Form 1120 F Schedule S Internal Revenue Service

What is the Form 1120 F Schedule S Internal Revenue Service

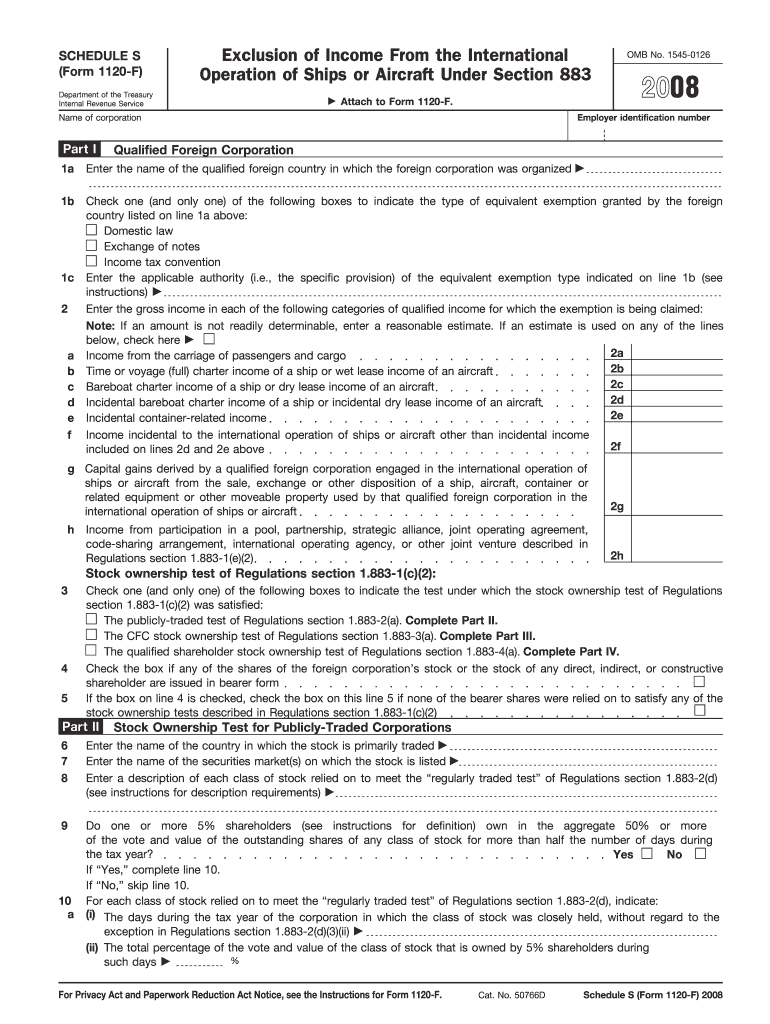

The Form 1120 F Schedule S is a tax form used by foreign corporations to report income effectively connected with a trade or business in the United States. This form is essential for determining the tax liability of foreign entities operating within U.S. borders. It provides the Internal Revenue Service (IRS) with detailed information regarding the corporation's income, deductions, and credits, allowing for accurate tax calculations. Understanding this form is crucial for compliance with U.S. tax regulations, especially for foreign businesses seeking to operate legally in the country.

How to use the Form 1120 F Schedule S Internal Revenue Service

Using the Form 1120 F Schedule S involves several steps to ensure accurate reporting of income and expenses. First, foreign corporations must gather all necessary financial information, including income statements and records of expenses related to their U.S. operations. Next, they should complete the form by providing details about their income, deductions, and any applicable credits. It's important to follow the IRS instructions carefully to avoid errors that could lead to penalties. Once completed, the form must be filed with the IRS along with the main Form 1120 F, ensuring that all information is consistent and accurate.

Steps to complete the Form 1120 F Schedule S Internal Revenue Service

Completing the Form 1120 F Schedule S requires a methodical approach:

- Gather financial documents, including income statements, expense records, and any other relevant information.

- Fill out the form, starting with basic information about the corporation, such as its name, address, and Employer Identification Number (EIN).

- Report effectively connected income, detailing sources and amounts.

- List deductions and credits applicable to the corporation's U.S. operations.

- Review all entries for accuracy and completeness before submission.

- File the completed form with the IRS alongside Form 1120 F by the designated deadline.

Key elements of the Form 1120 F Schedule S Internal Revenue Service

Several key elements are crucial when filling out the Form 1120 F Schedule S. These include:

- Effective Connected Income: This section requires detailed reporting of income derived from U.S. sources that are effectively connected to the corporation's trade or business.

- Deductions: Corporations can claim various deductions related to their U.S. operations, which can significantly affect their taxable income.

- Tax Credits: Any applicable tax credits should be reported, as they can reduce the overall tax liability.

- Signature and Verification: The form must be signed by an authorized representative of the corporation, verifying the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1120 F Schedule S are critical for compliance. Typically, the form must be filed on or before the 15th day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Corporations should also be aware of any extensions that may apply and ensure timely submission to avoid penalties.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the Form 1120 F Schedule S can result in significant penalties. These may include:

- Fines: The IRS may impose fines for late filing or failure to file the form altogether.

- Interest: Accrued interest on any unpaid taxes can increase the overall amount owed.

- Increased Scrutiny: Non-compliance may lead to increased scrutiny from the IRS, potentially resulting in audits or further investigations.

Quick guide on how to complete form 1120 f schedule s internal revenue service

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to quickly create, modify, and electronically sign your documents without any delays. Access [SKS] from any device with the airSlate SignNow applications for Android or iOS and enhance your document-based workflows today.

Edit and Electronically Sign [SKS] with Ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form—via email, text message (SMS), or invitation link—or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management requirements in just a few clicks from your chosen device. Modify and electronically sign [SKS] to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1120 F Schedule S Internal Revenue Service

Create this form in 5 minutes!

How to create an eSignature for the form 1120 f schedule s internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1120 F Schedule S and why is it important?

Form 1120 F Schedule S is a crucial document required by the Internal Revenue Service for foreign corporations to report their income effectively. It helps ensure compliance with U.S. tax laws and provides a clear overview of the corporation's financial activities. Understanding this form is essential for accurate tax reporting and avoiding penalties.

-

How can airSlate SignNow assist with completing Form 1120 F Schedule S?

airSlate SignNow offers a user-friendly platform that simplifies the process of completing Form 1120 F Schedule S. With our eSigning capabilities, you can easily fill out, sign, and send this form securely. This streamlines your workflow and ensures that all necessary documentation is handled efficiently.

-

What are the pricing options for using airSlate SignNow for Form 1120 F Schedule S?

airSlate SignNow provides flexible pricing plans tailored to meet the needs of businesses of all sizes. Our cost-effective solutions allow you to manage documents, including Form 1120 F Schedule S, without breaking the bank. You can choose from monthly or annual subscriptions based on your usage requirements.

-

Are there any integrations available for airSlate SignNow when handling Form 1120 F Schedule S?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your document management process. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to streamline the handling of Form 1120 F Schedule S. This integration ensures that all your documents are easily accessible and organized.

-

What features does airSlate SignNow offer for managing Form 1120 F Schedule S?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for documents like Form 1120 F Schedule S. These tools help you manage your forms efficiently and ensure that all parties involved can sign and submit documents promptly. Our platform is designed to enhance productivity and compliance.

-

How does airSlate SignNow ensure the security of Form 1120 F Schedule S?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your documents, including Form 1120 F Schedule S. Our compliance with industry standards ensures that your sensitive information remains confidential and secure throughout the signing process.

-

Can I access Form 1120 F Schedule S on mobile devices using airSlate SignNow?

Absolutely! airSlate SignNow is optimized for mobile devices, allowing you to access and manage Form 1120 F Schedule S on the go. Whether you’re using a smartphone or tablet, you can fill out, sign, and send your documents anytime, anywhere, ensuring flexibility and convenience.

Get more for Form 1120 F Schedule S Internal Revenue Service

- Nysif form

- Sbi life surrender partial withdrawal application form

- Tuesdays with morrie worksheets form

- Lesson 1 homework practice constant rate of change form

- Form 8892 instructions

- Gas unsafe situations pdf form

- Rental applicant reference form cowell properties

- Patient information sheet western dental

Find out other Form 1120 F Schedule S Internal Revenue Service

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament