Air ConditionerAir to Air Heat Pump Rebate Application Form

What is the Air ConditionerAir To Air Heat Pump Rebate Application

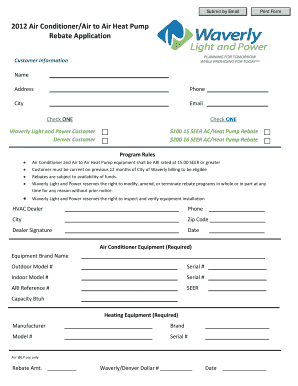

The Air ConditionerAir To Air Heat Pump Rebate Application is a form designed for homeowners and businesses seeking financial incentives for installing energy-efficient heating and cooling systems. This rebate program encourages the use of air-to-air heat pumps and air conditioners, promoting energy conservation and reducing utility costs. Applicants can receive rebates from local or state energy programs, which may vary based on specific criteria and eligibility requirements.

Eligibility Criteria

To qualify for the Air ConditionerAir To Air Heat Pump Rebate Application, applicants must meet certain criteria. Typically, eligibility includes:

- Installation of a qualified air-to-air heat pump or air conditioning system.

- Compliance with local energy efficiency standards.

- Residency in the state or locality offering the rebate.

- Completion of the application within specified timeframes.

It is essential for applicants to review the specific requirements of their state or local program, as these can differ significantly.

Steps to complete the Air ConditionerAir To Air Heat Pump Rebate Application

Completing the Air ConditionerAir To Air Heat Pump Rebate Application involves several key steps:

- Gather necessary documentation, including proof of purchase and installation details.

- Review eligibility criteria to ensure compliance with program requirements.

- Fill out the application form accurately, providing all requested information.

- Submit the completed application along with required documents by the deadline.

- Keep copies of all submitted materials for your records.

Following these steps can help streamline the application process and increase the likelihood of receiving a rebate.

Required Documents

When applying for the Air ConditionerAir To Air Heat Pump Rebate, certain documents are typically required. These may include:

- Proof of purchase, such as receipts or invoices for the equipment.

- Installation documentation, which may include contracts or service agreements.

- Energy efficiency certification for the installed system.

- Completed application form.

Ensuring all documents are accurate and complete can facilitate a smoother processing experience.

Form Submission Methods

The Air ConditionerAir To Air Heat Pump Rebate Application can usually be submitted through various methods, including:

- Online submission via the designated state or local energy program website.

- Mailing a printed application to the appropriate address.

- In-person submission at local offices or designated locations.

Applicants should choose the method that best suits their needs and ensure they follow any specific instructions for their chosen submission method.

Application Process & Approval Time

The application process for the Air ConditionerAir To Air Heat Pump Rebate typically involves several stages:

- Submission of the completed application and required documents.

- Review by the relevant energy program authority.

- Approval or denial of the rebate application.

- Issuance of the rebate, if approved.

Approval times can vary, but applicants should expect a waiting period of several weeks to a few months, depending on the program's workload and processing capabilities.

Quick guide on how to complete air conditionerair to air heat pump rebate application

Complete [SKS] seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with the necessary tools to create, modify, and eSign your documents swiftly and without holdups. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Choose your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiresome document searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Modify and eSign [SKS] to guarantee exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Air ConditionerAir To Air Heat Pump Rebate Application

Create this form in 5 minutes!

How to create an eSignature for the air conditionerair to air heat pump rebate application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Air ConditionerAir To Air Heat Pump Rebate Application?

The Air ConditionerAir To Air Heat Pump Rebate Application is a program designed to help homeowners and businesses receive financial incentives for installing energy-efficient air conditioning and heat pump systems. By applying for this rebate, you can signNowly reduce the upfront costs associated with these installations.

-

How can I apply for the Air ConditionerAir To Air Heat Pump Rebate?

To apply for the Air ConditionerAir To Air Heat Pump Rebate, you need to complete the application form available on our website. Ensure you have all necessary documentation, such as proof of purchase and installation details, to expedite the process.

-

What are the eligibility requirements for the Air ConditionerAir To Air Heat Pump Rebate Application?

Eligibility for the Air ConditionerAir To Air Heat Pump Rebate Application typically includes having a qualifying air conditioning or heat pump system installed by a certified contractor. Additionally, the system must meet specific energy efficiency standards set by the program.

-

How much can I save with the Air ConditionerAir To Air Heat Pump Rebate?

The savings from the Air ConditionerAir To Air Heat Pump Rebate can vary based on the type of system installed and local utility incentives. Generally, homeowners can expect rebates ranging from a few hundred to several thousand dollars, making energy-efficient upgrades more affordable.

-

What features should I look for in an air conditioner or heat pump for the rebate application?

When selecting an air conditioner or heat pump for the Air ConditionerAir To Air Heat Pump Rebate Application, look for high SEER ratings, energy efficiency certifications, and compatibility with smart home systems. These features not only qualify you for rebates but also enhance your home's energy savings.

-

Are there any deadlines for submitting the Air ConditionerAir To Air Heat Pump Rebate Application?

Yes, there are specific deadlines for submitting the Air ConditionerAir To Air Heat Pump Rebate Application, which can vary by region and program. It is essential to check the details on our website to ensure your application is submitted on time to qualify for the rebate.

-

Can I track the status of my Air ConditionerAir To Air Heat Pump Rebate Application?

Absolutely! Once you submit your Air ConditionerAir To Air Heat Pump Rebate Application, you will receive a confirmation email with a tracking number. You can use this number on our website to check the status of your application at any time.

Get more for Air ConditionerAir To Air Heat Pump Rebate Application

Find out other Air ConditionerAir To Air Heat Pump Rebate Application

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document