Fillable Online RESIDENTIAL FIREPLACE REBATE CenterPoint Form

What is the Fillable Online RESIDENTIAL FIREPLACE REBATE CenterPoint

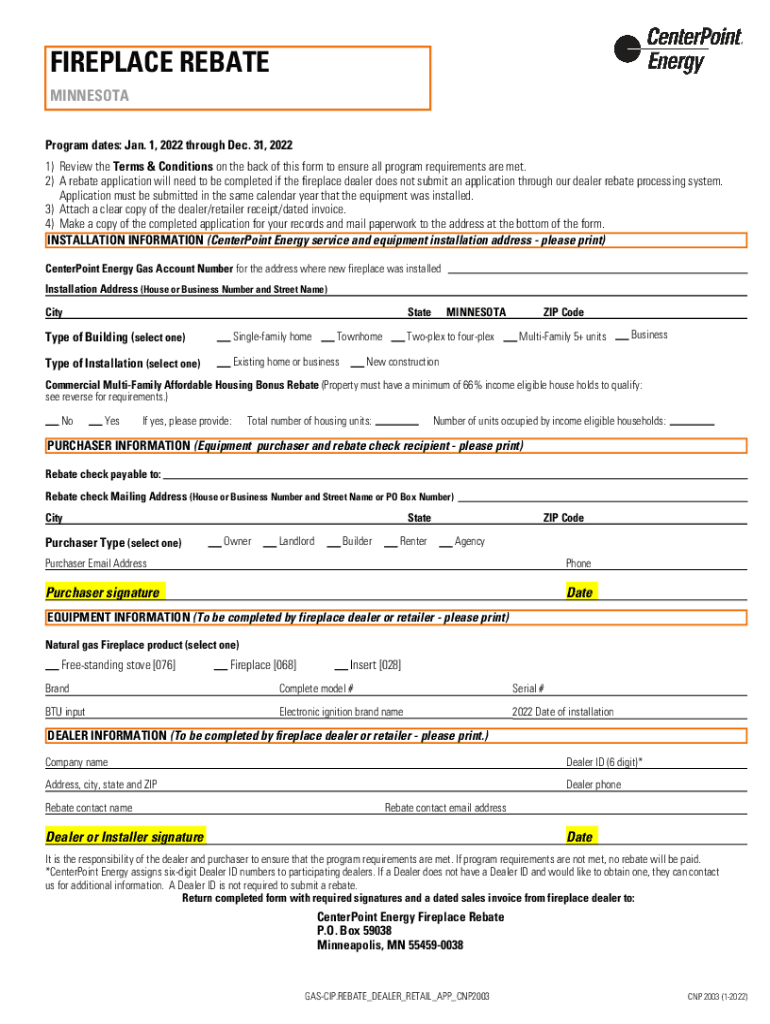

The Fillable Online Residential Fireplace Rebate CenterPoint is a form designed to assist homeowners in the United States who are upgrading their residential fireplaces. This rebate program aims to promote energy efficiency and reduce emissions by incentivizing the installation of more efficient heating systems. By completing this form, eligible homeowners can receive financial rebates that help offset the costs associated with purchasing and installing qualifying fireplace models.

How to use the Fillable Online RESIDENTIAL FIREPLACE REBATE CenterPoint

Using the Fillable Online Residential Fireplace Rebate CenterPoint form is straightforward. First, access the form through the designated website or platform. Next, fill in the required fields with accurate information, including your personal details, the type of fireplace being installed, and any supporting documentation. Once completed, review the form to ensure all information is correct before submitting it electronically. This digital submission process streamlines the application, making it easier for homeowners to apply for their rebates.

Steps to complete the Fillable Online RESIDENTIAL FIREPLACE REBATE CenterPoint

Completing the Fillable Online Residential Fireplace Rebate CenterPoint involves several key steps:

- Gather necessary information, including proof of purchase and installation details.

- Access the fillable form online through the appropriate platform.

- Fill in personal details, including name, address, and contact information.

- Provide specific details about the fireplace, including model number and installation date.

- Attach any required documentation, such as receipts or installation agreements.

- Review the form for accuracy and completeness.

- Submit the form electronically for processing.

Eligibility Criteria

To qualify for the Fillable Online Residential Fireplace Rebate CenterPoint, applicants must meet specific eligibility criteria. Generally, homeowners must reside in the service area of CenterPoint and have installed a qualifying fireplace model that meets energy efficiency standards. Additionally, the installation must be completed by a licensed professional. It is important for applicants to check the specific requirements outlined by CenterPoint to ensure compliance and maximize their chances of receiving the rebate.

Required Documents

When applying for the Fillable Online Residential Fireplace Rebate CenterPoint, certain documents are necessary to support the application. These typically include:

- A copy of the purchase receipt for the fireplace.

- Documentation proving the installation date, such as an installation agreement or invoice.

- Any additional forms or certifications required by CenterPoint.

Having these documents ready will facilitate a smoother application process and help prevent delays in rebate approval.

Form Submission Methods

The Fillable Online Residential Fireplace Rebate CenterPoint can be submitted electronically, which is the preferred method for most applicants. This online submission allows for quicker processing times and reduces the risk of lost paperwork. However, if necessary, applicants may also have the option to submit the form via mail or in person at designated CenterPoint locations. It is advisable to check the specific submission guidelines provided by CenterPoint to ensure compliance with their requirements.

Quick guide on how to complete fillable online residential fireplace rebate centerpoint

Effortlessly Prepare Fillable Online RESIDENTIAL FIREPLACE REBATE CenterPoint on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the capabilities required to create, modify, and eSign your documents swiftly without any hold-ups. Manage Fillable Online RESIDENTIAL FIREPLACE REBATE CenterPoint on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

Steps to Modify and eSign Fillable Online RESIDENTIAL FIREPLACE REBATE CenterPoint with Ease

- Obtain Fillable Online RESIDENTIAL FIREPLACE REBATE CenterPoint and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with the specialized tools provided by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a handwritten signature.

- Review the information and click the Done button to save your changes.

- Select your preferred delivery method for the form: email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form hunts, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Fillable Online RESIDENTIAL FIREPLACE REBATE CenterPoint and guarantee outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable online residential fireplace rebate centerpoint

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Fillable Online RESIDENTIAL FIREPLACE REBATE CenterPoint?

The Fillable Online RESIDENTIAL FIREPLACE REBATE CenterPoint is a digital form designed to streamline the application process for residential fireplace rebates. This user-friendly solution allows homeowners to easily fill out and submit their rebate applications online, ensuring a hassle-free experience.

-

How do I access the Fillable Online RESIDENTIAL FIREPLACE REBATE CenterPoint?

You can access the Fillable Online RESIDENTIAL FIREPLACE REBATE CenterPoint directly through our website. Simply navigate to the rebate section, and you will find the fillable form available for download and online submission.

-

Is there a cost associated with the Fillable Online RESIDENTIAL FIREPLACE REBATE CenterPoint?

No, there is no cost to use the Fillable Online RESIDENTIAL FIREPLACE REBATE CenterPoint. This service is provided free of charge to help homeowners take advantage of available rebates for their residential fireplaces.

-

What are the benefits of using the Fillable Online RESIDENTIAL FIREPLACE REBATE CenterPoint?

Using the Fillable Online RESIDENTIAL FIREPLACE REBATE CenterPoint simplifies the application process, reduces paperwork, and speeds up submission times. Additionally, it ensures that your application is filled out correctly, minimizing the chances of delays or rejections.

-

Can I save my progress while filling out the Fillable Online RESIDENTIAL FIREPLACE REBATE CenterPoint?

Yes, the Fillable Online RESIDENTIAL FIREPLACE REBATE CenterPoint allows you to save your progress. You can complete the form at your own pace and return to it later, ensuring that you have ample time to gather all necessary information.

-

What information do I need to complete the Fillable Online RESIDENTIAL FIREPLACE REBATE CenterPoint?

To complete the Fillable Online RESIDENTIAL FIREPLACE REBATE CenterPoint, you will need personal information such as your name, address, and contact details, as well as specifics about your fireplace installation. Having your purchase receipts and any relevant documentation on hand will also be helpful.

-

Does the Fillable Online RESIDENTIAL FIREPLACE REBATE CenterPoint integrate with other platforms?

Yes, the Fillable Online RESIDENTIAL FIREPLACE REBATE CenterPoint can integrate with various document management and e-signature platforms. This allows for seamless submission and tracking of your rebate application, enhancing your overall experience.

Get more for Fillable Online RESIDENTIAL FIREPLACE REBATE CenterPoint

Find out other Fillable Online RESIDENTIAL FIREPLACE REBATE CenterPoint

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free