SCHEDULE D Form 1120S OMB No

What is the SCHEDULE D Form 1120S OMB No

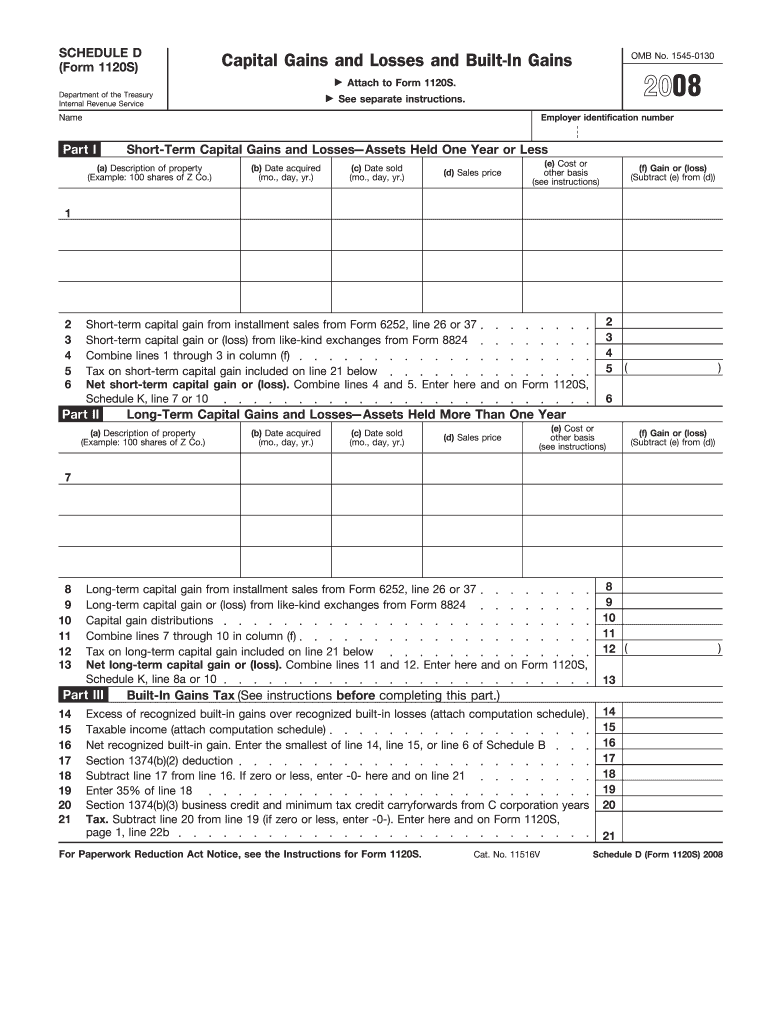

The SCHEDULE D Form 1120S OMB No is a tax form used by S corporations in the United States to report capital gains and losses. This form is essential for calculating the tax liability of an S corporation, as it details the company’s transactions involving capital assets. The information reported on this form is crucial for both the corporation and its shareholders, as it affects individual tax returns. Understanding this form is vital for compliance with IRS regulations and for accurate tax reporting.

How to use the SCHEDULE D Form 1120S OMB No

To use the SCHEDULE D Form 1120S OMB No, businesses must first gather all relevant financial information regarding their capital gains and losses. This includes records of asset sales, purchases, and any other transactions that impact capital accounts. Once the necessary data is collected, the form can be filled out by entering the details of each transaction in the appropriate sections. It is important to follow IRS guidelines closely to ensure accuracy and compliance.

Steps to complete the SCHEDULE D Form 1120S OMB No

Completing the SCHEDULE D Form 1120S OMB No involves several key steps:

- Gather all relevant financial documents related to capital transactions.

- Fill out the form by entering details of each transaction, including dates, amounts, and descriptions.

- Calculate total capital gains and losses based on the information provided.

- Review the completed form for accuracy before submission.

- Submit the form along with the S corporation's tax return.

Key elements of the SCHEDULE D Form 1120S OMB No

The SCHEDULE D Form 1120S OMB No includes several key elements that must be accurately reported:

- Capital Gains: Report all gains from the sale of capital assets.

- Capital Losses: Document any losses incurred from capital transactions.

- Net Gain or Loss: Calculate the overall result of capital transactions.

- Details of Assets: Provide information on each asset sold or exchanged.

Filing Deadlines / Important Dates

Filing deadlines for the SCHEDULE D Form 1120S OMB No align with the tax return deadlines for S corporations. Typically, S corporations must file their tax returns by the fifteenth day of the third month after the end of their tax year. For most corporations operating on a calendar year, this means the deadline is March 15. It is crucial to adhere to these deadlines to avoid penalties and interest charges.

Penalties for Non-Compliance

Failure to file the SCHEDULE D Form 1120S OMB No accurately or on time can result in significant penalties. The IRS may impose fines for late filing, which can accumulate over time. Additionally, inaccuracies in reporting capital gains and losses can lead to audits and further financial repercussions. It is essential for S corporations to ensure compliance with all IRS requirements to avoid these potential issues.

Quick guide on how to complete schedule d form 1120s omb no

Complete [SKS] effortlessly on any gadget

Managing documents online has become widely embraced by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, amend, and electronically sign your documents quickly without any holdups. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and electronically sign [SKS] without hassle

- Obtain [SKS] and click Get Form to initiate the process.

- Utilize the instruments we offer to fill out your form.

- Emphasize essential sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to store your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to SCHEDULE D Form 1120S OMB No

Create this form in 5 minutes!

How to create an eSignature for the schedule d form 1120s omb no

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SCHEDULE D Form 1120S OMB No. used for?

The SCHEDULE D Form 1120S OMB No. is used by S corporations to report capital gains and losses. This form helps businesses track their investment activities and ensures compliance with IRS regulations. Understanding this form is crucial for accurate tax reporting and maximizing potential deductions.

-

How can airSlate SignNow assist with the SCHEDULE D Form 1120S OMB No.?

airSlate SignNow provides a streamlined solution for electronically signing and sending the SCHEDULE D Form 1120S OMB No. Our platform simplifies the document management process, allowing users to focus on their business while ensuring compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for the SCHEDULE D Form 1120S OMB No.?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that facilitate the signing and management of documents like the SCHEDULE D Form 1120S OMB No. Choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the SCHEDULE D Form 1120S OMB No.?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools enhance the efficiency of handling the SCHEDULE D Form 1120S OMB No., ensuring that all necessary signatures are collected promptly and securely.

-

Can I integrate airSlate SignNow with other software for the SCHEDULE D Form 1120S OMB No.?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage the SCHEDULE D Form 1120S OMB No. alongside your existing tools. This flexibility allows for a seamless workflow and improved productivity.

-

What are the benefits of using airSlate SignNow for the SCHEDULE D Form 1120S OMB No.?

Using airSlate SignNow for the SCHEDULE D Form 1120S OMB No. provides numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform ensures that your documents are handled efficiently, reducing the risk of errors and compliance issues.

-

Is airSlate SignNow user-friendly for completing the SCHEDULE D Form 1120S OMB No.?

Yes, airSlate SignNow is designed with user experience in mind. The intuitive interface makes it easy for anyone to navigate and complete the SCHEDULE D Form 1120S OMB No., regardless of their technical expertise.

Get more for SCHEDULE D Form 1120S OMB No

Find out other SCHEDULE D Form 1120S OMB No

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document