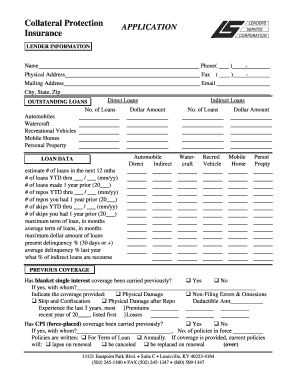

Collateral Protection APPLICATION Insurance Form

Understanding Collateral Protection APPLICATION Insurance

Collateral Protection APPLICATION Insurance is a specialized insurance designed to protect lenders from financial loss in case a borrower defaults on a loan secured by collateral. This type of insurance ensures that the collateral, such as a vehicle or property, is adequately covered. If the borrower fails to maintain their own insurance, the lender can activate this policy to safeguard their investment. This insurance is particularly relevant in auto loans and mortgages, where the collateral is a significant asset.

Steps to Complete the Collateral Protection APPLICATION Insurance

Completing the Collateral Protection APPLICATION Insurance involves several key steps:

- Gather necessary information: Collect all relevant details about the collateral, including its value, make, model, and any existing insurance coverage.

- Fill out the application: Provide accurate information on the application form, ensuring all sections are completed to avoid delays.

- Submit the application: Send the completed application to the insurance provider, either online or via mail, depending on their submission guidelines.

- Await approval: Once submitted, the insurance provider will review the application and notify you of approval or any required additional information.

Key Elements of the Collateral Protection APPLICATION Insurance

Understanding the key elements of Collateral Protection APPLICATION Insurance can help borrowers and lenders alike. Important components include:

- Coverage limits: This defines the maximum amount the insurance will pay in case of a loss.

- Premium costs: The cost of the insurance policy, which may vary based on the type and value of the collateral.

- Exclusions: Specific situations or conditions that are not covered under the policy, which should be clearly outlined in the insurance agreement.

- Claim process: The steps required to file a claim, including documentation and timeframes for submission.

Eligibility Criteria for Collateral Protection APPLICATION Insurance

Eligibility for Collateral Protection APPLICATION Insurance typically depends on several factors, including:

- Type of collateral: The insurance is generally applicable to specific assets like vehicles, real estate, or equipment.

- Loan status: The borrower must have an active loan with the lender that requires collateral.

- Insurance requirements: Borrowers may need to demonstrate that they have or had insurance coverage on the collateral to qualify.

Obtaining Collateral Protection APPLICATION Insurance

To obtain Collateral Protection APPLICATION Insurance, borrowers typically follow these steps:

- Contact the lender: Reach out to the lender to understand their specific requirements for collateral protection insurance.

- Choose an insurance provider: Select a reputable insurance company that offers this type of coverage.

- Complete the application: Fill out the necessary forms and provide any required documentation to the insurer.

- Review the policy: Carefully read through the terms and conditions of the insurance policy before finalizing the purchase.

Legal Use of Collateral Protection APPLICATION Insurance

The legal use of Collateral Protection APPLICATION Insurance is governed by state regulations and the terms set forth by the lender. It is essential for borrowers to understand the legal implications of this insurance, including:

- Compliance with state laws: Each state may have different regulations regarding collateral protection insurance that must be adhered to.

- Disclosure requirements: Lenders are often required to inform borrowers about the insurance and its implications on their loan agreement.

- Rights and responsibilities: Borrowers should be aware of their rights under the insurance policy and the responsibilities they hold in maintaining coverage.

Quick guide on how to complete collateral protection application insurance

Prepare Collateral Protection APPLICATION Insurance easily on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage Collateral Protection APPLICATION Insurance on any platform using airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Collateral Protection APPLICATION Insurance effortlessly

- Locate Collateral Protection APPLICATION Insurance and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Collateral Protection APPLICATION Insurance and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the collateral protection application insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Collateral Protection APPLICATION Insurance?

Collateral Protection APPLICATION Insurance is a type of insurance designed to protect lenders from losses due to damage or loss of collateral. This insurance ensures that the value of the collateral remains intact, providing peace of mind for both lenders and borrowers. Understanding this insurance is crucial for anyone involved in financing or lending.

-

How does Collateral Protection APPLICATION Insurance work?

Collateral Protection APPLICATION Insurance works by covering the lender's interests in the collateral if it is damaged or lost. When a borrower fails to maintain adequate insurance on the collateral, this policy automatically steps in to protect the lender's investment. This ensures that the lender can recover their losses without signNow financial impact.

-

What are the benefits of Collateral Protection APPLICATION Insurance?

The primary benefits of Collateral Protection APPLICATION Insurance include financial security for lenders and reduced risk of loss. It helps maintain the value of the collateral, ensuring that lenders can recover their investments. Additionally, it simplifies the insurance process for borrowers, as they are not required to provide proof of insurance.

-

Is Collateral Protection APPLICATION Insurance mandatory?

While Collateral Protection APPLICATION Insurance is not universally mandatory, many lenders require it as a condition of financing. This requirement helps protect their interests in the collateral. Borrowers should check with their lenders to understand specific requirements related to this insurance.

-

How much does Collateral Protection APPLICATION Insurance cost?

The cost of Collateral Protection APPLICATION Insurance varies based on factors such as the type of collateral, its value, and the lender's policies. Generally, it is designed to be a cost-effective solution for both lenders and borrowers. It's advisable to consult with your lender for specific pricing details.

-

Can I integrate Collateral Protection APPLICATION Insurance with other services?

Yes, many lenders offer the option to integrate Collateral Protection APPLICATION Insurance with other financial services. This integration can streamline the process of managing collateral and insurance requirements. Check with your lender to explore available integration options.

-

What types of collateral are covered by Collateral Protection APPLICATION Insurance?

Collateral Protection APPLICATION Insurance typically covers various types of collateral, including vehicles, real estate, and equipment. The specific coverage can vary based on the lender's policies and the nature of the collateral. It's important to review the terms of the insurance to understand what is included.

Get more for Collateral Protection APPLICATION Insurance

- Pulpotomy consent form

- Physicians certification of borrowers ability to engage in substantial gainful activity form

- Mcl 565 152 form

- Veterinary hospitalisation sheet template form

- Breastscreen victoria registration form 286230754

- Collingswood nj information about the borough and its

- Family child care parent provider agreement form

- Ppe receipt ampamp training certification form

Find out other Collateral Protection APPLICATION Insurance

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast