Ador Forms

What is the Arizona 5011 Form?

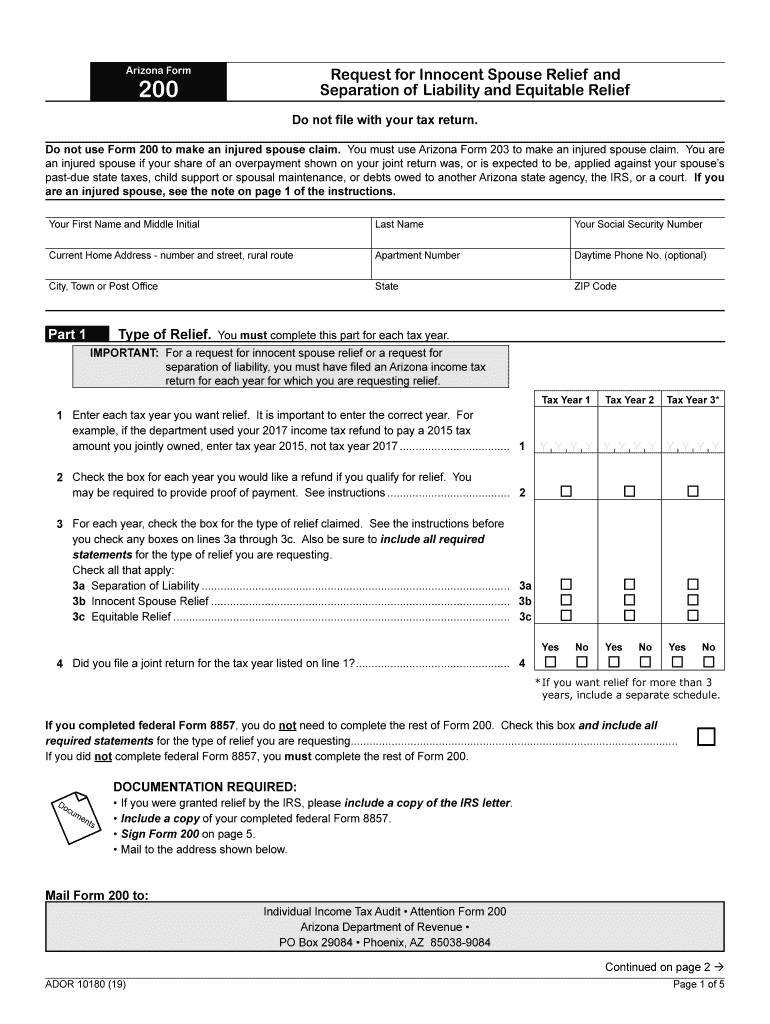

The Arizona 5011 form is a legal document used primarily for the purpose of claiming innocent spouse relief in the state of Arizona. This form allows individuals who believe they are unfairly liable for taxes due to their spouse's actions to request relief from such liabilities. The form is an essential tool for those seeking to protect themselves from tax obligations that they did not incur directly.

Steps to Complete the Arizona 5011 Form

Completing the Arizona 5011 form involves a series of steps to ensure accuracy and compliance with state regulations. Here are the key steps:

- Gather necessary personal information, including your Social Security number and your spouse's information.

- Review the eligibility criteria for innocent spouse relief to confirm your qualification.

- Fill out the form accurately, providing all required details about your tax situation and your spouse's actions.

- Sign and date the form to validate your submission.

- Submit the form to the appropriate Arizona Department of Revenue office as specified in the instructions.

Legal Use of the Arizona 5011 Form

The Arizona 5011 form is legally recognized for claiming innocent spouse relief under Arizona tax law. Properly completing and submitting this form can protect individuals from tax liabilities incurred by their spouse without their knowledge. It is crucial to follow the legal guidelines provided by the Arizona Department of Revenue to ensure that the form is valid and effective in achieving the intended relief.

Filing Deadlines / Important Dates

When submitting the Arizona 5011 form, it is important to be aware of relevant deadlines. Typically, the form must be filed within a specific time frame following the tax year in question. Missing these deadlines can result in the denial of relief. It is advisable to consult the Arizona Department of Revenue for the most current deadlines and any updates regarding filing procedures.

Required Documents

To complete the Arizona 5011 form, certain documents may be required to support your claim. These may include:

- Copies of your tax returns for the years in question.

- Documentation of your spouse's income and any discrepancies.

- Any correspondence from the IRS or state tax authorities related to your tax liabilities.

Having these documents ready can streamline the process and strengthen your case for relief.

Who Issues the Form

The Arizona 5011 form is issued by the Arizona Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance within Arizona. It is important to obtain the form directly from the official state resources to ensure that you are using the most current version and following the correct procedures.

Examples of Using the Arizona 5011 Form

Individuals may find themselves needing to use the Arizona 5011 form in various scenarios, such as:

- When a spouse fails to report income, leading to unexpected tax liabilities.

- If a spouse claims deductions or credits that the other spouse was unaware of.

- In cases of divorce, where one spouse is seeking to absolve themselves of tax responsibilities incurred during the marriage.

These examples illustrate the importance of the form in protecting individual taxpayers from unfair financial burdens.

Quick guide on how to complete you must use arizona form 203 to make an injured spouse claim

Complete Ador Forms effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your files swiftly without delays. Handle Ador Forms on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Ador Forms without any hassle

- Obtain Ador Forms and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important portions of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and then click on the Done button to save your updates.

- Select your preferred method for submitting your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Edit and eSign Ador Forms to guarantee outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the you must use arizona form 203 to make an injured spouse claim

How to make an eSignature for your You Must Use Arizona Form 203 To Make An Injured Spouse Claim in the online mode

How to make an eSignature for the You Must Use Arizona Form 203 To Make An Injured Spouse Claim in Chrome

How to create an electronic signature for signing the You Must Use Arizona Form 203 To Make An Injured Spouse Claim in Gmail

How to make an eSignature for the You Must Use Arizona Form 203 To Make An Injured Spouse Claim straight from your smartphone

How to create an eSignature for the You Must Use Arizona Form 203 To Make An Injured Spouse Claim on iOS devices

How to create an electronic signature for the You Must Use Arizona Form 203 To Make An Injured Spouse Claim on Android

People also ask

-

What is the 5011 form and how can airSlate SignNow help?

The 5011 form is a critical document used for various purposes, including tax and financial reporting. airSlate SignNow provides a user-friendly platform that allows you to create, send, and eSign your 5011 form quickly and securely, ensuring compliance with legal standards.

-

Can I fill out the 5011 form online using airSlate SignNow?

Yes, you can easily fill out the 5011 form online using airSlate SignNow's intuitive interface. Our platform allows you to enter all necessary information directly on the form, saving you time and ensuring accuracy before sending it out for signatures.

-

What are the pricing options for using airSlate SignNow with the 5011 form?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you're an individual or a larger team, you can choose a plan that allows you to manage the 5011 form efficiently while benefiting from our cost-effective solutions.

-

Are electronic signatures on the 5011 form legally binding?

Absolutely! Electronic signatures on the 5011 form through airSlate SignNow are legally binding and comply with the U.S. ESIGN Act and UETA. This enables you to securely sign the form without the need for physical paperwork.

-

How does airSlate SignNow ensure the security of the 5011 form?

airSlate SignNow prioritizes the security of your documents, including the 5011 form. We employ advanced encryption methods and secure cloud storage to protect your sensitive information throughout the signing process.

-

Can I integrate airSlate SignNow with other applications for managing the 5011 form?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage the 5011 form. Whether you use CRM systems, cloud storage solutions, or productivity tools, you can streamline your document workflows effectively.

-

What are the benefits of using airSlate SignNow for the 5011 form?

Using airSlate SignNow for the 5011 form offers numerous benefits, including faster turnaround times, improved accuracy, and reduced paperwork. Our platform's simplicity allows you to focus on your business rather than the signing process.

Get more for Ador Forms

- T his form may be used for annual reporting of regularly scheduled sos ok

- Irp6 form

- Ohf screening declaration form pdf

- Content creator contract template form

- Software service contract template form

- Software subscription contract template form

- Software support contract template form

- Software time and materials contract template form

Find out other Ador Forms

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure