Form 8655 Rev May the People Group

Understanding Form 8655 Rev May

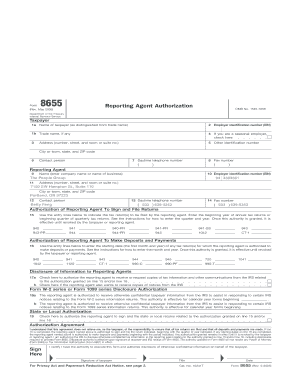

Form 8655, also known as the "Tax Information Authorization," is a document used by taxpayers in the United States to authorize an individual or entity to receive and discuss tax information on their behalf. This form is essential for ensuring that tax professionals can communicate with the IRS regarding a taxpayer's account, facilitating smoother interactions and compliance with tax regulations. The latest revision, dated May, reflects updates to streamline the authorization process and improve clarity for users.

How to Use Form 8655 Rev May

To effectively use Form 8655, a taxpayer must complete the form accurately, providing necessary details such as their name, address, and taxpayer identification number. The authorized representative's information must also be included, ensuring that the IRS recognizes their authority to act on behalf of the taxpayer. Once completed, the form should be submitted to the IRS, allowing the designated individual or organization to access the taxpayer's information and discuss it with IRS representatives.

Steps to Complete Form 8655 Rev May

Completing Form 8655 involves several straightforward steps:

- Begin by entering the taxpayer's name and address in the designated fields.

- Provide the taxpayer identification number, which may be a Social Security number or an Employer Identification Number.

- Fill in the information for the authorized representative, including their name, title, and contact information.

- Specify the tax matters for which the authorization is granted, ensuring clarity on the scope of the authorization.

- Sign and date the form to validate the authorization.

Legal Use of Form 8655 Rev May

Form 8655 is legally binding once signed by the taxpayer, granting the authorized individual or entity permission to access and discuss tax-related information with the IRS. This form is particularly important for tax professionals who need to represent clients during audits, inquiries, or other tax matters. Ensuring that the form is filled out correctly and submitted in a timely manner is crucial for maintaining compliance with IRS regulations.

Filing Deadlines and Important Dates

When using Form 8655, it is important to be aware of any relevant deadlines. While the form itself does not have a specific filing deadline, it should be submitted as soon as the taxpayer wishes to authorize a representative. Timely submission ensures that the representative can act on behalf of the taxpayer without delays, particularly during critical periods such as tax season or when responding to IRS inquiries.

Examples of Using Form 8655 Rev May

Form 8655 is commonly used in various scenarios, including:

- A self-employed individual authorizing their accountant to handle tax filings and communications with the IRS.

- A business owner allowing a tax professional to represent the company during an audit.

- A taxpayer granting permission to a family member to discuss tax matters on their behalf.

These examples illustrate the form's versatility in providing necessary authorizations for different types of taxpayers and situations.

Quick guide on how to complete form 8655 rev may the people group

Complete [SKS] effortlessly on any device

Digital document management has become popular with businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to edit and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from a device of your choice. Edit and eSign [SKS] and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8655 Rev May The People Group

Create this form in 5 minutes!

How to create an eSignature for the form 8655 rev may the people group

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How long does it take to process form 8655?

The turnaround time on these forms is around 3–4 weeks. Once you have your EFIN number, the designated individual calls the IRS to tie the 8655 forms to your EFIN number.

-

What is the difference between form 2678 and 8655?

Reporting Agents An employer may appoint an agent to file its employment tax returns by filing Form 2678, Employer/Payer Appointment of Agent; and Form 8655, Reporting Agent Authorization. Form 2678 identifies the employer, the reporting agent, and the forms covered by the authorization.

-

Can IRS form 8655 be signed electronically?

Authorizations - Form 8655, Reporting Agent Authorization Taxpayers may designate a RA to sign and file their federal employment tax returns electronically or on paper (if not required to file electronically).

-

How long does it take to process form 8655?

The turnaround time on these forms is around 3–4 weeks. Once you have your EFIN number, the designated individual calls the IRS to tie the 8655 forms to your EFIN number.

-

Can IRS form 8655 be signed electronically?

Authorizations - Form 8655, Reporting Agent Authorization Taxpayers may designate a RA to sign and file their federal employment tax returns electronically or on paper (if not required to file electronically).

-

What is the IRS form 8655 used for?

Use this form to authorize a reporting agent to: Sign and file certain returns; Make deposits and payments for certain returns; Receive duplicate copies of tax information, notices, and other written and/or electronic communication regarding any authority granted; and.

-

Who fills out a 8655?

The Form 8655 - Reporting Agent Authorization is a legal IRS document signed by an owner or corporate officer authorizing OnPay to file and deposit taxes on behalf of their company.

-

Who needs to file form 8655?

Filing Authorization. Form 8655 can be used to authorize Reporting Agents to file certain tax returns on paper for existing clients who have already authorized the filing of magnetic/electronic Forms 941 and/or Forms 940 by the Reporting Agent.

Get more for Form 8655 Rev May The People Group

Find out other Form 8655 Rev May The People Group

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now