Part a Life Insurance Application Form

What is the Part A Life Insurance Application

The Part A Life Insurance Application is a crucial document used to apply for life insurance coverage. This form collects essential information about the applicant, including personal details, health history, and lifestyle choices. Insurance providers use this information to assess risk and determine eligibility for coverage. Understanding this application is vital for anyone seeking life insurance, as it lays the foundation for the underwriting process and ultimately influences the policy terms and premium rates.

Steps to complete the Part A Life Insurance Application

Completing the Part A Life Insurance Application involves several key steps to ensure accuracy and completeness. Start by gathering necessary personal information, such as your full name, address, date of birth, and Social Security number. Next, provide detailed health information, including any pre-existing conditions, medications, and family health history. Be prepared to answer questions about your lifestyle, such as smoking or alcohol consumption. After filling out the application, review it thoroughly for any errors or omissions before submission. This careful approach can help expedite the approval process.

Key elements of the Part A Life Insurance Application

The Part A Life Insurance Application contains several key elements that applicants must address. These include:

- Personal Information: Basic details about the applicant.

- Health History: A comprehensive overview of the applicant's medical background.

- Lifestyle Questions: Inquiries regarding habits that may affect health, such as smoking and exercise.

- Beneficiary Designation: Information about who will receive the policy benefits.

Each of these elements plays a significant role in the underwriting process, influencing the coverage offered and the associated costs.

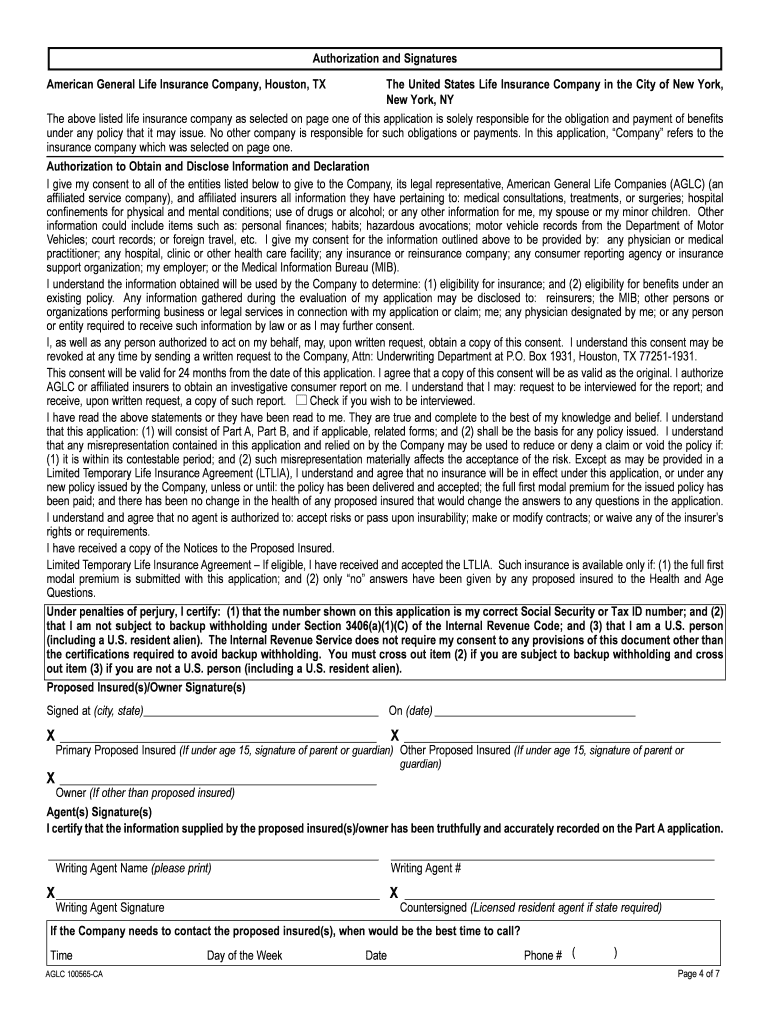

Legal use of the Part A Life Insurance Application

The Part A Life Insurance Application is legally binding once submitted and signed. This means that the information provided must be accurate and truthful, as any discrepancies can lead to denial of coverage or policy cancellation. It is essential to understand that misrepresentation, whether intentional or not, can have serious legal implications. Therefore, applicants should take care to disclose all relevant information and seek clarification from their insurance provider if they have any questions regarding the application process.

Form Submission Methods

The Part A Life Insurance Application can typically be submitted through various methods, accommodating different preferences and needs. Common submission methods include:

- Online Submission: Many insurance companies offer digital platforms for completing and submitting applications, allowing for quick processing.

- Mail: Applicants can print the completed form and send it via postal service, which may take longer for processing.

- In-Person Submission: Some applicants may prefer to submit their application directly at a local insurance office, where they can receive immediate assistance.

Choosing the right submission method can enhance the overall experience and efficiency of the application process.

Eligibility Criteria

Eligibility for the Part A Life Insurance Application varies by insurer but generally includes several common criteria. Applicants must be of a certain age, typically between eighteen and sixty-five, to qualify for standard life insurance policies. Additionally, insurers may evaluate health status, lifestyle choices, and occupation. Some companies may have specific requirements based on the type of coverage being sought, such as term or whole life insurance. Understanding these criteria can help applicants prepare effectively and increase their chances of approval.

Quick guide on how to complete part a life insurance application

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an excellent environmentally-friendly option to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents swiftly and without delays. Handle [SKS] on any platform with the airSlate SignNow applications for Android or iOS, and streamline any document-related process today.

How to edit and electronically sign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS], ensuring excellent communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Part A Life Insurance Application

Create this form in 5 minutes!

How to create an eSignature for the part a life insurance application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Part A Life Insurance Application?

The Part A Life Insurance Application is a crucial document that initiates the process of obtaining life insurance coverage. It collects essential information about the applicant's health, lifestyle, and financial status. Completing this application accurately is vital for determining eligibility and premium rates.

-

How can airSlate SignNow help with the Part A Life Insurance Application?

airSlate SignNow streamlines the process of completing and signing the Part A Life Insurance Application. Our platform allows users to easily fill out the application online, ensuring that all necessary information is captured efficiently. Additionally, eSigning features enable quick and secure submission.

-

What are the pricing options for using airSlate SignNow for the Part A Life Insurance Application?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling the Part A Life Insurance Application. Our cost-effective solutions ensure that you only pay for what you need, with options for monthly or annual subscriptions. Contact us for a detailed pricing breakdown.

-

What features does airSlate SignNow provide for the Part A Life Insurance Application?

Our platform includes features such as customizable templates, automated workflows, and secure cloud storage for the Part A Life Insurance Application. These tools enhance efficiency and ensure that all documents are easily accessible and organized. Additionally, real-time tracking allows you to monitor the application process.

-

What are the benefits of using airSlate SignNow for the Part A Life Insurance Application?

Using airSlate SignNow for the Part A Life Insurance Application offers numerous benefits, including reduced processing time and improved accuracy. Our user-friendly interface simplifies the application process, making it easier for applicants to provide the necessary information. Enhanced security features also protect sensitive data.

-

Can I integrate airSlate SignNow with other tools for the Part A Life Insurance Application?

Yes, airSlate SignNow seamlessly integrates with various CRM and document management systems to enhance the Part A Life Insurance Application process. This integration allows for better data management and streamlined workflows, ensuring that all relevant information is synchronized across platforms.

-

Is airSlate SignNow compliant with regulations for the Part A Life Insurance Application?

Absolutely! airSlate SignNow is designed to comply with industry regulations and standards for the Part A Life Insurance Application. We prioritize data security and privacy, ensuring that all documents are handled in accordance with applicable laws and regulations.

Get more for Part A Life Insurance Application

- Jessaskincare form

- Criminal history disclosure form

- 180 essential vocabulary words for 5th grade pdf form

- Illinois financial affidavit form

- Pythagorean theorem guided notes pdf form

- Illinois lottery retailer application form

- Team opponent date circle attempted shots use slash form

- Mosque boq xls form

Find out other Part A Life Insurance Application

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now