Cr Q1 Form

What is the Cr Q1?

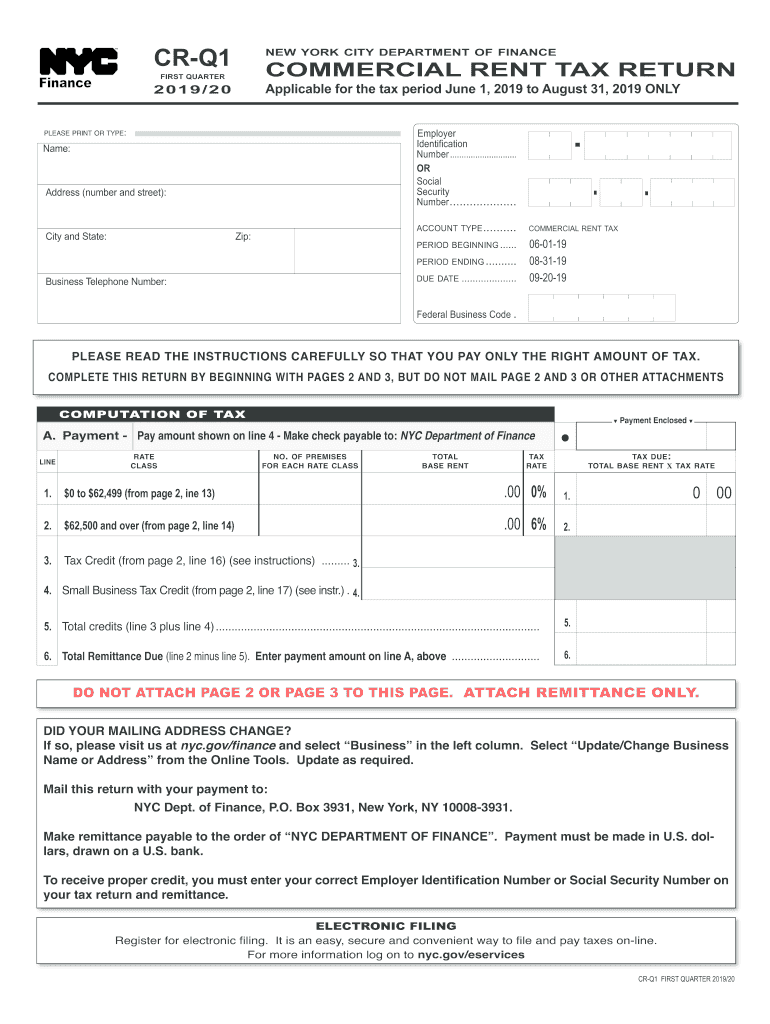

The Cr Q1 refers to the first quarter commercial rent tax return form required by businesses operating in New York City. This form is essential for property owners and tenants who are subject to the city’s commercial rent tax regulations. The Cr Q1 form must be completed accurately to reflect the rental income received during the first quarter of the year, ensuring compliance with local tax laws.

Steps to complete the Cr Q1

Completing the Cr Q1 involves several key steps to ensure accuracy and compliance:

- Gather necessary documentation, including rental agreements and financial records.

- Calculate the total commercial rent received during the first quarter.

- Fill out the Cr Q1 form with the calculated figures, ensuring all sections are completed.

- Review the form for accuracy, checking for any errors or omissions.

- Submit the completed form by the due date, either electronically or via mail.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Cr Q1 to avoid penalties. The due date for submitting the Cr Q1 is typically set for the last day of the month following the end of the first quarter. For example, if the first quarter ends on March 31, the form must be filed by April 30. Staying informed about these dates helps ensure timely compliance with tax obligations.

Required Documents

To complete the Cr Q1 form, several documents are necessary:

- Rental agreements outlining the terms of the lease.

- Financial statements showing the total rent collected during the quarter.

- Any previous tax returns or forms related to commercial rent tax.

Having these documents ready will streamline the process of filling out the Cr Q1 and help avoid potential issues.

Legal use of the Cr Q1

The Cr Q1 must be used in accordance with New York City tax regulations. It serves as a formal declaration of the commercial rent received and is subject to verification by tax authorities. Proper use of this form ensures that businesses comply with local laws and avoid penalties associated with non-compliance.

Who Issues the Form

The Cr Q1 form is issued by the New York City Department of Finance. This department oversees the administration of commercial rent tax and provides the necessary forms and guidelines for businesses to fulfill their tax obligations. It is important to refer to the official resources provided by this department for the most current information and updates regarding the Cr Q1.

Quick guide on how to complete commercial rent tax crt returns nycgov

Complete Cr Q1 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents swiftly without delays. Handle Cr Q1 on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest way to modify and eSign Cr Q1 effortlessly

- Obtain Cr Q1 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, monotonous form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Cr Q1 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the commercial rent tax crt returns nycgov

How to generate an eSignature for the Commercial Rent Tax Crt Returns Nycgov online

How to make an electronic signature for your Commercial Rent Tax Crt Returns Nycgov in Google Chrome

How to create an eSignature for putting it on the Commercial Rent Tax Crt Returns Nycgov in Gmail

How to create an eSignature for the Commercial Rent Tax Crt Returns Nycgov straight from your smart phone

How to create an eSignature for the Commercial Rent Tax Crt Returns Nycgov on iOS devices

How to create an eSignature for the Commercial Rent Tax Crt Returns Nycgov on Android devices

People also ask

-

What is the NYC CRT form and how can airSlate SignNow help?

The NYC CRT form is a crucial document required for various legal and business processes in New York City. airSlate SignNow simplifies the completion and submission of the NYC CRT form by providing an intuitive eSignature platform, enabling users to fill out, sign, and send documents effortlessly.

-

What features does airSlate SignNow offer for handling the NYC CRT form?

airSlate SignNow offers a range of features to streamline the process of managing the NYC CRT form. Users can easily create templates, add eSignatures, and automate workflows, ensuring that the necessary legal documents are processed quickly and efficiently.

-

Is airSlate SignNow affordable for small businesses needing the NYC CRT form?

Yes, airSlate SignNow is designed to be cost-effective, making it accessible for small businesses that need to complete the NYC CRT form. With various pricing plans, users can choose an option that fits their budget while still enjoying full access to essential features for document management.

-

Can I integrate airSlate SignNow with other applications when handling the NYC CRT form?

Absolutely! airSlate SignNow offers integrations with popular applications like Google Drive, Salesforce, and more, which facilitate seamless handling of the NYC CRT form. These integrations help businesses streamline their document processes and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for the NYC CRT form?

Using airSlate SignNow for the NYC CRT form provides numerous benefits, including time savings, enhanced security, and improved accuracy. The electronic signature capabilities ensure that documents are signed quickly and securely, reducing the risk of delays and errors.

-

How secure is airSlate SignNow when it comes to the NYC CRT form?

airSlate SignNow prioritizes security, implementing robust encryption and compliance protocols for handling the NYC CRT form. Users can rest assured that their sensitive information is protected, meeting industry standards for data security and privacy.

-

How can I access customer support for questions about the NYC CRT form and airSlate SignNow?

Customer support at airSlate SignNow is readily available to assist with any questions regarding the NYC CRT form. Users can signNow out through live chat, email, or phone support for prompt and helpful responses to their inquiries.

Get more for Cr Q1

- Or126 horseshoe creek siuslaw river section oregon gov oregon form

- Whodas 2 0 assessment form

- Form 1 aadhaar enrolment and update for a resident indian or

- Content creation contract template form

- Software development outsourc contract template form

- Software implementation contract template form

- Software engineer contract template form

- Software license contract template form

Find out other Cr Q1

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer