Texas Secured Promissory Note 2022-2026

Understanding the Texas Secured Promissory Note

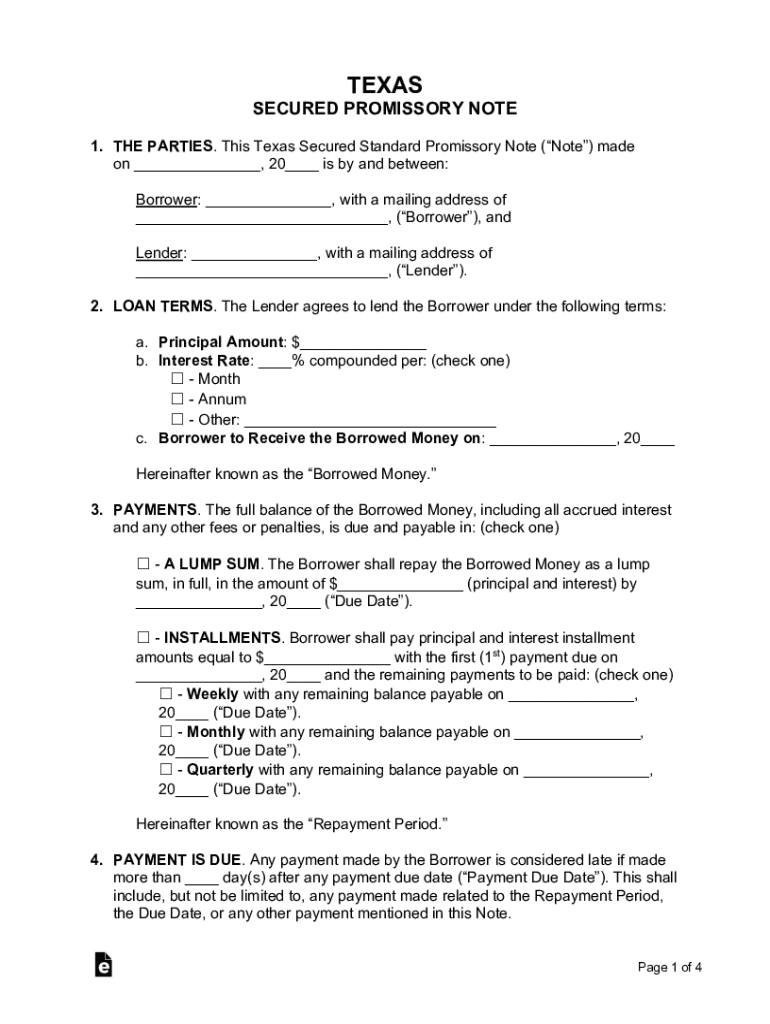

A Texas secured promissory note is a legal document that outlines a borrower's promise to repay a loan with interest, secured by collateral. This type of note is commonly used in real estate transactions and personal loans, providing lenders with a degree of security in case of default. The collateral can be any asset of value, such as property or equipment, which the lender can claim if the borrower fails to meet their payment obligations.

Key Elements of the Texas Secured Promissory Note

Several essential components must be included in a Texas secured promissory note to ensure its validity and enforceability:

- Parties Involved: Clearly identify the borrower and lender, including their legal names and addresses.

- Loan Amount: Specify the total amount of money being borrowed.

- Interest Rate: State the interest rate applicable to the loan, whether fixed or variable.

- Payment Schedule: Outline the repayment terms, including due dates and the frequency of payments.

- Collateral Description: Provide a detailed description of the collateral securing the note.

- Default Terms: Define what constitutes a default and the consequences for the borrower.

Steps to Complete the Texas Secured Promissory Note

Completing a Texas secured promissory note involves several important steps to ensure that the document is legally binding:

- Gather necessary information about both parties, including names, addresses, and contact details.

- Determine the loan amount, interest rate, and repayment schedule that both parties agree upon.

- Clearly describe the collateral that will secure the loan.

- Draft the note, including all key elements and ensuring clarity in language.

- Review the document with all parties to confirm accuracy and understanding.

- Sign the promissory note in the presence of a notary public to enhance its legal standing.

Legal Use of the Texas Secured Promissory Note

The Texas secured promissory note is legally recognized and can be enforced in court if necessary. It is crucial for both lenders and borrowers to understand their rights and obligations under this agreement. In the event of a default, the lender has the right to seize the collateral as outlined in the note. Borrowers should ensure they are fully aware of the terms before signing, as this document creates a binding contract.

Obtaining the Texas Secured Promissory Note

To obtain a Texas secured promissory note, individuals can either draft one using templates available online or consult with a legal professional to create a customized document. Many legal websites offer downloadable templates that comply with Texas laws. It is advisable to ensure that any template used includes all necessary elements specific to the agreement being made.

Examples of Using the Texas Secured Promissory Note

Common scenarios for utilizing a Texas secured promissory note include:

- Real estate transactions where a buyer borrows money to purchase property.

- Personal loans where a friend or family member lends money secured by valuable assets.

- Business loans where a company borrows funds to expand operations, using equipment as collateral.

Quick guide on how to complete texas secured promissory note

Complete Texas Secured Promissory Note effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your files swiftly without any holdups. Manage Texas Secured Promissory Note on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process now.

The easiest way to modify and eSign Texas Secured Promissory Note without difficulty

- Find Texas Secured Promissory Note and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your files or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require you to print new document versions. airSlate SignNow meets your document management needs in a few clicks from any device you choose. Modify and eSign Texas Secured Promissory Note to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct texas secured promissory note

Create this form in 5 minutes!

How to create an eSignature for the texas secured promissory note

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a promissory note payments agreement?

A promissory note payments agreement is a legal document that outlines the terms of a loan between a borrower and a lender. It specifies the amount borrowed, the interest rate, repayment schedule, and any penalties for late payments. This agreement is crucial for ensuring both parties understand their obligations.

-

How can airSlate SignNow help with promissory note payments agreements?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning promissory note payments agreements. With its intuitive interface, users can quickly customize templates to fit their needs, ensuring a smooth transaction process. This streamlines the documentation process and enhances efficiency.

-

What are the pricing options for using airSlate SignNow for promissory note payments agreements?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and teams. Each plan includes features that support the creation and management of promissory note payments agreements. You can choose a plan that best fits your budget and requirements.

-

Are there any features specifically designed for promissory note payments agreements?

Yes, airSlate SignNow includes features tailored for promissory note payments agreements, such as customizable templates, automated reminders for payments, and secure eSigning. These features ensure that both parties can easily manage their agreements and stay informed about important deadlines.

-

What benefits does airSlate SignNow offer for managing promissory note payments agreements?

Using airSlate SignNow for promissory note payments agreements offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick document turnaround and ensures that all agreements are legally binding and securely stored. This helps businesses maintain compliance and improve their workflow.

-

Can I integrate airSlate SignNow with other tools for managing promissory note payments agreements?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, allowing you to manage your promissory note payments agreements alongside your existing tools. This integration enhances productivity by enabling data sharing and streamlining your overall document management process.

-

Is it easy to track the status of promissory note payments agreements in airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all your promissory note payments agreements. You can easily monitor who has viewed, signed, or completed the agreement, ensuring that you stay updated on the status of your documents. This feature helps you manage your agreements more effectively.

Get more for Texas Secured Promissory Note

- Cr770 form

- Texas quit claim deed form

- Opseu professional liability insurance form

- Work applications form

- Beach driving application form town of emerald isle emeraldisle nc

- Appraisal waiver form 404051638

- Le formulaire suivant satisfait aux exigences de base obligatoires dun contrat de vente

- Custom t shirts for as low as 600 each form

Find out other Texas Secured Promissory Note

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form