Form 1120X Rev December HCoop

What is the Form 1120X Rev December HCoop

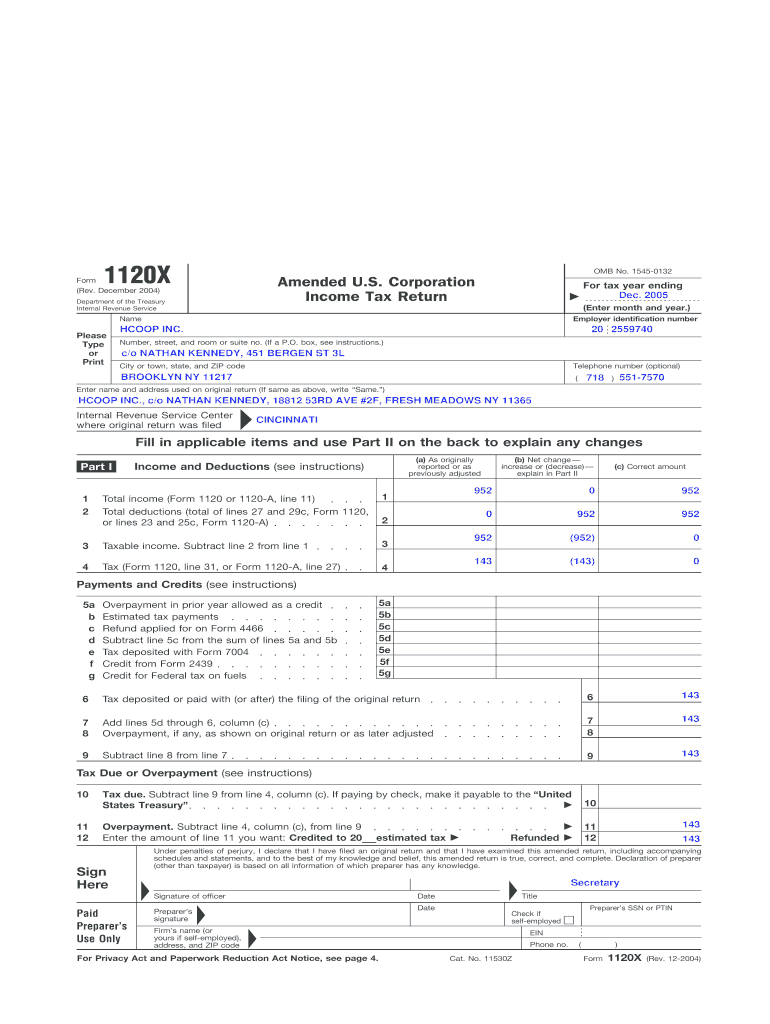

The Form 1120X Rev December HCoop is a tax form used by cooperative housing corporations in the United States to amend their previously filed corporate income tax returns. This form allows cooperatives to correct errors or make adjustments to their tax filings for a given tax year. It is essential for ensuring compliance with IRS regulations and for accurately reflecting the financial status of the cooperative. The form must be filed with the Internal Revenue Service (IRS) and is specifically designed for entities classified under Subchapter T of the Internal Revenue Code.

How to use the Form 1120X Rev December HCoop

Using the Form 1120X Rev December HCoop involves several steps to ensure accurate completion and submission. First, gather all relevant financial documents and the original Form 1120 that needs amendment. Review the specific areas that require changes, such as income, deductions, or credits. Fill out the Form 1120X with the corrected information, clearly indicating the adjustments made. It is crucial to provide a detailed explanation of the reasons for the amendments in the designated section. Once completed, the form should be submitted to the IRS, following the appropriate guidelines for filing amendments.

Steps to complete the Form 1120X Rev December HCoop

Completing the Form 1120X Rev December HCoop requires attention to detail. Follow these steps for successful completion:

- Obtain the latest version of the Form 1120X Rev December HCoop from the IRS website or authorized sources.

- Review the original Form 1120 to identify specific errors or necessary adjustments.

- Fill in the cooperative's name, address, and Employer Identification Number (EIN) at the top of the form.

- In the appropriate sections, enter the corrected amounts and provide explanations for each change.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1120X Rev December HCoop are crucial for compliance. Generally, the form must be filed within three years from the original due date of the tax return being amended. This timeline allows cooperatives to make necessary adjustments without facing penalties. It is important to keep track of any changes in IRS regulations that may affect these deadlines. Cooperatives should also be aware of any specific state requirements that may apply.

Required Documents

When preparing to file the Form 1120X Rev December HCoop, it is important to gather the necessary documents to support the amendments. Required documents may include:

- The original Form 1120 that is being amended.

- Financial statements that reflect the changes in income or expenses.

- Supporting documentation for deductions or credits being claimed.

- Any correspondence from the IRS related to the original filing.

Penalties for Non-Compliance

Failing to file the Form 1120X Rev December HCoop or submitting it inaccurately can result in penalties. The IRS may impose fines for late filings, and incorrect information could lead to additional tax liabilities or audits. It is essential for cooperatives to ensure timely and accurate submissions to avoid these consequences. Understanding the potential penalties can help motivate compliance and encourage careful review of tax filings.

Quick guide on how to complete form 1120x rev december hcoop

Effortlessly Prepare [SKS] on Any Device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily access the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign [SKS] with minimal effort

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Alter and electronically sign [SKS] to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1120X Rev December HCoop

Create this form in 5 minutes!

How to create an eSignature for the form 1120x rev december hcoop

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1120X Rev December HCoop?

Form 1120X Rev December HCoop is a tax form used by cooperative housing corporations to amend their previously filed corporate tax returns. This form allows businesses to correct errors or make changes to their tax filings. Understanding how to properly fill out Form 1120X Rev December HCoop is crucial for compliance and accurate reporting.

-

How can airSlate SignNow help with Form 1120X Rev December HCoop?

airSlate SignNow provides an efficient platform for businesses to eSign and send documents, including Form 1120X Rev December HCoop. With its user-friendly interface, you can easily upload, sign, and share your amended tax forms securely. This streamlines the process and ensures that your documents are handled promptly.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial. Each plan includes features that support document management and eSigning, including for Form 1120X Rev December HCoop. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage. These tools enhance the management of documents like Form 1120X Rev December HCoop, making it easier to track changes and maintain compliance. The platform also supports real-time collaboration among team members.

-

Is airSlate SignNow secure for handling sensitive documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your documents, including Form 1120X Rev December HCoop, are protected. The platform uses encryption and secure access protocols to safeguard your data. You can confidently manage sensitive information knowing that it is in safe hands.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow efficiency. You can connect it with accounting software or CRM systems to streamline the process of managing Form 1120X Rev December HCoop and other documents seamlessly.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like Form 1120X Rev December HCoop provides numerous benefits, including time savings and improved accuracy. The platform simplifies the signing process, reduces paperwork, and minimizes the risk of errors. This allows businesses to focus on their core operations while ensuring compliance.

Get more for Form 1120X Rev December HCoop

Find out other Form 1120X Rev December HCoop

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now