Rev 03292018 Form

What is the Rev 03292018

The Rev 03292018 is a specific form used in the United States, primarily associated with tax-related processes. This form is utilized by individuals and businesses to report certain financial information to the Internal Revenue Service (IRS). It is essential for ensuring compliance with federal tax regulations and may be required in various situations, such as for tax deductions or credits.

How to use the Rev 03292018

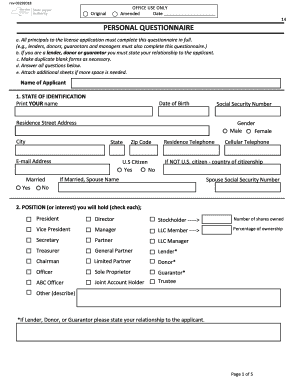

Using the Rev 03292018 involves several steps to ensure accurate completion. First, gather all necessary information, including financial records and any relevant documentation. Next, fill out the form carefully, ensuring that all fields are completed accurately. After filling out the form, review it for any errors or omissions. Finally, submit the form according to the guidelines provided by the IRS, either electronically or via mail.

Steps to complete the Rev 03292018

Completing the Rev 03292018 requires a systematic approach:

- Gather all required documents, such as income statements and receipts.

- Access the form from the IRS website or a trusted source.

- Fill in personal information, including name, address, and taxpayer identification number.

- Provide detailed financial information as required by the form.

- Double-check all entries for accuracy and completeness.

- Submit the completed form to the IRS by the specified deadline.

Legal use of the Rev 03292018

The Rev 03292018 is legally recognized by the IRS as a valid document for reporting tax information. Proper use of this form is crucial for compliance with federal tax laws. Failure to accurately complete and submit the form can lead to penalties or audits. It is advisable to consult with a tax professional if there are uncertainties regarding the legal implications of using this form.

Filing Deadlines / Important Dates

Filing deadlines for the Rev 03292018 are typically aligned with the annual tax filing season. Generally, the form must be submitted by April 15 of each year unless that date falls on a weekend or holiday, in which case the deadline may be extended. It is important to stay informed about any changes to deadlines, as the IRS may announce extensions or modifications based on specific circumstances.

Required Documents

To complete the Rev 03292018, certain documents are necessary. These may include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

- Any additional documentation required by the IRS for specific claims.

Form Submission Methods (Online / Mail / In-Person)

The Rev 03292018 can be submitted through various methods. Taxpayers may choose to file electronically using IRS-approved software, which often streamlines the process and reduces errors. Alternatively, the form can be printed and mailed to the appropriate IRS address. In some cases, individuals may also have the option to submit the form in person at designated IRS offices, although this method is less common.

Quick guide on how to complete rev 03292018

Complete Rev 03292018 effortlessly on any device

Managing documents online has gained popularity among organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Rev 03292018 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest method to modify and eSign Rev 03292018 seamlessly

- Locate Rev 03292018 and click on Get Form to begin.

- Utilize the tools we provide to finish your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Modify and eSign Rev 03292018 and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rev 03292018

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Rev 03292018 and how does it relate to airSlate SignNow?

Rev 03292018 refers to a specific version of our document signing solution that enhances user experience and security. With this version, airSlate SignNow empowers businesses to efficiently send and eSign documents, ensuring compliance and ease of use.

-

What are the pricing options for airSlate SignNow under Rev 03292018?

Under Rev 03292018, airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Whether you are a small startup or a large enterprise, you can choose a plan that fits your budget while enjoying the full benefits of our eSigning capabilities.

-

What features are included in Rev 03292018?

Rev 03292018 includes a range of features designed to streamline the document signing process. Key features include customizable templates, advanced security options, and real-time tracking, all aimed at enhancing productivity and ensuring document integrity.

-

How can Rev 03292018 benefit my business?

By utilizing Rev 03292018, your business can signNowly reduce the time spent on document management. The easy-to-use interface and efficient eSigning process allow for faster transactions, improved workflow, and enhanced customer satisfaction.

-

Does Rev 03292018 integrate with other software?

Yes, Rev 03292018 is designed to seamlessly integrate with various third-party applications. This allows businesses to connect their existing tools and workflows, making it easier to manage documents and eSignatures within their preferred platforms.

-

Is there a free trial available for Rev 03292018?

Absolutely! airSlate SignNow offers a free trial for Rev 03292018, allowing prospective customers to explore its features and benefits without any commitment. This trial period is a great opportunity to see how our solution can enhance your document signing process.

-

What security measures are in place with Rev 03292018?

Rev 03292018 prioritizes security with advanced encryption and compliance with industry standards. Your documents are protected throughout the signing process, ensuring that sensitive information remains confidential and secure.

Get more for Rev 03292018

Find out other Rev 03292018

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online