ENRG B Indd Montana Department of Revenue Form

What is the ENRG B indd Montana Department Of Revenue

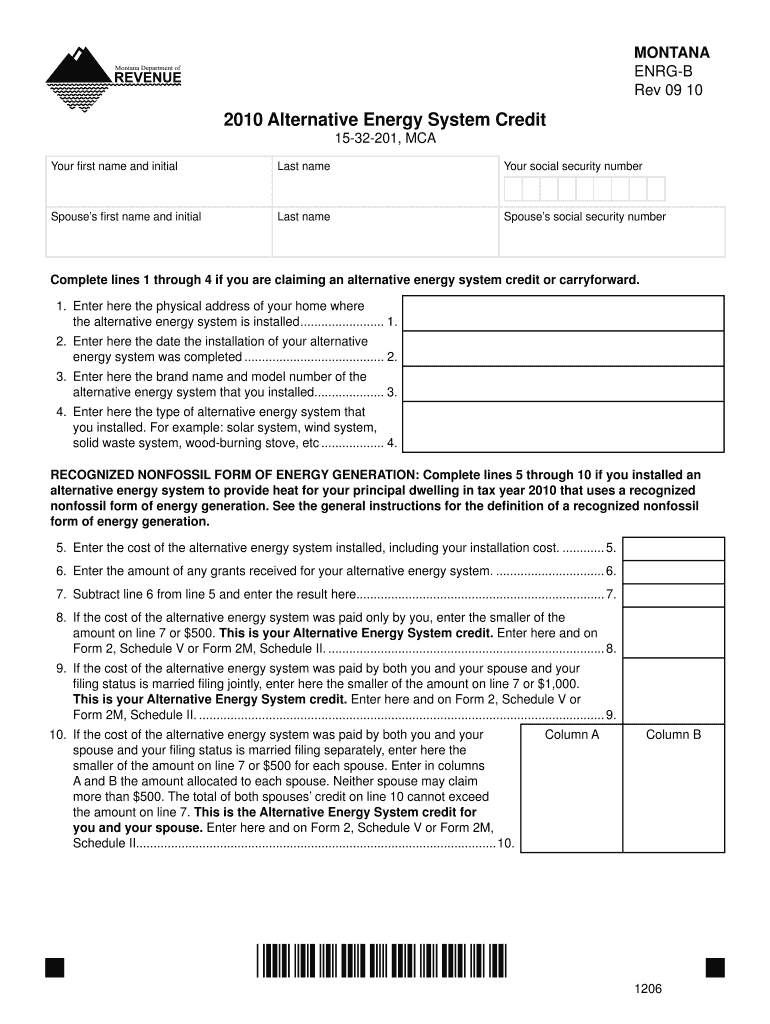

The ENRG B indd form is a document utilized by the Montana Department of Revenue, primarily related to energy resource tax reporting. This form is essential for businesses engaged in the extraction or production of energy resources within the state. It facilitates the accurate reporting of revenues, expenses, and other pertinent financial data, ensuring compliance with state tax regulations.

How to use the ENRG B indd Montana Department Of Revenue

Using the ENRG B indd form involves several steps. First, gather all necessary financial data related to energy resource activities. This includes income from sales, operational costs, and any applicable deductions. Next, fill out the form accurately, ensuring that all sections are completed to reflect your business's financial situation. Once completed, the form must be submitted to the Montana Department of Revenue as per the specified guidelines.

Steps to complete the ENRG B indd Montana Department Of Revenue

Completing the ENRG B indd form requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, including income statements and expense reports.

- Access the form from the Montana Department of Revenue website or through authorized channels.

- Fill in each section, ensuring accuracy in reporting figures.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either online or via mail.

Legal use of the ENRG B indd Montana Department Of Revenue

The ENRG B indd form serves a legal purpose in the context of tax compliance. Businesses must use this form to report their energy resource activities accurately, as failure to do so may result in penalties or fines. It is crucial to adhere to the guidelines set forth by the Montana Department of Revenue to ensure that all legal obligations are met.

Key elements of the ENRG B indd Montana Department Of Revenue

Key elements of the ENRG B indd form include:

- Identification of the business and its tax identification number.

- Detailed reporting of revenue generated from energy resources.

- Documentation of allowable deductions and expenses.

- Signature of the responsible party certifying the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the ENRG B indd form are critical for compliance. Typically, businesses must submit this form by the end of the fiscal year, but specific dates may vary. It is advisable to check the Montana Department of Revenue's official calendar for the most accurate and up-to-date information regarding submission deadlines.

Quick guide on how to complete enrg b indd montana department of revenue

Effortlessly Prepare [SKS] on Any Device

The management of online documents has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage [SKS] on any device using the airSlate SignNow apps available for Android or iOS, and enhance any document-related process today.

Steps to Edit and Electronically Sign [SKS] with Ease

- Locate [SKS] and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, and mistakes that necessitate new copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign [SKS] to ensure flawless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to ENRG B indd Montana Department Of Revenue

Create this form in 5 minutes!

How to create an eSignature for the enrg b indd montana department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ENRG B indd Montana Department Of Revenue form?

The ENRG B indd Montana Department Of Revenue form is a document required for specific tax-related submissions in Montana. It ensures compliance with state regulations and helps businesses manage their tax obligations effectively. Using airSlate SignNow, you can easily fill out and eSign this form, streamlining your submission process.

-

How can airSlate SignNow help with the ENRG B indd Montana Department Of Revenue form?

airSlate SignNow simplifies the process of completing the ENRG B indd Montana Department Of Revenue form by providing an intuitive interface for filling out and signing documents. Our platform allows you to collaborate with team members and securely store your completed forms. This ensures that you can manage your tax documents efficiently and without hassle.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and teams. Each plan provides access to essential features for managing documents like the ENRG B indd Montana Department Of Revenue form. You can choose a plan that best fits your budget and requirements.

-

Are there any features specifically designed for tax documents like the ENRG B indd Montana Department Of Revenue?

Yes, airSlate SignNow includes features tailored for tax documents, such as templates for the ENRG B indd Montana Department Of Revenue form. You can also set reminders for deadlines and track the status of your submissions. These features help ensure that you stay organized and compliant with tax regulations.

-

Can I integrate airSlate SignNow with other software for managing the ENRG B indd Montana Department Of Revenue?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to connect with your existing tools for managing the ENRG B indd Montana Department Of Revenue form. This integration capability enhances your workflow and ensures that all your documents are easily accessible in one place.

-

What are the benefits of using airSlate SignNow for the ENRG B indd Montana Department Of Revenue?

Using airSlate SignNow for the ENRG B indd Montana Department Of Revenue offers numerous benefits, including time savings and improved accuracy. The platform's eSigning capabilities eliminate the need for printing and scanning, making the process more efficient. Additionally, you can ensure that your documents are securely stored and easily retrievable.

-

Is airSlate SignNow secure for handling sensitive documents like the ENRG B indd Montana Department Of Revenue?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents such as the ENRG B indd Montana Department Of Revenue. Our platform uses advanced encryption and security protocols to protect your data. You can trust that your information is secure while using our services.

Get more for ENRG B indd Montana Department Of Revenue

- Sealed birth certificate or paternity form

- Respond to a petition for a parenting plan residential form

- Scheduleparenting plan or form

- Final order and findings for a parenting plan residential form

- Fillable online courts wa superior court of washington form

- Final order rs form

- Does not apply because no attorneys fees or back child support has been ordered form

- Out of state acknowledgment form

Find out other ENRG B indd Montana Department Of Revenue

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement