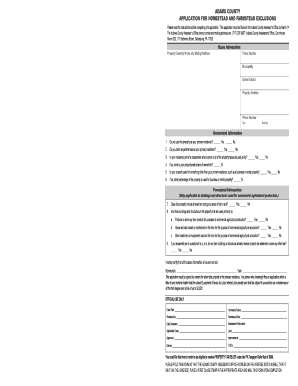

Adams County Application for Homestead and County of Adams Form

What is the Adams County Application For Homestead And County Of Adams

The Adams County Application for Homestead is a specific form used by residents of Adams County to apply for homestead exemptions. This application allows homeowners to reduce their property tax burden by qualifying for exemptions based on their primary residence. The form is designed to facilitate the assessment and approval process for eligible applicants, ensuring that they receive the tax benefits intended for homeowners in the area.

How to use the Adams County Application For Homestead And County Of Adams

To use the Adams County Application for Homestead, individuals must first obtain the form from the county's official website or local government office. Once the form is acquired, applicants should carefully fill it out, providing accurate information about their property and personal details. After completing the application, it must be submitted to the appropriate county office for review. It is essential to follow any specific instructions provided with the form to ensure timely processing.

Steps to complete the Adams County Application For Homestead And County Of Adams

Completing the Adams County Application for Homestead involves several key steps:

- Obtain the application form from the county office or website.

- Fill in personal details, including name, address, and contact information.

- Provide information about the property, including its location and type.

- Indicate eligibility criteria, such as ownership status and residency.

- Review the application for accuracy and completeness.

- Submit the completed application to the designated county office, either in person or by mail.

Eligibility Criteria

To qualify for the homestead exemption in Adams County, applicants must meet specific eligibility criteria. Generally, the applicant must be the owner of the property and use it as their primary residence. Additionally, certain age, income, or disability requirements may apply, depending on local regulations. It is important for applicants to review these criteria carefully to ensure they meet all necessary conditions before submitting their application.

Required Documents

When applying for the Adams County Homestead exemption, several documents may be required to support the application. These typically include:

- Proof of property ownership, such as a deed or title.

- Identification documents, like a driver's license or state ID.

- Evidence of residency, such as utility bills or lease agreements.

- Any additional documentation requested by the county office.

Form Submission Methods

The Adams County Application for Homestead can be submitted through various methods, depending on the preferences of the applicant. Common submission methods include:

- In-person delivery to the county office during business hours.

- Mailing the completed application to the designated address.

- Some counties may offer online submission options through their official website.

Application Process & Approval Time

Once the Adams County Application for Homestead is submitted, it undergoes a review process by the county office. The approval time can vary based on the volume of applications received and the complexity of each case. Generally, applicants can expect to receive a decision within a few weeks to a couple of months. It is advisable to follow up with the county office if there are any delays or questions regarding the status of the application.

Quick guide on how to complete adams county application for homestead and county of adams

Complete [SKS] seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly solution to traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and electronically sign [SKS] without hassle

- Find [SKS] and click Obtain Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or redact sensitive details using tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Finish button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Edit and electronically sign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Adams County Application For Homestead And County Of Adams

Create this form in 5 minutes!

How to create an eSignature for the adams county application for homestead and county of adams

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Adams County Application For Homestead And County Of Adams?

The Adams County Application For Homestead And County Of Adams is a form that allows residents to apply for homestead benefits in Adams County. This application helps homeowners reduce their property taxes and access various local benefits. Completing this application is essential for those looking to maximize their financial advantages in the county.

-

How can airSlate SignNow assist with the Adams County Application For Homestead And County Of Adams?

airSlate SignNow simplifies the process of completing the Adams County Application For Homestead And County Of Adams by providing an easy-to-use platform for eSigning and document management. Users can fill out the application digitally, ensuring accuracy and efficiency. This streamlines the submission process, making it easier for residents to apply for their homestead benefits.

-

What are the pricing options for using airSlate SignNow for the Adams County Application For Homestead And County Of Adams?

airSlate SignNow offers various pricing plans to accommodate different needs, starting with a free trial for new users. The plans are designed to be cost-effective, ensuring that residents can easily manage their Adams County Application For Homestead And County Of Adams without breaking the bank. Each plan includes features that enhance document management and eSigning capabilities.

-

What features does airSlate SignNow provide for the Adams County Application For Homestead And County Of Adams?

airSlate SignNow provides a range of features that enhance the completion of the Adams County Application For Homestead And County Of Adams. These include customizable templates, secure eSigning, and real-time tracking of document status. These features ensure that users can efficiently manage their applications and stay informed throughout the process.

-

What are the benefits of using airSlate SignNow for the Adams County Application For Homestead And County Of Adams?

Using airSlate SignNow for the Adams County Application For Homestead And County Of Adams offers numerous benefits, including increased efficiency and reduced paperwork. The platform allows users to complete and submit their applications quickly, minimizing delays. Additionally, the secure eSigning feature ensures that documents are legally binding and protected.

-

Can I integrate airSlate SignNow with other applications for the Adams County Application For Homestead And County Of Adams?

Yes, airSlate SignNow offers integrations with various applications to enhance the process of managing the Adams County Application For Homestead And County Of Adams. Users can connect with popular tools like Google Drive, Dropbox, and CRM systems. This flexibility allows for a seamless workflow, making it easier to access and manage documents.

-

Is airSlate SignNow secure for handling the Adams County Application For Homestead And County Of Adams?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that all documents related to the Adams County Application For Homestead And County Of Adams are protected. The platform employs advanced encryption and secure storage solutions to safeguard sensitive information. Users can confidently manage their applications knowing their data is secure.

Get more for Adams County Application For Homestead And County Of Adams

Find out other Adams County Application For Homestead And County Of Adams

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online