Form 1120 PC Schedule M 3 Internal Revenue Service

What is the Form 1120 PC Schedule M-3 Internal Revenue Service

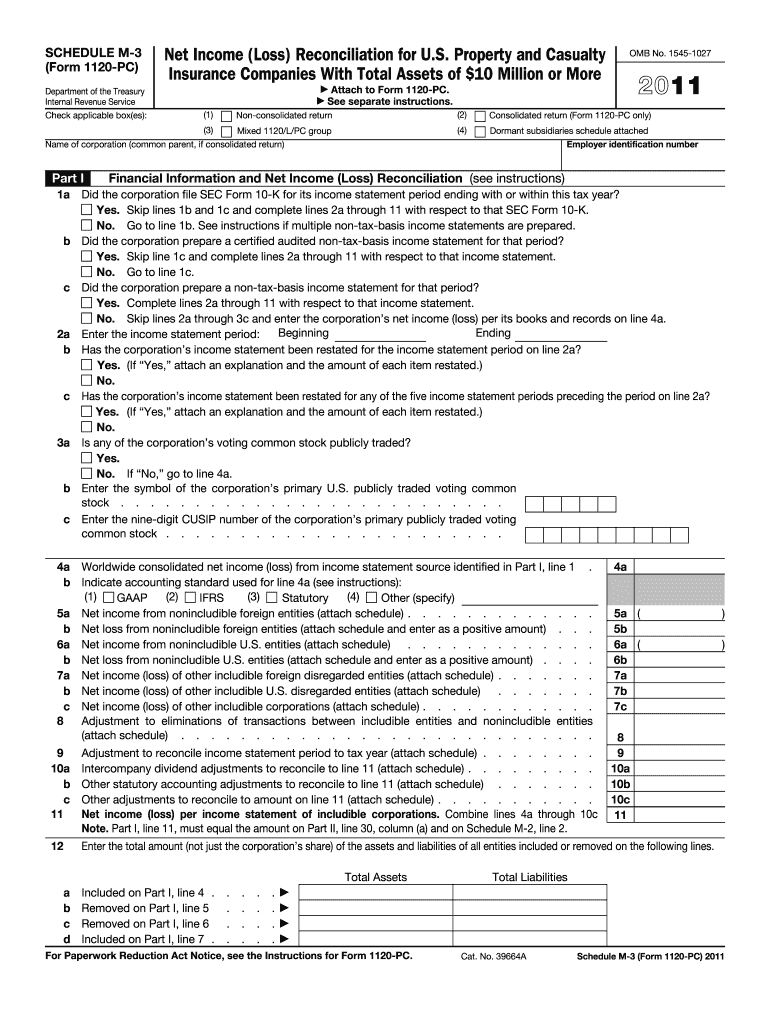

The Form 1120 PC Schedule M-3 is a tax form used by certain corporations to report their financial information to the Internal Revenue Service (IRS). This form is specifically designed for corporations that are classified as personal holding companies (PHCs). It provides a detailed reconciliation of income and expenses, allowing the IRS to assess the tax liability accurately. The Schedule M-3 is essential for ensuring compliance with federal tax regulations and helps to identify discrepancies between book income and taxable income.

How to use the Form 1120 PC Schedule M-3 Internal Revenue Service

Using the Form 1120 PC Schedule M-3 involves several steps that require careful attention to detail. First, corporations must gather all relevant financial documents, including income statements and balance sheets. Next, they should complete the form by accurately reporting income, deductions, and other adjustments. The form requires detailed information about the corporation's financial activities, which may include foreign income and tax credits. After completing the form, it should be reviewed for accuracy before submission to ensure compliance with IRS guidelines.

Steps to complete the Form 1120 PC Schedule M-3 Internal Revenue Service

Completing the Form 1120 PC Schedule M-3 involves a systematic approach:

- Gather financial records, including income statements and balance sheets.

- Begin filling out the form by entering basic corporate information, such as name, address, and Employer Identification Number (EIN).

- Report total income and deductions as outlined in the instructions.

- Detail any adjustments to reconcile book income with taxable income.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS by the designated deadline.

Key elements of the Form 1120 PC Schedule M-3 Internal Revenue Service

The Form 1120 PC Schedule M-3 includes several key elements that are crucial for accurate reporting. These elements consist of:

- Income Reporting: Detailed reporting of all sources of income, including ordinary income and capital gains.

- Deductions: A comprehensive list of allowable deductions that can reduce taxable income.

- Reconciliation: A section for reconciling differences between financial accounting and tax reporting.

- Additional Information: Questions regarding foreign income, tax credits, and other relevant financial activities.

Legal use of the Form 1120 PC Schedule M-3 Internal Revenue Service

The legal use of the Form 1120 PC Schedule M-3 is imperative for compliance with U.S. tax laws. Corporations required to file this form must do so accurately and on time to avoid penalties. The form serves as a legal document that provides the IRS with necessary financial information to determine tax obligations. Failing to file or providing incorrect information can lead to legal repercussions, including fines and audits. Therefore, it is essential for corporations to understand their obligations under the law when using this form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1120 PC Schedule M-3 are critical for compliance. Generally, the form must be filed on or before the 15th day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this typically means a deadline of March 15. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Corporations should also be aware of any extensions that may be available, which require separate forms to be filed.

Quick guide on how to complete form 1120 pc schedule m 3 internal revenue service

Effortlessly Prepare Form 1120 PC Schedule M 3 Internal Revenue Service on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed materials, as you can access the required form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Form 1120 PC Schedule M 3 Internal Revenue Service on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

Easily Modify and eSign Form 1120 PC Schedule M 3 Internal Revenue Service

- Obtain Form 1120 PC Schedule M 3 Internal Revenue Service and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Edit and eSign Form 1120 PC Schedule M 3 Internal Revenue Service and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1120 pc schedule m 3 internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1120 PC Schedule M 3 Internal Revenue Service?

Form 1120 PC Schedule M 3 Internal Revenue Service is a tax form used by certain corporations to report their income, deductions, and tax liability. It provides detailed information about the corporation's financial activities and is essential for compliance with federal tax regulations. Understanding this form is crucial for accurate tax reporting.

-

How can airSlate SignNow help with Form 1120 PC Schedule M 3 Internal Revenue Service?

airSlate SignNow simplifies the process of preparing and submitting Form 1120 PC Schedule M 3 Internal Revenue Service by allowing users to easily create, edit, and eSign documents. Our platform ensures that all necessary fields are filled out correctly, reducing the risk of errors. This streamlines your tax filing process and enhances compliance.

-

What features does airSlate SignNow offer for managing Form 1120 PC Schedule M 3 Internal Revenue Service?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for Form 1120 PC Schedule M 3 Internal Revenue Service. These tools help users manage their tax documents efficiently and ensure that they are always up-to-date. Additionally, our platform provides reminders for important deadlines.

-

Is airSlate SignNow cost-effective for businesses needing Form 1120 PC Schedule M 3 Internal Revenue Service?

Yes, airSlate SignNow is a cost-effective solution for businesses that need to manage Form 1120 PC Schedule M 3 Internal Revenue Service. Our pricing plans are designed to accommodate various business sizes and needs, ensuring that you get the best value for your investment. With our platform, you can save time and reduce costs associated with traditional document management.

-

Can I integrate airSlate SignNow with other software for Form 1120 PC Schedule M 3 Internal Revenue Service?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, making it easier to manage Form 1120 PC Schedule M 3 Internal Revenue Service. This allows for a more streamlined workflow, as you can easily import and export data between platforms. Our integrations enhance efficiency and reduce manual data entry.

-

What are the benefits of using airSlate SignNow for Form 1120 PC Schedule M 3 Internal Revenue Service?

Using airSlate SignNow for Form 1120 PC Schedule M 3 Internal Revenue Service provides numerous benefits, including increased efficiency, enhanced security, and improved compliance. Our platform allows for quick document preparation and eSigning, which saves time during tax season. Additionally, our secure storage ensures that your sensitive information is protected.

-

How does airSlate SignNow ensure the security of Form 1120 PC Schedule M 3 Internal Revenue Service documents?

airSlate SignNow prioritizes the security of your documents, including Form 1120 PC Schedule M 3 Internal Revenue Service, by employing advanced encryption and secure cloud storage. We comply with industry standards to protect your sensitive data from unauthorized access. You can trust that your documents are safe while using our platform.

Get more for Form 1120 PC Schedule M 3 Internal Revenue Service

- Plaza ins co v lester civil action no 14 cv 01162 ltb cbs form

- In the chancery court of county mississippi form

- Modifications mass legal services form

- State of kentucky hereinafter referred to as the trustor and the trustee form

- Checklist for sale or acquisition of a small business professional form

- Utah registered agent servicesct corporation form

- Using a pour over will in estate planning the balance form

- Free eviction notice forms notices to quit pdfwordeforms

Find out other Form 1120 PC Schedule M 3 Internal Revenue Service

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors