1040nr Form

What is the 1040NR Form

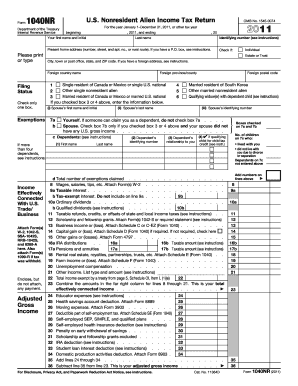

The 1040NR Form is a U.S. tax document specifically designed for non-resident aliens who earn income in the United States. This form allows individuals to report their income, claim deductions, and determine their tax liability. It is essential for non-residents to accurately complete this form to comply with U.S. tax laws. The 1040NR is distinct from the standard 1040 Form, which is used by U.S. citizens and residents.

How to Use the 1040NR Form

Using the 1040NR Form involves several important steps. First, gather all necessary financial documents, including income statements and any relevant tax documents. Next, fill out the form with accurate information regarding your income, deductions, and credits. It is crucial to ensure that all entries are correct to avoid delays or penalties. Once completed, you can submit the form electronically or via mail, depending on your preference and eligibility.

Steps to Complete the 1040NR Form

Completing the 1040NR Form requires careful attention to detail. Follow these steps:

- Begin by entering your personal information, including your name, address, and taxpayer identification number.

- Report your income from U.S. sources, including wages, dividends, and interest.

- Claim any applicable deductions, such as those for state taxes paid or certain business expenses.

- Calculate your total tax liability based on the income reported.

- Sign and date the form to certify that the information provided is accurate.

Legal Use of the 1040NR Form

The 1040NR Form is legally binding when completed correctly and submitted on time. It must adhere to the guidelines set forth by the Internal Revenue Service (IRS). Electronic signatures are accepted, provided they meet the requirements of eSignature laws. Ensuring compliance with these regulations is vital for the form to be recognized as valid by the IRS and other legal entities.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the 1040NR Form to avoid penalties. Generally, the deadline for submitting the form is April 15 for the previous tax year. However, if you are a non-resident alien who is not required to file a return, you may have different deadlines based on your circumstances. Always check the IRS website for the most current information regarding deadlines.

Required Documents

To complete the 1040NR Form accurately, you will need several documents:

- Form W-2 from your employer, if applicable.

- Form 1099 for any freelance or contract work.

- Documentation of any deductions you plan to claim, such as receipts for expenses.

- Your taxpayer identification number or Social Security number.

Quick guide on how to complete 1040nr form

Complete 1040nr Form effortlessly on any device

Online document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly and without delays. Manage 1040nr Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-based process today.

The easiest way to modify and eSign 1040nr Form without a hassle

- Locate 1040nr Form and click Get Form to initiate the process.

- Utilize the features we provide to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tiresome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Edit and eSign 1040nr Form and ensure exceptional communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1040nr form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1040nr Form and who needs to file it?

The 1040nr Form is designed for non-resident aliens who need to report their income earned in the United States. Individuals and foreign nationals who have U.S. tax obligations must file this form to maintain compliance with IRS regulations.

-

How can airSlate SignNow help me with the 1040nr Form?

airSlate SignNow offers a seamless solution for sending and eSigning your 1040nr Form, ensuring a quick and secure process. With our user-friendly interface, you can easily manage your document workflow and ensure timely submission to the IRS.

-

What are the pricing options for using airSlate SignNow for the 1040nr Form?

airSlate SignNow provides various pricing plans to cater to different needs, whether you are filing a single 1040nr Form or managing multiple documents. Visit our pricing page to find the best plan that meets your requirements without compromising on features.

-

Is it safe to use airSlate SignNow for my 1040nr Form?

Absolutely! airSlate SignNow prioritizes your security by implementing top-notch encryption and compliance measures. Your 1040nr Form and other documents are protected, ensuring your sensitive information remains confidential throughout the signing process.

-

What features does airSlate SignNow offer for handling the 1040nr Form?

airSlate SignNow provides features like customizable templates, unlimited document storage, and integrated eSigning options specifically tailored for the 1040nr Form. These tools help streamline your tax filing process while guaranteeing ease of use and efficiency.

-

Can I integrate airSlate SignNow with other software for my 1040nr Form transactions?

Yes, airSlate SignNow offers integrations with several third-party applications to enhance your productivity. Streamlining your workflow while preparing or submitting your 1040nr Form is easier with tools like Google Drive, Dropbox, and more.

-

What are the benefits of using airSlate SignNow for my 1040nr Form?

Using airSlate SignNow to manage your 1040nr Form simplifies the signing and submission process, which saves you time and effort. Additionally, our platform enhances collaboration, allowing multiple parties to sign documents securely and efficiently.

Get more for 1040nr Form

- Pakistan passport report form

- Pdf electrification futures study scenarios of electric technology nrel form

- Pakistan public expenditure review reform issues and options

- Pakistan application withdrawal form

- Ministry of planningdevelopment amp special initiatives form

- Wwwscribdcomdocument359602820chapter 2united states armed forcescivil service form

- Actra toronto member branch transfer form

- Pakistan attestation form

Find out other 1040nr Form

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney