Form 5305 E Rev October EFile

What is the Form 5305 E Rev October EFile

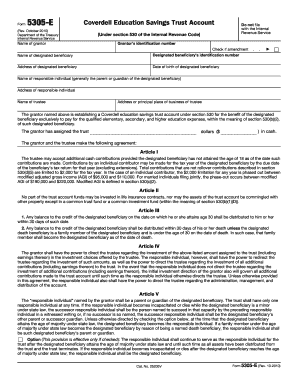

The Form 5305 E Rev October EFile is a document used by businesses and individuals to establish and maintain a qualified retirement plan under the Internal Revenue Code. This form is specifically designed for employers who want to create a simplified employee pension (SEP) plan, which allows them to contribute to their employees' retirement savings. The form outlines the terms of the plan and ensures compliance with IRS regulations, making it a crucial component in retirement planning for small businesses and self-employed individuals.

How to use the Form 5305 E Rev October EFile

Using the Form 5305 E Rev October EFile involves several steps. First, employers must fill out the form with the necessary information about the business and the retirement plan. This includes details about contributions, eligibility, and the plan's effective date. Once completed, the form must be retained in the employer's records, but it does not need to be submitted to the IRS unless requested. It is important to ensure that all employees are informed about the plan and understand their rights and benefits under it.

Steps to complete the Form 5305 E Rev October EFile

Completing the Form 5305 E Rev October EFile requires careful attention to detail. Follow these steps:

- Download the form from the IRS website or obtain a copy from a tax professional.

- Fill in the employer's name, address, and Employer Identification Number (EIN).

- Specify the plan's effective date and the contribution limits.

- Detail the eligibility requirements for employees to participate in the plan.

- Review the completed form for accuracy and completeness.

- Keep the form in your records for future reference and compliance purposes.

Legal use of the Form 5305 E Rev October EFile

The legal use of the Form 5305 E Rev October EFile is essential for compliance with IRS regulations. By properly completing and retaining this form, employers can ensure that their SEP plan meets federal requirements. Failure to comply with these regulations can result in penalties or disqualification of the retirement plan, which may affect both the employer and employees. It is advisable to consult with a tax professional to ensure that all legal aspects of the form are correctly addressed.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Form 5305 E Rev October EFile. Employers must adhere to these guidelines to maintain the tax-advantaged status of their retirement plans. Key points include ensuring that contributions do not exceed the limits set by the IRS, providing employees with necessary disclosures about the plan, and maintaining accurate records of contributions and eligibility. Regularly reviewing IRS updates is recommended to stay compliant with any changes in regulations.

Filing Deadlines / Important Dates

While the Form 5305 E Rev October EFile does not need to be submitted to the IRS, employers should be aware of important deadlines related to contributions and plan establishment. Generally, contributions for a given tax year must be made by the tax filing deadline, including extensions. It is crucial to mark these dates on the calendar to ensure timely compliance and to maximize tax benefits for both the employer and employees.

Required Documents

To effectively use the Form 5305 E Rev October EFile, certain documents may be required. These include:

- Employer Identification Number (EIN)

- Records of employee eligibility and contributions

- Plan documents outlining the terms of the SEP

- Any prior forms or amendments related to the retirement plan

Having these documents readily available will facilitate the completion of the form and ensure compliance with IRS requirements.

Quick guide on how to complete form 5305 e rev october efile

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform with the airSlate SignNow Android or iOS applications and simplify any document-centric task today.

The easiest way to modify and eSign [SKS] seamlessly

- Find [SKS] and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes moments and carries the same legal authority as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Select your preferred method to submit your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you choose. Edit and eSign [SKS] and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5305 e rev october efile

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 5305 E Rev October EFile?

Form 5305 E Rev October EFile is a tax form used for electronic filing of certain tax-related documents. It simplifies the submission process, allowing users to file their forms quickly and efficiently. Understanding this form is crucial for businesses looking to streamline their tax filing.

-

How does airSlate SignNow support Form 5305 E Rev October EFile?

airSlate SignNow provides a user-friendly platform that allows businesses to easily eSign and send Form 5305 E Rev October EFile. Our solution ensures that your documents are securely signed and stored, making the filing process seamless. With our platform, you can manage your forms efficiently and reduce the risk of errors.

-

What are the pricing options for using airSlate SignNow for Form 5305 E Rev October EFile?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different businesses. Whether you are a small business or a large enterprise, we have a plan that fits your budget. Our pricing is transparent, with no hidden fees, ensuring you get the best value for managing your Form 5305 E Rev October EFile.

-

What features does airSlate SignNow offer for Form 5305 E Rev October EFile?

Our platform includes features such as customizable templates, secure eSigning, and real-time tracking for Form 5305 E Rev October EFile. These tools enhance your document management process, making it easier to prepare and submit your forms. Additionally, our user-friendly interface ensures that you can navigate the platform with ease.

-

Can I integrate airSlate SignNow with other software for Form 5305 E Rev October EFile?

Yes, airSlate SignNow offers integrations with various software applications to enhance your workflow for Form 5305 E Rev October EFile. You can connect with popular tools like CRM systems, accounting software, and more. This integration capability allows for a more streamlined process, saving you time and effort.

-

What are the benefits of using airSlate SignNow for Form 5305 E Rev October EFile?

Using airSlate SignNow for Form 5305 E Rev October EFile provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete your forms quickly and securely, minimizing the risk of errors. Additionally, you can access your documents anytime, anywhere, making it convenient for busy professionals.

-

Is airSlate SignNow compliant with regulations for Form 5305 E Rev October EFile?

Absolutely! airSlate SignNow is designed to comply with all relevant regulations for Form 5305 E Rev October EFile. We prioritize data security and legal compliance, ensuring that your documents are handled according to industry standards. You can trust our platform to keep your information safe and secure.

Get more for Form 5305 E Rev October EFile

Find out other Form 5305 E Rev October EFile

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure