Dr 15mo Form

What is the DR 15mo Form

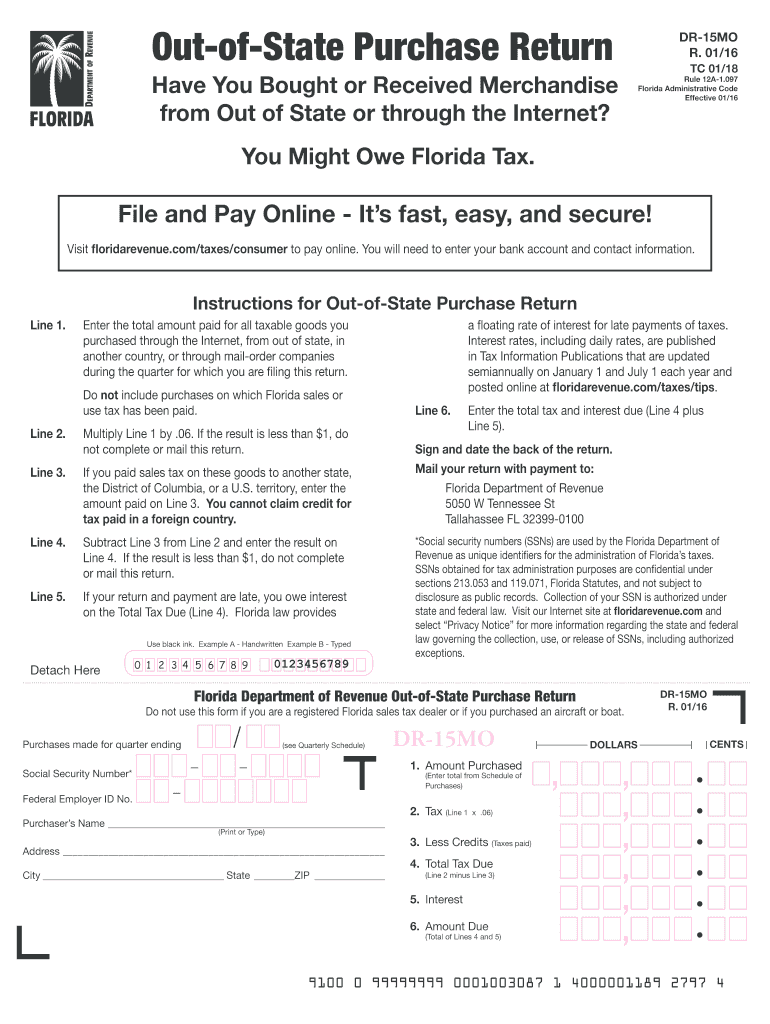

The Florida DR 15mo form is a crucial document used for reporting sales tax on out-of-state purchases. This form is specifically designed for individuals and businesses that have made purchases outside of Florida and are required to remit the appropriate sales tax to the state. The DR 15mo form helps ensure compliance with Florida's tax laws by allowing taxpayers to report and pay the sales tax owed on these transactions.

How to Obtain the DR 15mo Form

To obtain the Florida DR 15mo form, taxpayers can visit the Florida Department of Revenue's official website. The form is available for download in a fillable format, making it easy to complete electronically. Additionally, taxpayers can request a physical copy of the form by contacting their local tax office or the Florida Department of Revenue directly.

Steps to Complete the DR 15mo Form

Completing the Florida DR 15mo form involves several straightforward steps:

- Begin by entering your personal or business information at the top of the form.

- List all out-of-state purchases made during the reporting period, including the date of purchase and the total amount.

- Calculate the total sales tax owed based on the applicable Florida sales tax rate.

- Sign and date the form to certify that the information provided is accurate.

Once completed, the form can be submitted either online or via mail to the appropriate tax authority.

Legal Use of the DR 15mo Form

The DR 15mo form is legally binding when completed correctly and submitted in compliance with Florida tax regulations. It serves as a formal declaration of out-of-state purchases and the corresponding sales tax owed. Failing to file this form accurately can result in penalties or interest charges, emphasizing the importance of understanding the legal implications of its use.

Required Documents

When filling out the Florida DR 15mo form, it is essential to have certain documents on hand to ensure accuracy. These may include:

- Receipts or invoices for all out-of-state purchases.

- Previous tax returns that may provide context for your current filing.

- Any correspondence with the Florida Department of Revenue regarding your tax status.

Having these documents readily available will facilitate a smoother completion process and help ensure compliance.

Form Submission Methods

The Florida DR 15mo form can be submitted through multiple methods to accommodate taxpayer preferences:

- Online submission through the Florida Department of Revenue's eServices portal.

- Mailing a printed copy of the completed form to the designated tax office.

- In-person submission at local tax offices, if preferred.

Choosing the right submission method can help streamline the process and ensure timely processing of your form.

Quick guide on how to complete dr 15mo r 01 16 u 09 17indd

Complete Dr 15mo Form effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents swiftly without setbacks. Manage Dr 15mo Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest way to alter and eSign Dr 15mo Form without hassle

- Obtain Dr 15mo Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important parts of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, exhausting form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Dr 15mo Form and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 15mo r 01 16 u 09 17indd

How to make an electronic signature for your Dr 15mo R 01 16 U 09 17indd online

How to make an eSignature for your Dr 15mo R 01 16 U 09 17indd in Google Chrome

How to create an electronic signature for signing the Dr 15mo R 01 16 U 09 17indd in Gmail

How to create an eSignature for the Dr 15mo R 01 16 U 09 17indd straight from your smartphone

How to generate an electronic signature for the Dr 15mo R 01 16 U 09 17indd on iOS

How to create an eSignature for the Dr 15mo R 01 16 U 09 17indd on Android OS

People also ask

-

What is the florida dr 15mo plan in airSlate SignNow?

The florida dr 15mo plan is a subscription option offered by airSlate SignNow, designed to provide businesses with essential eSigning and document management features for 15 months. This plan is perfect for companies looking for a cost-effective solution to streamline their document workflows while enjoying extended access to our services.

-

How much does the florida dr 15mo plan cost?

The florida dr 15mo plan is competitively priced to fit various business budgets. By choosing this 15-month plan, users can benefit from a discount compared to paying monthly, making it a smart financial choice for those needing ongoing access to airSlate SignNow's eSigning capabilities.

-

What features are included in the florida dr 15mo subscription?

With the florida dr 15mo subscription, users gain access to essential features like unlimited eSignatures, document templates, and real-time tracking. Additional functionalities such as in-person signing and integrations with other software make this plan a comprehensive solution for document management.

-

How can the florida dr 15mo plan benefit my business?

The florida dr 15mo plan empowers businesses to reduce turnaround time for document approvals and enhance compliance with legally binding eSignatures. By facilitating seamless collaboration and improving efficiency, this plan can signNowly contribute to your overall productivity and client satisfaction.

-

Can I integrate airSlate SignNow with other tools using the florida dr 15mo plan?

Yes, the florida dr 15mo plan allows for integration with a variety of third-party applications, such as Google Drive, Dropbox, and CRM systems. This capability ensures that you can streamline your workflow by connecting your existing tools with airSlate SignNow's comprehensive eSigning capabilities.

-

Is there customer support available with the florida dr 15mo plan?

Absolutely! The florida dr 15mo plan includes access to our dedicated customer support team, who are available to assist you with any questions or issues you may encounter. Whether it's technical support or guidance on using features, our team is here to help you.

-

What types of documents can I eSign with the florida dr 15mo plan?

You can eSign a wide array of documents with the florida dr 15mo plan, including contracts, agreements, and consent forms. Whether it’s for internal approval or external contracts with clients, airSlate SignNow makes it simple and secure to sign any document digitally.

Get more for Dr 15mo Form

- If you havent already lower frederick fire company form

- Bellefonte area school district request for use of form

- Address information uspsaddressing your mailpostal exploreraddressing your mailpostal exploreraddressing your mailpostal

- Graduate transcript request alumni only central bucks school cbsd form

- Chapter 102 visual site inspection report instructions form

- Change made on form

- How to file police report philadelphia form

- Re registration form our lady of good counsel school

Find out other Dr 15mo Form

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy