely send the forms for signatures. This not only saves time but also enhances accuracy in the filing process.

-

What are the pricing options for using airSlate SignNow for Form N 30x, Rev , Amended Corporation Income Tax Return Forms?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for those specifically handling Form N 30x, Rev , Amended Corporation Income Tax Return Forms. Pricing is competitive and designed to provide a cost-effective solution for businesses of all sizes. You can choose a plan that best fits your volume of document management and eSigning needs.

-

Are there any integrations available for airSlate SignNow when handling Form N 30x, Rev , Amended Corporation Income Tax Return Forms?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing the workflow for managing Form N 30x, Rev , Amended Corporation Income Tax Return Forms. These integrations allow users to connect their existing tools, such as CRM systems and cloud storage services, making it easier to access and manage documents. This flexibility helps streamline the entire process.

-

What features does airSlate SignNow offer for completing Form N 30x, Rev , Amended Corporation Income Tax Return Forms?

airSlate SignNow offers a range of features tailored for completing Form N 30x, Rev , Amended Corporation Income Tax Return Forms, including customizable templates, secure eSigning, and real-time tracking. These features ensure that users can efficiently manage their tax documents while maintaining compliance. Additionally, the platform provides a user-friendly experience that simplifies the entire process.

-

How secure is airSlate SignNow for handling sensitive tax documents like Form N 30x, Rev , Amended Corporation Income Tax Return Forms?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents such as Form N 30x, Rev , Amended Corporation Income Tax Return Forms. The platform employs advanced encryption and security protocols to protect user data and ensure confidentiality. Users can confidently manage their tax documents knowing that their information is secure.

-

Can I access airSlate SignNow on mobile devices for Form N 30x, Rev , Amended Corporation Income Tax Return Forms?

Absolutely! airSlate SignNow is accessible on mobile devices, allowing users to manage Form N 30x, Rev , Amended Corporation Income Tax Return Forms on the go. The mobile app provides the same features as the desktop version, ensuring that you can complete and eSign documents anytime, anywhere. This flexibility is ideal for busy professionals.

Get more for Form N 30x, Rev , Amended Corporation Income Tax Return Forms

Find out other Form N 30x, Rev , Amended Corporation Income Tax Return Forms

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form