Sa103f Form

What is the Sa103f

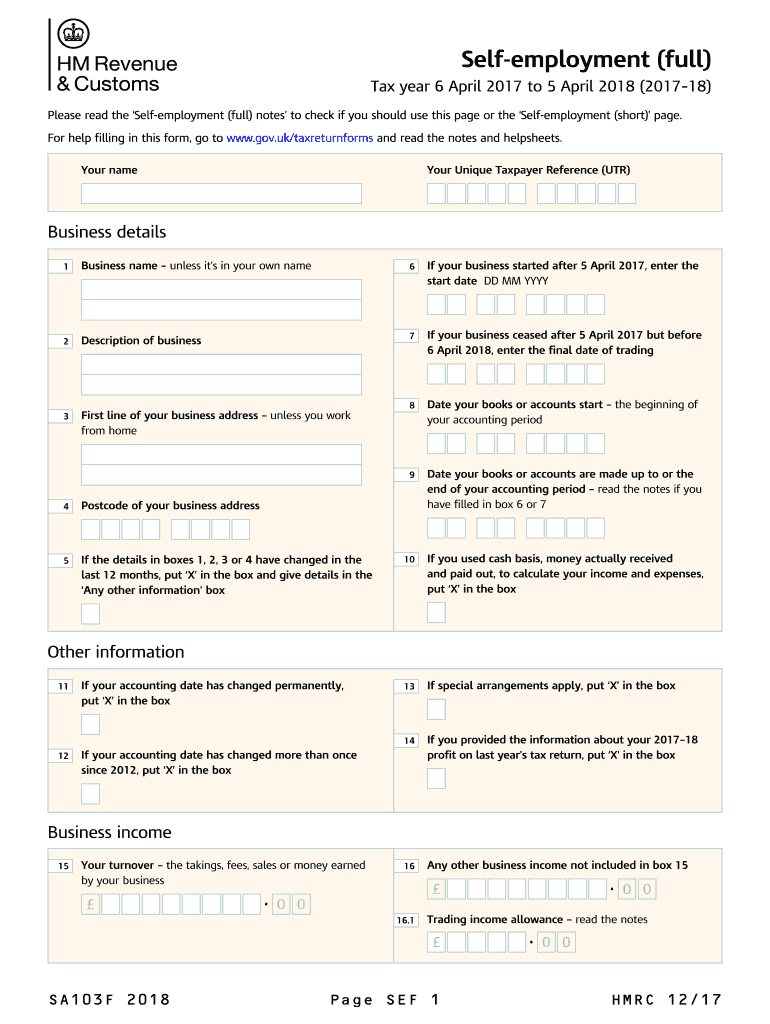

The Sa103f is a specific tax form used by self-employed individuals in the United Kingdom to report their income and expenses to HM Revenue and Customs (HMRC). This form is particularly relevant for those who operate as sole traders or freelancers. It allows taxpayers to declare their earnings and claim allowable expenses, ensuring they pay the correct amount of tax. The Sa103f is part of the self-assessment tax return process, which is essential for maintaining compliance with tax regulations.

How to use the Sa103f

To effectively use the Sa103f, individuals must first gather all necessary financial documentation, including records of income and receipts for expenses. The form requires detailed information about earnings, allowable deductions, and any other relevant financial activities. Once the form is completed, it can be submitted as part of the self-assessment tax return. It is crucial to ensure accuracy when filling out the Sa103f, as any discrepancies may lead to penalties or delays in processing.

Steps to complete the Sa103f

Completing the Sa103f involves several key steps:

- Gather financial records, including income statements and expense receipts.

- Fill out the form with accurate income figures and allowable expenses.

- Review the completed form for any errors or omissions.

- Submit the Sa103f as part of the overall self-assessment tax return.

- Keep a copy of the submitted form for your records.

Legal use of the Sa103f

The Sa103f must be used in accordance with HMRC regulations to ensure that the submitted information is legally binding. This means that all figures reported must be truthful and verifiable. Failure to comply with legal requirements can result in penalties, including fines or additional tax assessments. It is advisable to consult with a tax professional if there are any uncertainties regarding the form's completion or submission.

Filing Deadlines / Important Dates

Filing deadlines for the Sa103f are crucial for compliance. Typically, the self-assessment tax return, including the Sa103f, must be submitted by January 31st following the end of the tax year. For example, for the tax year ending April 5, the deadline would be January 31 of the following year. Late submissions can incur penalties, so it is essential to adhere to these dates to avoid additional costs.

Required Documents

To complete the Sa103f accurately, several documents are necessary:

- Income statements from all sources of self-employment.

- Receipts for business-related expenses.

- Bank statements showing income deposits and expenses.

- Any previous tax returns for reference.

Having these documents organized will facilitate a smoother completion process and help ensure accuracy.

Quick guide on how to complete sa103f 2018 self employment full 2018 if youre self employed have more complex tax affairs and your annual business turnover

Effortlessly Prepare Sa103f on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to swiftly create, edit, and eSign your documents without unnecessary delays. Handle Sa103f on any device using the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

How to Alter and eSign Sa103f with Ease

- Find Sa103f and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Sa103f and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sa103f 2018 self employment full 2018 if youre self employed have more complex tax affairs and your annual business turnover

How to make an eSignature for the Sa103f 2018 Self Employment Full 2018 If Youre Self Employed Have More Complex Tax Affairs And Your Annual Business Turnover online

How to generate an eSignature for the Sa103f 2018 Self Employment Full 2018 If Youre Self Employed Have More Complex Tax Affairs And Your Annual Business Turnover in Chrome

How to generate an eSignature for signing the Sa103f 2018 Self Employment Full 2018 If Youre Self Employed Have More Complex Tax Affairs And Your Annual Business Turnover in Gmail

How to create an eSignature for the Sa103f 2018 Self Employment Full 2018 If Youre Self Employed Have More Complex Tax Affairs And Your Annual Business Turnover from your smartphone

How to make an eSignature for the Sa103f 2018 Self Employment Full 2018 If Youre Self Employed Have More Complex Tax Affairs And Your Annual Business Turnover on iOS devices

How to create an electronic signature for the Sa103f 2018 Self Employment Full 2018 If Youre Self Employed Have More Complex Tax Affairs And Your Annual Business Turnover on Android OS

People also ask

-

What is the sa103f hmrc form and why is it important?

The sa103f hmrc form is essential for self-employed individuals in the UK, as it provides a comprehensive overview of your business's income and expenses for tax purposes. Submitting this form accurately helps ensure that you comply with HMRC regulations and meet your tax obligations.

-

How can airSlate SignNow help with the sa103f hmrc submission process?

airSlate SignNow streamlines the process of preparing and signing the sa103f hmrc form, making it hassle-free. With our electronic signature solution, you can securely sign documents from anywhere, ensuring timely submission and reduced paperwork.

-

What features does airSlate SignNow offer for managing the sa103f hmrc form?

airSlate SignNow includes features such as document templates, real-time collaboration, and secure cloud storage. These tools simplify the management of your sa103f hmrc form, allowing you to efficiently gather necessary information and obtain signatures.

-

Is airSlate SignNow a cost-effective solution for submitting the sa103f hmrc?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses and individuals handling the sa103f hmrc submission. With flexible pricing plans, you can choose a package that fits your needs without sacrificing essential features.

-

What integrations does airSlate SignNow offer that can assist with the sa103f hmrc?

airSlate SignNow integrates seamlessly with various accounting and financial software, such as QuickBooks and Xero. These integrations can help streamline the process of preparing your sa103f hmrc form by automatically importing financial data and minimizing manual entry.

-

Can I track the status of my sa103f hmrc submissions with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your sa103f hmrc submissions. You'll receive notifications when documents are viewed or signed, giving you peace of mind and better control over your submissions.

-

Is it secure to sign the sa103f hmrc form using airSlate SignNow?

Yes, airSlate SignNow prioritizes your security with advanced encryption and data protection measures. When signing the sa103f hmrc form, you can trust that your sensitive information and documents are handled securely.

Get more for Sa103f

- Housing unlimited form

- Rental application blizzard property management form

- Form f 1 sec gov

- Form sba form 1149 sba form 1149 lenders transcript of account

- Application for help with medicare prescription drug plan costs secure ssa form

- Form ssa 1696 sup1 08

- Form g 197 authorization to disclose information

- Rb 19a 03 19 childs disability benefits rb 19a form

Find out other Sa103f

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney