Il 1120 Form

What is the IL-1120?

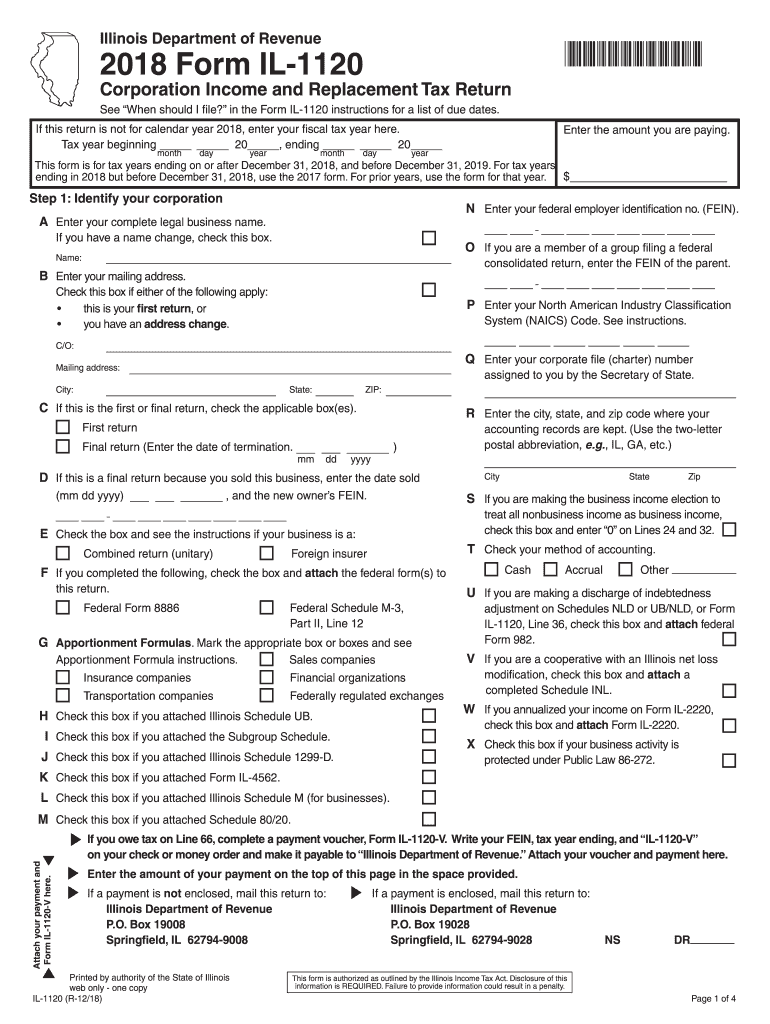

The IL-1120 is the Illinois Corporation Income and Replacement Tax Return form. It is used by corporations operating in Illinois to report their income, calculate their taxes owed, and submit their tax returns to the Illinois Department of Revenue. This form is essential for ensuring compliance with state tax laws and regulations. It is important for corporations to accurately complete the IL-1120 to avoid penalties and ensure proper tax reporting.

Steps to Complete the IL-1120

Completing the IL-1120 involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and prior tax returns.

- Fill out the form with accurate financial data, ensuring all income and deductions are reported correctly.

- Calculate the total tax liability based on the corporation's income and applicable tax rates.

- Review the completed form for accuracy and completeness before submission.

- Submit the form by the filing deadline, either electronically or by mail.

Legal Use of the IL-1120

The IL-1120 must be used in accordance with Illinois tax law. Corporations must ensure that they are filing the correct version of the form and adhering to all relevant regulations. Failure to comply with legal requirements can result in penalties, interest on unpaid taxes, and potential audits. Understanding the legal implications of the IL-1120 is crucial for maintaining compliance and avoiding legal issues.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines for the IL-1120 to avoid penalties. Generally, the form is due on the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this typically means the due date is March 15. It is essential to keep track of these dates to ensure timely filing.

Required Documents

To complete the IL-1120, corporations need to gather several documents, including:

- Income statements detailing revenue and expenses.

- Balance sheets reflecting the corporation's financial position.

- Prior year tax returns for reference and consistency.

- Any supporting documentation for deductions and credits claimed.

Form Submission Methods

The IL-1120 can be submitted through various methods, including:

- Online submission via the Illinois Department of Revenue's e-filing system.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person submission at designated Illinois Department of Revenue offices.

Penalties for Non-Compliance

Corporations that fail to file the IL-1120 on time or provide inaccurate information may face penalties. These can include fines, interest on unpaid taxes, and potential legal action. It is important for corporations to understand the consequences of non-compliance and take necessary steps to ensure accurate and timely filing.

Quick guide on how to complete il 1120 x instructions 2014 illinois department of revenue

Complete Il 1120 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Il 1120 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Il 1120 without any hassle

- Locate Il 1120 and click on Get Form to begin.

- Utilize the tools we offer to complete your form efficiently.

- Emphasize pertinent sections of your documents or redact sensitive data using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Adjust and eSign Il 1120 to maintain excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il 1120 x instructions 2014 illinois department of revenue

How to create an electronic signature for the Il 1120 X Instructions 2014 Illinois Department Of Revenue online

How to generate an eSignature for the Il 1120 X Instructions 2014 Illinois Department Of Revenue in Google Chrome

How to create an eSignature for signing the Il 1120 X Instructions 2014 Illinois Department Of Revenue in Gmail

How to create an electronic signature for the Il 1120 X Instructions 2014 Illinois Department Of Revenue straight from your mobile device

How to make an eSignature for the Il 1120 X Instructions 2014 Illinois Department Of Revenue on iOS

How to make an electronic signature for the Il 1120 X Instructions 2014 Illinois Department Of Revenue on Android devices

People also ask

-

What is a replacement tax return?

A replacement tax return is filed to correct errors or omissions in a previously submitted tax return. It allows taxpayers to ensure their filing is accurate and complete, which may lead to a potential refund or reduced tax liability.

-

How can airSlate SignNow help with my replacement tax return?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending documents, which can streamline the process of submitting your replacement tax return. Our tools make it simple to collaborate with tax professionals and keep your documents organized.

-

Is there a cost associated with using airSlate SignNow for replacement tax returns?

Yes, airSlate SignNow offers a variety of pricing plans that cater to both individual users and businesses. Each plan provides access to features that simplify the management of documents, including those related to your replacement tax return.

-

What features does airSlate SignNow offer for managing replacement tax returns?

Key features of airSlate SignNow include document templates, secure eSigning, and comprehensive audit trails. These functionalities ensure that your replacement tax return process is not only efficient but also adheres to compliance standards.

-

Can I integrate airSlate SignNow with other tax preparation software?

Absolutely! airSlate SignNow offers integration capabilities with a wide range of tax preparation software. This allows you to manage your replacement tax return documents and signing processes seamlessly within your existing workflow.

-

What are the benefits of using airSlate SignNow for my replacement tax return?

Using airSlate SignNow for your replacement tax return offers benefits like improved efficiency, reduced processing time, and better document security. Our platform enables you to track changes and easily make modifications when needed.

-

What should I do if I made a mistake on my replacement tax return?

If you find an error on your replacement tax return, you can quickly correct it using airSlate SignNow. Simply update the document as needed, eSign it, and send the new version to the appropriate tax authorities to ensure the corrections are processed.

Get more for Il 1120

- Estes express form

- Replacement bl confirmation form

- What value should be on the commercial invoice submitted form

- Model forms docx nycourts

- Application smallampcommercial claims form

- Application for smallclaim rochester city court judiciary of new york form

- Tlc affidavit form

- Request for a new hearing after a failure to appear form

Find out other Il 1120

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors