Delaware S Corporation Reconciliation and Shareholders Information

What is the Delaware S Corporation Reconciliation And Shareholders Information

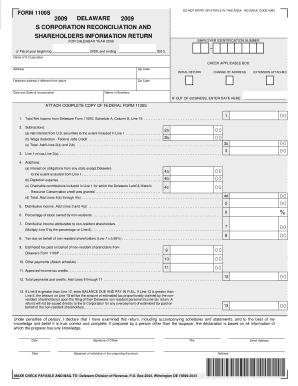

The Delaware S Corporation Reconciliation and Shareholders Information form is a crucial document for S corporations operating in Delaware. This form is designed to reconcile the income and expenses of the corporation with the income reported by shareholders on their personal tax returns. It ensures that all income is accurately reported and taxed at the appropriate levels, providing transparency between the corporation and its shareholders.

This form is essential for maintaining compliance with state tax regulations and helps to prevent discrepancies that could lead to audits or penalties. By accurately completing this form, corporations can ensure that shareholders receive the correct information for their individual tax filings.

Steps to complete the Delaware S Corporation Reconciliation And Shareholders Information

Completing the Delaware S Corporation Reconciliation and Shareholders Information form involves several key steps:

- Gather financial records, including income statements and balance sheets for the corporation.

- Compile a list of all shareholders and their respective ownership percentages.

- Calculate the total income of the corporation and any deductions that apply.

- Distribute the income to shareholders based on their ownership percentages.

- Complete the form by accurately reporting the reconciled income and any additional information required.

- Review the completed form for accuracy before submission.

Following these steps helps ensure that the form is filled out correctly, reducing the risk of errors and potential issues with tax authorities.

Legal use of the Delaware S Corporation Reconciliation And Shareholders Information

The legal use of the Delaware S Corporation Reconciliation and Shareholders Information form is primarily to comply with state tax regulations. By filing this form, S corporations confirm their status and report income distributions to shareholders, which is necessary for tax purposes. This form must be filed annually to maintain compliance and avoid penalties.

Additionally, accurate completion of this form helps ensure that shareholders are taxed appropriately on their share of the corporation's income, aligning with IRS guidelines and state requirements. Failure to file or inaccuracies in the form can lead to legal repercussions, including fines or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Delaware S Corporation Reconciliation and Shareholders Information form are critical to ensure compliance. Typically, the form must be submitted by the fifteenth day of the fourth month following the end of the corporation's tax year. For most corporations operating on a calendar year, this means the form is due by April 15.

It is essential to stay informed about any changes in deadlines or requirements, as these can vary based on state regulations or changes in tax law. Marking these dates on a calendar can help ensure timely submission and avoid penalties.

Required Documents

To complete the Delaware S Corporation Reconciliation and Shareholders Information form, several documents are necessary:

- Financial statements, including income statements and balance sheets.

- Shareholder information, including names, addresses, and ownership percentages.

- Records of any distributions made to shareholders during the tax year.

- Supporting documentation for any deductions claimed by the corporation.

Having these documents readily available can streamline the process of completing the form and ensure accuracy.

Who Issues the Form

The Delaware S Corporation Reconciliation and Shareholders Information form is issued by the Delaware Division of Revenue. This state agency is responsible for overseeing tax compliance and ensuring that corporations adhere to state tax laws. The form is typically made available on the Division of Revenue's official website, where corporations can access the most current version and any accompanying instructions.

It is advisable to check for updates regularly, as forms and requirements may change from year to year.

Quick guide on how to complete delaware s corporation reconciliation and shareholders information

Complete [SKS] seamlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with everything necessary to create, modify, and electronically sign your documents quickly and without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to edit and eSign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight signNow sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] while ensuring effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Delaware S Corporation Reconciliation And Shareholders Information

Create this form in 5 minutes!

How to create an eSignature for the delaware s corporation reconciliation and shareholders information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Delaware S Corporation Reconciliation And Shareholders Information?

Delaware S Corporation Reconciliation And Shareholders Information refers to the process of aligning financial records and ensuring accurate reporting for S Corporations in Delaware. This includes managing shareholder details and ensuring compliance with state regulations. Proper reconciliation helps maintain transparency and trust among shareholders.

-

How can airSlate SignNow assist with Delaware S Corporation Reconciliation And Shareholders Information?

airSlate SignNow provides a streamlined platform for managing documents related to Delaware S Corporation Reconciliation And Shareholders Information. With features like eSigning and document tracking, businesses can efficiently handle shareholder agreements and financial statements. This ensures that all necessary documents are easily accessible and securely stored.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs, including options for small businesses and larger enterprises. Each plan includes features that support Delaware S Corporation Reconciliation And Shareholders Information, ensuring you have the tools necessary for effective document management. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and automated workflows, all of which are beneficial for Delaware S Corporation Reconciliation And Shareholders Information. These features help streamline the document process, reduce errors, and save time. Additionally, users can track document status in real-time.

-

Is airSlate SignNow compliant with Delaware state regulations?

Yes, airSlate SignNow is designed to comply with Delaware state regulations, making it a reliable choice for managing Delaware S Corporation Reconciliation And Shareholders Information. The platform ensures that all documents meet legal standards, providing peace of mind for businesses. Compliance is crucial for maintaining good standing with state authorities.

-

Can airSlate SignNow integrate with other software tools?

Absolutely! airSlate SignNow offers integrations with various software tools, enhancing its functionality for Delaware S Corporation Reconciliation And Shareholders Information. Whether you use accounting software or CRM systems, these integrations help streamline your workflow and improve overall efficiency. This connectivity allows for seamless data transfer and management.

-

What are the benefits of using airSlate SignNow for S Corporations?

Using airSlate SignNow for S Corporations provides numerous benefits, including improved efficiency in document handling and enhanced security for sensitive information. It simplifies the process of Delaware S Corporation Reconciliation And Shareholders Information, allowing businesses to focus on growth rather than paperwork. Additionally, the user-friendly interface makes it accessible for all team members.

Get more for Delaware S Corporation Reconciliation And Shareholders Information

Find out other Delaware S Corporation Reconciliation And Shareholders Information

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding