Et 706 Form

What is the ET 706?

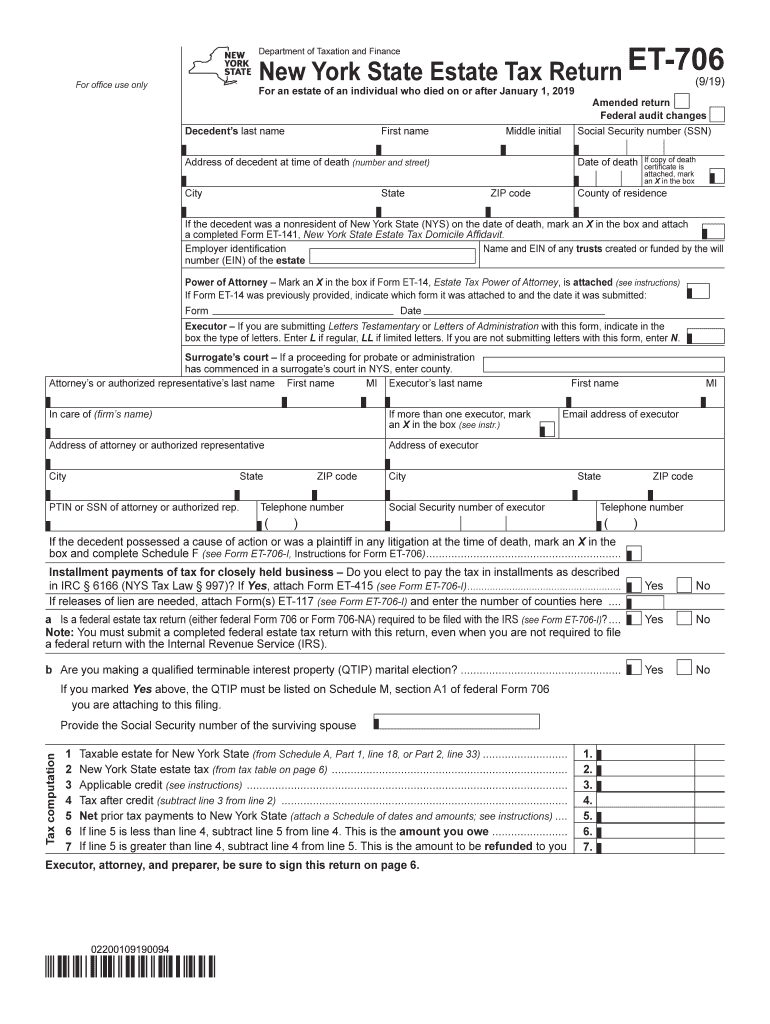

The ET 706, or New York State Estate Tax Return, is a crucial document used to report the estate tax obligations of a deceased individual’s estate. This form is required when the total value of the estate exceeds the exemption limit set by New York State. The ET 706 is designed to ensure that all taxable assets are accounted for and that the appropriate taxes are calculated and paid. It includes details about the decedent's assets, liabilities, and any deductions that may apply, which are essential for determining the estate's tax liability.

Steps to Complete the ET 706

Completing the ET 706 involves several key steps to ensure accuracy and compliance with New York State regulations. Begin by gathering all necessary documentation, including the decedent's financial records, property deeds, and any relevant tax documents. Next, accurately assess the total value of the estate, including real estate, bank accounts, investments, and personal property. Once you have compiled this information, fill out the form carefully, ensuring that all entries are complete and correct. It is advisable to consult with a tax professional or legal advisor to review the completed form before submission to avoid any errors that could lead to penalties.

Legal Use of the ET 706

The ET 706 serves as a legally binding document that must be filed with the New York State Department of Taxation and Finance. It is essential to understand that submitting this form is not merely a formality; it is a legal requirement for estates that meet the specified value thresholds. Proper completion and timely submission of the ET 706 can help prevent legal complications, including audits or penalties for non-compliance. The form must be signed by the executor or administrator of the estate, affirming that the information provided is accurate to the best of their knowledge.

Filing Deadlines / Important Dates

Timely filing of the ET 706 is critical to avoid penalties and interest on unpaid taxes. The deadline for submitting the form is typically nine months after the date of the decedent's death. However, if an extension is needed, it is possible to file for an extension, which can provide additional time to complete the form. It is important to be aware of these deadlines and to plan accordingly to ensure that all necessary documentation is prepared and submitted on time.

Required Documents

To complete the ET 706, several documents are required to provide a comprehensive overview of the estate's assets and liabilities. These documents may include:

- Death certificate of the decedent

- Will or trust documents, if applicable

- Financial statements, including bank and investment accounts

- Property deeds and appraisals for real estate

- Documentation of debts and liabilities

- Any prior gift tax returns filed by the decedent

Gathering these documents in advance can streamline the process of completing the ET 706.

Form Submission Methods

The ET 706 can be submitted through various methods, providing flexibility for executors and administrators. The form can be filed online through the New York State Department of Taxation and Finance website, which offers a secure portal for electronic submissions. Alternatively, the completed form can be mailed to the appropriate tax office. It is also possible to submit the form in person at designated tax offices. Each submission method has its advantages, and choosing the right one can depend on the urgency and complexity of the estate.

Quick guide on how to complete estate tax forms current period taxnygov

Effortlessly Prepare Et 706 on Any Device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the essentials to swiftly create, modify, and electronically sign your documents without delays. Handle Et 706 on any platform using airSlate SignNow apps for Android or iOS and enhance any document-oriented process today.

Edit and eSign Et 706 with Ease

- Obtain Et 706 and then click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using the tools airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate worries about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and eSign Et 706 to guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the estate tax forms current period taxnygov

How to make an eSignature for the Estate Tax Forms Current Period Taxnygov online

How to make an electronic signature for your Estate Tax Forms Current Period Taxnygov in Google Chrome

How to generate an eSignature for signing the Estate Tax Forms Current Period Taxnygov in Gmail

How to create an eSignature for the Estate Tax Forms Current Period Taxnygov from your mobile device

How to create an electronic signature for the Estate Tax Forms Current Period Taxnygov on iOS

How to create an eSignature for the Estate Tax Forms Current Period Taxnygov on Android OS

People also ask

-

What is the ET Tax NYS form and who needs it?

The ET Tax NYS form is a state tax form required by New York for certain business transactions. This form is essential for businesses operating in New York to ensure compliance with tax regulations and avoid penalties. If you're running a business that collects sales tax, you need to be familiar with the ET Tax NYS form.

-

How can airSlate SignNow help with the ET Tax NYS form?

airSlate SignNow streamlines the process of preparing and eSigning the ET Tax NYS form, making it easy to manage your tax documents. With a user-friendly interface, you can quickly fill out, sign, and send this form electronically. This efficiency helps you stay organized and compliant with New York tax laws.

-

Is airSlate SignNow cost-effective for filing the ET Tax NYS form?

Yes, airSlate SignNow offers a cost-effective solution for businesses looking to file the ET Tax NYS form. Our pricing plans are designed to cater to different business needs without compromising on features. You'll save both time and money while ensuring your documents are signed and filed correctly.

-

What features does airSlate SignNow provide for managing the ET Tax NYS form?

airSlate SignNow includes features like templates, reusable fields, and automatic reminders that simplify managing the ET Tax NYS form. You can customize the form to fit your needs and ensure that all necessary information is included accurately. These features enhance productivity and prevent delays in filing.

-

Can I integrate airSlate SignNow with other software for the ET Tax NYS form?

Absolutely! airSlate SignNow integrates seamlessly with multiple platforms, including CRM systems and document management tools, to streamline your workflow with the ET Tax NYS form. This integration helps you automate the process, ensuring that your documentation is always up-to-date and easily accessible.

-

What are the benefits of using airSlate SignNow for the ET Tax NYS form?

Using airSlate SignNow for the ET Tax NYS form offers various benefits, including enhanced security, ease of use, and quick turnaround times. Your documents are safely stored and can be accessed anytime, facilitating better collaboration among team members. You'll also reduce paper waste and improve your overall efficiency.

-

How do I get started with airSlate SignNow to handle the ET Tax NYS form?

Getting started with airSlate SignNow is easy! Simply sign up for an account, explore our features, and start creating or uploading the ET Tax NYS form. Our intuitive platform guides you through the process of eSigning, making tax season much less stressful.

Get more for Et 706

- Marathon oil company 5555 sam 1ip nd form

- Arra airport sponsor certification dot nd form

- Troy city clerk 500 w big beaver rd troy mi form

- Square contract template form

- Sra train contract template form

- Staff agency contract template form

- Staff agency recruitment agency contract template form

- Staff contract template form

Find out other Et 706

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge

- How Do I Sign North Dakota Notice to Stop Credit Charge

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple