Virginia Fprm Pte Form

What is the Virginia Form PTE?

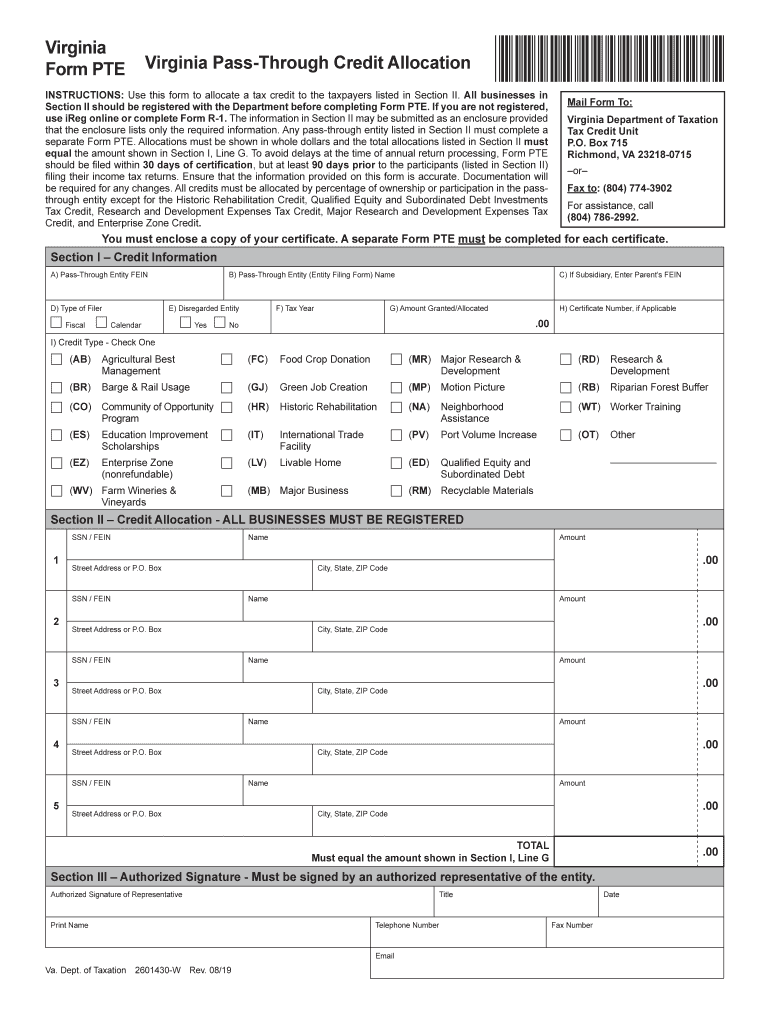

The Virginia Form PTE is a tax document used by partnerships and S corporations to report income, deductions, and credits to the state of Virginia. This form is essential for entities that need to comply with state tax regulations. It ensures that the income generated by these entities is accurately reported and taxed according to Virginia law. Understanding the specifics of this form is crucial for both business owners and tax professionals to ensure compliance and avoid penalties.

Steps to complete the Virginia Form PTE

Completing the Virginia Form PTE involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form with the required information, which includes details about the entity, income, and deductions. It is important to double-check all entries for accuracy before submission. Once completed, the form can be submitted electronically or via mail, depending on the chosen submission method.

Legal use of the Virginia Form PTE

The Virginia Form PTE is legally binding when completed and submitted according to state regulations. To ensure its legal standing, it must be signed by an authorized representative of the partnership or S corporation. Additionally, compliance with the relevant tax laws, such as the Virginia Code, is essential. Using a reliable eSignature solution can enhance the legal validity of the form, as it provides a digital certificate that verifies the signer's identity and intent.

Filing Deadlines / Important Dates

Filing deadlines for the Virginia Form PTE are crucial for compliance. Typically, the form must be filed by the 15th day of the fourth month following the end of the entity's tax year. For entities operating on a calendar year, this means the deadline is April 15. It is important to be aware of these dates to avoid late fees and penalties. Additionally, any extensions must be filed in a timely manner to ensure continued compliance with state tax laws.

Required Documents

To complete the Virginia Form PTE, specific documents are required. These typically include financial statements, such as profit and loss statements, balance sheets, and any supporting documentation for deductions claimed. Additionally, the entity's federal tax return may be necessary to provide a comprehensive overview of income and expenses. Ensuring that all required documents are gathered before starting the form will streamline the completion process.

Form Submission Methods (Online / Mail / In-Person)

The Virginia Form PTE can be submitted through various methods, providing flexibility for businesses. Online submission is available through the Virginia Department of Taxation's e-file system, which is efficient and secure. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own guidelines and processing times, so it is important to choose the one that best fits the entity's needs.

Examples of using the Virginia Form PTE

Examples of using the Virginia Form PTE include various business scenarios. For instance, a partnership that generates income from real estate investments would need to report its earnings and expenses using this form. Similarly, an S corporation providing consulting services must also file the PTE to report its income. These examples illustrate the form's applicability across different business types and industries, emphasizing its importance in maintaining compliance with state tax regulations.

Quick guide on how to complete form pte virginia pass through credit virginia tax

Effortlessly Prepare Virginia Fprm Pte on Any Device

Managing documents online has become increasingly common among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, adjust, and electronically sign your files promptly without delays. Handle Virginia Fprm Pte on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to adjust and eSign Virginia Fprm Pte effortlessly

- Find Virginia Fprm Pte and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Mark important parts of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new copies. airSlate SignNow accommodates all your document management needs in just a few clicks from any device of your preference. Adjust and eSign Virginia Fprm Pte to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form pte virginia pass through credit virginia tax

How to make an eSignature for your Form Pte Virginia Pass Through Credit Virginia Tax online

How to create an electronic signature for the Form Pte Virginia Pass Through Credit Virginia Tax in Google Chrome

How to create an eSignature for signing the Form Pte Virginia Pass Through Credit Virginia Tax in Gmail

How to generate an eSignature for the Form Pte Virginia Pass Through Credit Virginia Tax straight from your mobile device

How to create an eSignature for the Form Pte Virginia Pass Through Credit Virginia Tax on iOS devices

How to make an electronic signature for the Form Pte Virginia Pass Through Credit Virginia Tax on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to PTE?

airSlate SignNow is an electronic signature solution that enables businesses to send and sign documents securely. PTE, or Physical Test Environment, can benefit from airSlate SignNow by streamlining document workflows and ensuring compliance in test-related paperwork.

-

How does airSlate SignNow improve the efficiency of PTE processes?

Using airSlate SignNow for PTE processes enhances efficiency by reducing turnaround time for document approvals. The platform automates signature requests and reminders, allowing for faster completion of necessary documentation in PTE workflows.

-

What are the pricing options for airSlate SignNow tailored to PTE users?

airSlate SignNow offers flexible pricing plans to cater to various needs, including those in PTE environments. Whether you're a small business or a large organization, there are options to fit your budget while still enjoying all the essential features for effective document management.

-

Can airSlate SignNow integrate with other tools commonly used in PTE?

Yes, airSlate SignNow can seamlessly integrate with a variety of tools that are frequently used in PTE setups, like CRM systems and cloud storage services. This ensures a smooth workflow and enhances productivity by keeping all your tools connected.

-

What features does airSlate SignNow offer that benefit PTE documentation?

airSlate SignNow provides essential features such as customizable templates, secure storage, and audit trails for PTE documentation. These features ensure that all signatures and document changes are tracked, providing transparency and security throughout the process.

-

Is airSlate SignNow compliant with regulatory requirements for PTE?

Absolutely! airSlate SignNow complies with various regulatory requirements such as ESIGN and UETA, making it suitable for PTE environments. This compliance ensures that your electronic signatures are legally binding and helps maintain regulatory standards.

-

What are the benefits of using airSlate SignNow for PTE-related tasks?

The primary benefits of using airSlate SignNow for PTE-related tasks include increased speed, reduced costs, and improved document security. By simplifying the signing process, businesses can focus more on their core activities while ensuring that all paperwork is handled efficiently.

Get more for Virginia Fprm Pte

- Preservation program kcha form

- Outdoor bazaar information rules ampamp application

- Www psd1 orgcmslibc l booth education service center 1215 w lewis street form

- Rzp application form

- Columbia fire fire sprinkler systemsfire protection service form

- Tournament liability form

- Small project stormwater pollution prevention plan swppp form

- State environmental review process serp checklist fortress wa form

Find out other Virginia Fprm Pte

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT