TAXABLE YEAR California S Corporation Franchise or Income Tax Return FORM 100S for Calendar Year or Fiscal Year Beginning Month

Understanding the California S Corporation Franchise or Income Tax Return FORM 100S

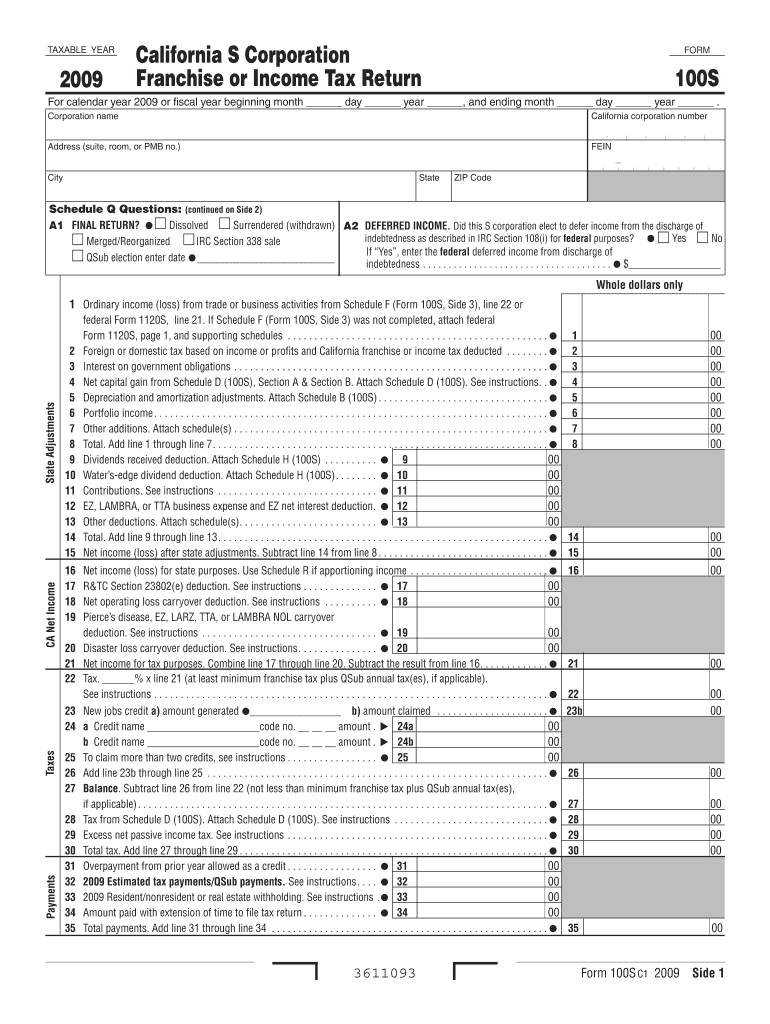

The California S Corporation Franchise or Income Tax Return FORM 100S is a crucial document for S corporations operating in California. This form is used to report the income, deductions, and credits of the corporation for a specific taxable year. S corporations must file this return annually, regardless of whether they have taxable income or not. The form is applicable for both calendar year and fiscal year corporations, allowing flexibility in financial reporting based on the corporation's operational calendar.

Steps to Complete the California S Corporation Franchise or Income Tax Return FORM 100S

Completing the FORM 100S involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and prior year tax returns.

- Determine the taxable year for the corporation, noting the beginning and ending dates.

- Fill out the form accurately, ensuring all income, deductions, and credits are reported.

- Review the completed form for accuracy and completeness before submission.

- Submit the form by the designated deadline to avoid penalties.

Obtaining the California S Corporation Franchise or Income Tax Return FORM 100S

The FORM 100S can be obtained through the California Franchise Tax Board's official website. It is available for download in a printable format, allowing corporations to fill it out manually or electronically. Additionally, many tax software programs include this form, facilitating easier completion and submission for business owners.

Key Elements of the California S Corporation Franchise or Income Tax Return FORM 100S

Several key elements must be included when filling out the FORM 100S:

- Identification information, including the corporation's name, address, and federal employer identification number (EIN).

- Income details, including gross receipts and other income sources.

- Deductions for business expenses, which can significantly affect taxable income.

- Credits that the corporation may be eligible for, which can reduce the overall tax liability.

Filing Deadlines for the California S Corporation Franchise or Income Tax Return FORM 100S

The filing deadline for the FORM 100S typically aligns with the corporation's taxable year end. For calendar year corporations, the deadline is usually March 15 of the following year. Fiscal year corporations must file on the 15th day of the third month following the end of their fiscal year. It is essential to adhere to these deadlines to avoid late fees and penalties.

Legal Use of the California S Corporation Franchise or Income Tax Return FORM 100S

The FORM 100S serves as the legal document for reporting the financial activities of an S corporation in California. It is crucial for compliance with state tax laws and regulations. Accurate completion and timely submission of this form help ensure that the corporation fulfills its legal obligations and avoids potential legal issues related to tax compliance.

Quick guide on how to complete taxable year california s corporation franchise or income tax return form 100s for calendar year or fiscal year beginning month

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to access the right forms and securely save them online. airSlate SignNow equips you with all the instruments necessary to create, alter, and eSign your documents swiftly without any delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

Steps to Alter and eSign [SKS] with Ease

- Locate [SKS] and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize essential sections of your documents or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Carefully review all the information and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Adjust and eSign [SKS] while ensuring outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to TAXABLE YEAR California S Corporation Franchise Or Income Tax Return FORM 100S For Calendar Year Or Fiscal Year Beginning Month

Create this form in 5 minutes!

How to create an eSignature for the taxable year california s corporation franchise or income tax return form 100s for calendar year or fiscal year beginning month

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TAXABLE YEAR California S Corporation Franchise Or Income Tax Return FORM 100S?

The TAXABLE YEAR California S Corporation Franchise Or Income Tax Return FORM 100S is a tax form used by S corporations in California to report their income, deductions, and credits for a specific taxable year. This form is essential for ensuring compliance with state tax regulations and must be filed for either a calendar year or a fiscal year.

-

How do I determine my taxable year for filing FORM 100S?

To determine your taxable year for filing the TAXABLE YEAR California S Corporation Franchise Or Income Tax Return FORM 100S, you can choose either a calendar year or a fiscal year. A calendar year runs from January 1 to December 31, while a fiscal year can be any 12-month period ending on the last day of any month. It's important to select the option that best fits your business operations.

-

What are the benefits of using airSlate SignNow for filing FORM 100S?

Using airSlate SignNow for filing the TAXABLE YEAR California S Corporation Franchise Or Income Tax Return FORM 100S offers several benefits, including streamlined document management and eSigning capabilities. This user-friendly platform allows you to easily prepare, send, and sign your tax documents, ensuring a hassle-free filing process while maintaining compliance with state regulations.

-

Is there a cost associated with using airSlate SignNow for tax document management?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Pricing plans vary based on features and usage, allowing you to choose a plan that fits your needs for managing the TAXABLE YEAR California S Corporation Franchise Or Income Tax Return FORM 100S and other documents.

-

Can I integrate airSlate SignNow with other accounting software for filing FORM 100S?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage your documents related to the TAXABLE YEAR California S Corporation Franchise Or Income Tax Return FORM 100S. This seamless integration helps streamline your workflow and ensures that all your financial data is in one place.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides a range of features for tax document management, including customizable templates, secure eSigning, and real-time tracking of document status. These features are particularly useful when preparing and submitting the TAXABLE YEAR California S Corporation Franchise Or Income Tax Return FORM 100S, ensuring that your documents are handled efficiently.

-

How can airSlate SignNow help ensure compliance when filing FORM 100S?

airSlate SignNow helps ensure compliance when filing the TAXABLE YEAR California S Corporation Franchise Or Income Tax Return FORM 100S by providing secure storage and easy access to your documents. The platform also allows for electronic signatures, which are legally binding, ensuring that your filings meet all necessary legal requirements.

Get more for TAXABLE YEAR California S Corporation Franchise Or Income Tax Return FORM 100S For Calendar Year Or Fiscal Year Beginning Month

- Mortgage denial letter form

- Mathematics of personal finance sem 1 form

- Rice lake 720i manual espaol pdf form

- Nora roberts knjige pdf form

- Applemdt 5306774 form

- Graphs of proportional relationships independent practice worksheet answer key form

- Construction loan cost breakdown worksheet 100318847 form

- Facilitator feedback form

Find out other TAXABLE YEAR California S Corporation Franchise Or Income Tax Return FORM 100S For Calendar Year Or Fiscal Year Beginning Month

- Sign Business Operations PDF South Carolina Safe

- Sign Rhode Island Business Operations Letter Of Intent Later

- Sign Rhode Island Business Operations Letter Of Intent Myself

- How To Sign Rhode Island Business Operations Letter Of Intent

- How Do I Sign Rhode Island Business Operations Letter Of Intent

- Sign Rhode Island Business Operations Letter Of Intent Free

- Help Me With Sign Rhode Island Business Operations Letter Of Intent

- Sign Oregon Business Operations Residential Lease Agreement Online

- How Can I Sign Rhode Island Business Operations Letter Of Intent

- Sign Rhode Island Business Operations Letter Of Intent Secure

- Can I Sign Rhode Island Business Operations Letter Of Intent

- Sign Rhode Island Business Operations Letter Of Intent Fast

- Sign Oregon Business Operations Residential Lease Agreement Computer

- Sign Rhode Island Business Operations Letter Of Intent Simple

- How To Sign Oregon Business Operations Residential Lease Agreement

- Sign Oregon Business Operations Residential Lease Agreement Mobile

- How Do I Sign Oregon Business Operations Residential Lease Agreement

- Sign Rhode Island Business Operations Letter Of Intent Easy

- Help Me With Sign Oregon Business Operations Residential Lease Agreement

- How Can I Sign Oregon Business Operations Residential Lease Agreement