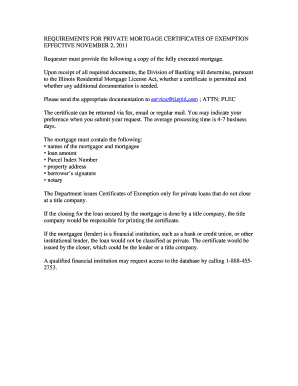

REQUIREMENTS for PRIVATE MORTGAGE CERTIFICATES of EXEMPTION Form

What are the requirements for private mortgage certificates of exemption?

The requirements for private mortgage certificates of exemption are specific criteria that must be met to qualify for exemption from certain mortgage-related taxes. These requirements can vary by state, but generally include the following:

- The property must be used for residential purposes.

- The applicant must provide proof of ownership or a legal interest in the property.

- Documentation demonstrating compliance with local zoning laws may be required.

- Income and asset limits may apply, depending on state regulations.

Understanding these requirements is crucial for homeowners and investors seeking to benefit from tax exemptions on private mortgages.

How to obtain private mortgage certificates of exemption

Obtaining a private mortgage certificate of exemption involves several steps. First, you need to determine your eligibility based on your state’s specific criteria. Next, gather the necessary documentation, which may include:

- Proof of identity, such as a driver's license or passport.

- Documentation of property ownership, like a deed or title.

- Any additional forms required by your state or local government.

Once you have collected the required documents, you can submit your application to the appropriate state or local agency, either online or in person. Be sure to check for any filing fees or deadlines associated with your application.

Steps to complete the private mortgage certificates of exemption

Completing the process for private mortgage certificates of exemption typically involves the following steps:

- Review your state’s eligibility criteria to ensure you qualify.

- Gather all necessary documentation, including proof of ownership and identification.

- Fill out the application form accurately, ensuring all information is complete.

- Submit your application along with any required fees to the designated agency.

- Keep a copy of your application and any correspondence for your records.

Following these steps carefully can help ensure a smooth application process and increase the likelihood of approval.

Required documents for private mortgage certificates of exemption

The required documents for applying for a private mortgage certificate of exemption can vary by state, but typically include:

- A completed application form.

- Proof of identity, such as a government-issued ID.

- Documentation of property ownership, like a deed or title.

- Any relevant financial documents, such as tax returns or income statements.

It is essential to check your state’s specific requirements to ensure you submit all necessary documentation to avoid delays in processing your application.

Eligibility criteria for private mortgage certificates of exemption

Eligibility criteria for private mortgage certificates of exemption can differ significantly from one state to another. Common factors that determine eligibility often include:

- The intended use of the property, which must typically be residential.

- The applicant's income level, which may need to fall below a certain threshold.

- Compliance with local zoning laws and regulations.

Understanding these criteria is vital for applicants to assess their chances of receiving an exemption and to prepare the necessary documentation accordingly.

Legal use of private mortgage certificates of exemption

Private mortgage certificates of exemption are used to legally waive certain mortgage-related taxes. This legal status allows homeowners and investors to save money on their mortgage obligations. However, it is important to ensure that:

- The certificate is obtained through the proper legal channels.

- All eligibility requirements are met to avoid penalties.

- Documentation is maintained to support the exemption if audited.

Legal compliance is essential to ensure the benefits of the exemption are fully realized without any risk of legal repercussions.

Quick guide on how to complete requirements for private mortgage certificates of exemption

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can access the appropriate form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Use the tools available to complete your form.

- Mark important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any preferred device. Edit and eSign [SKS] and guarantee clear communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to REQUIREMENTS FOR PRIVATE MORTGAGE CERTIFICATES OF EXEMPTION

Create this form in 5 minutes!

How to create an eSignature for the requirements for private mortgage certificates of exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the requirements for obtaining a private mortgage certificate of exemption?

The requirements for private mortgage certificates of exemption typically include proof of income, property documentation, and a completed application form. It's essential to ensure that all necessary documents are submitted to avoid delays in processing. Additionally, specific criteria may vary by state or lender, so it's advisable to check local regulations.

-

How can airSlate SignNow help with the requirements for private mortgage certificates of exemption?

airSlate SignNow streamlines the process of gathering and signing documents required for private mortgage certificates of exemption. Our platform allows users to easily create, send, and eSign necessary forms, ensuring compliance with all requirements. This efficiency can signNowly reduce the time it takes to obtain your certificate.

-

Are there any fees associated with obtaining a private mortgage certificate of exemption?

Yes, there may be fees associated with obtaining a private mortgage certificate of exemption, which can vary based on the lender and local regulations. It's important to inquire about any application fees, processing fees, or other costs involved. Using airSlate SignNow can help you manage these documents efficiently, potentially saving you time and money.

-

What features does airSlate SignNow offer for managing private mortgage certificates of exemption?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing private mortgage certificates of exemption. These tools help ensure that all requirements are met and that documents are processed quickly. Additionally, our platform provides a user-friendly interface that simplifies the entire process.

-

Can I integrate airSlate SignNow with other tools for managing private mortgage certificates of exemption?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRM systems and cloud storage services. This integration allows you to manage all aspects of your private mortgage certificates of exemption in one place, enhancing productivity and ensuring that all requirements are easily accessible.

-

What are the benefits of using airSlate SignNow for private mortgage certificates of exemption?

Using airSlate SignNow for private mortgage certificates of exemption offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that all documents are securely stored and easily retrievable, which is crucial for meeting the requirements. Additionally, the eSigning feature speeds up the approval process.

-

How does airSlate SignNow ensure the security of documents related to private mortgage certificates of exemption?

airSlate SignNow prioritizes the security of your documents by employing advanced encryption and secure cloud storage. This ensures that all information related to private mortgage certificates of exemption is protected from unauthorized access. Our compliance with industry standards further guarantees the safety of your sensitive data.

Get more for REQUIREMENTS FOR PRIVATE MORTGAGE CERTIFICATES OF EXEMPTION

- Direct transfer from grow financial federal credit union growfinancial form

- Diabetes form

- Mailing address if different from address form

- Schedule appointment request form

- La jolla gastroenterology medical group patient forms la

- Fst intake formdocx

- Center for pediatric and adolescent medicine form

- Excellus claim form 100853424

Find out other REQUIREMENTS FOR PRIVATE MORTGAGE CERTIFICATES OF EXEMPTION

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast