Form 593 C Real Estate Withholding Certificate California Form 593 C

What is the Form 593 C Real Estate Withholding Certificate?

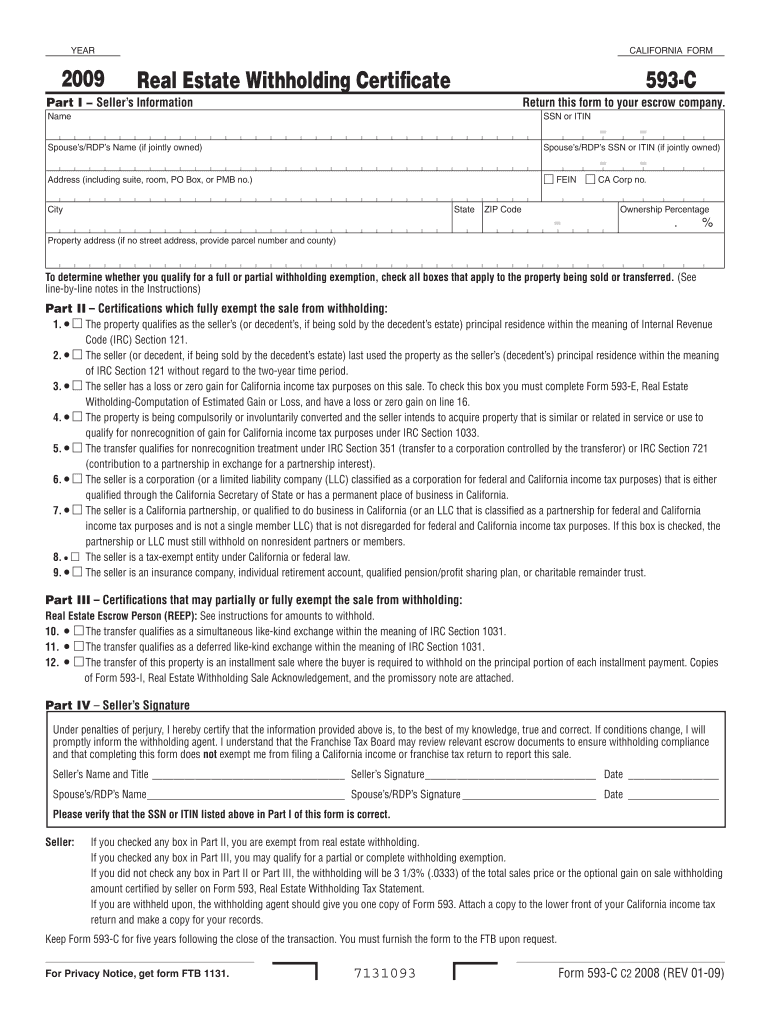

The Form 593 C, officially known as the Real Estate Withholding Certificate, is a tax document required by the state of California. This form is primarily used by buyers of real estate to report the withholding of taxes on the sale of property. It is essential for ensuring that the seller meets their tax obligations, particularly if they are a non-resident of California. The form helps facilitate the transfer of property while ensuring compliance with state tax laws.

How to Use the Form 593 C Real Estate Withholding Certificate

To use the Form 593 C, the buyer must complete the form during the real estate transaction. This involves providing information about the property, the seller, and the amount withheld for taxes. Once completed, the form should be submitted to the California Franchise Tax Board along with the payment of any withholding taxes. Proper use of this form is crucial for avoiding penalties and ensuring that the seller's tax responsibilities are met.

Steps to Complete the Form 593 C Real Estate Withholding Certificate

Completing the Form 593 C involves several key steps:

- Gather necessary information about the property and the seller.

- Fill out the buyer's information, including name, address, and tax identification number.

- Provide details about the seller, including their name and address.

- Indicate the total sales price of the property and the amount being withheld for taxes.

- Sign and date the form to certify the information provided is accurate.

After completing the form, it should be submitted to the appropriate tax authority along with any required payment.

Key Elements of the Form 593 C Real Estate Withholding Certificate

The Form 593 C includes several critical elements that must be accurately filled out:

- Buyer Information: Name, address, and taxpayer identification number of the buyer.

- Seller Information: Name and address of the seller, including their status as a resident or non-resident.

- Property Details: Description of the property being sold, including the address and sales price.

- Withholding Amount: The total amount being withheld for tax purposes, which is typically based on the sales price.

Ensuring all elements are correctly filled out is vital for compliance with California tax regulations.

Legal Use of the Form 593 C Real Estate Withholding Certificate

The legal use of the Form 593 C is mandated by California tax law, which requires withholding on certain real estate transactions. This form serves as a declaration that the buyer has withheld the appropriate amount of tax from the seller's proceeds. It is important for both parties to understand their obligations under the law, as failure to comply can lead to penalties and interest on unpaid taxes.

Filing Deadlines / Important Dates

Filing deadlines for the Form 593 C are critical to ensure compliance. The form must be submitted to the California Franchise Tax Board at the time of the property sale. Typically, the withholding payment is due within a specified timeframe after the close of escrow. It is advisable to check the latest guidelines from the California Franchise Tax Board for any updates on deadlines to avoid penalties.

Quick guide on how to complete form 593 c real estate withholding certificate california form 593 c

Prepare [SKS] effortlessly on any device

Online document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as it allows you to access the right forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without interruptions. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Decide how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or unorganized files, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 593 C Real Estate Withholding Certificate California Form 593 C

Create this form in 5 minutes!

How to create an eSignature for the form 593 c real estate withholding certificate california form 593 c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 593 C Real Estate Withholding Certificate California Form 593 C?

The Form 593 C Real Estate Withholding Certificate California Form 593 C is a document used by sellers of real estate in California to signNow their withholding status. This form helps ensure that the correct amount of taxes is withheld during the sale of property. It is essential for compliance with California tax regulations.

-

How do I complete the Form 593 C Real Estate Withholding Certificate California Form 593 C?

To complete the Form 593 C Real Estate Withholding Certificate California Form 593 C, you need to provide information about the seller, the buyer, and the property being sold. Ensure that all sections are filled out accurately to avoid delays in processing. You can find detailed instructions on the California Franchise Tax Board's website.

-

What are the benefits of using airSlate SignNow for the Form 593 C Real Estate Withholding Certificate California Form 593 C?

Using airSlate SignNow for the Form 593 C Real Estate Withholding Certificate California Form 593 C streamlines the signing and submission process. Our platform offers an easy-to-use interface, ensuring that you can complete and eSign documents quickly. Additionally, it provides secure storage and easy access to your documents anytime.

-

Is there a cost associated with using airSlate SignNow for the Form 593 C Real Estate Withholding Certificate California Form 593 C?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses. We offer various pricing plans that cater to different needs, ensuring you get the best value for managing your Form 593 C Real Estate Withholding Certificate California Form 593 C and other documents.

-

Can I integrate airSlate SignNow with other software for the Form 593 C Real Estate Withholding Certificate California Form 593 C?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage your Form 593 C Real Estate Withholding Certificate California Form 593 C alongside your existing tools. This integration helps streamline your workflow and enhances productivity.

-

What features does airSlate SignNow offer for managing the Form 593 C Real Estate Withholding Certificate California Form 593 C?

airSlate SignNow provides features such as eSigning, document templates, and real-time tracking for the Form 593 C Real Estate Withholding Certificate California Form 593 C. These features simplify the document management process, allowing you to focus on your business while ensuring compliance with tax regulations.

-

How secure is airSlate SignNow when handling the Form 593 C Real Estate Withholding Certificate California Form 593 C?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your data, including the Form 593 C Real Estate Withholding Certificate California Form 593 C. You can trust that your sensitive information is safe with us.

Get more for Form 593 C Real Estate Withholding Certificate California Form 593 C

Find out other Form 593 C Real Estate Withholding Certificate California Form 593 C

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease