Att Tax Form it 201

What is the Att Tax Form It 201

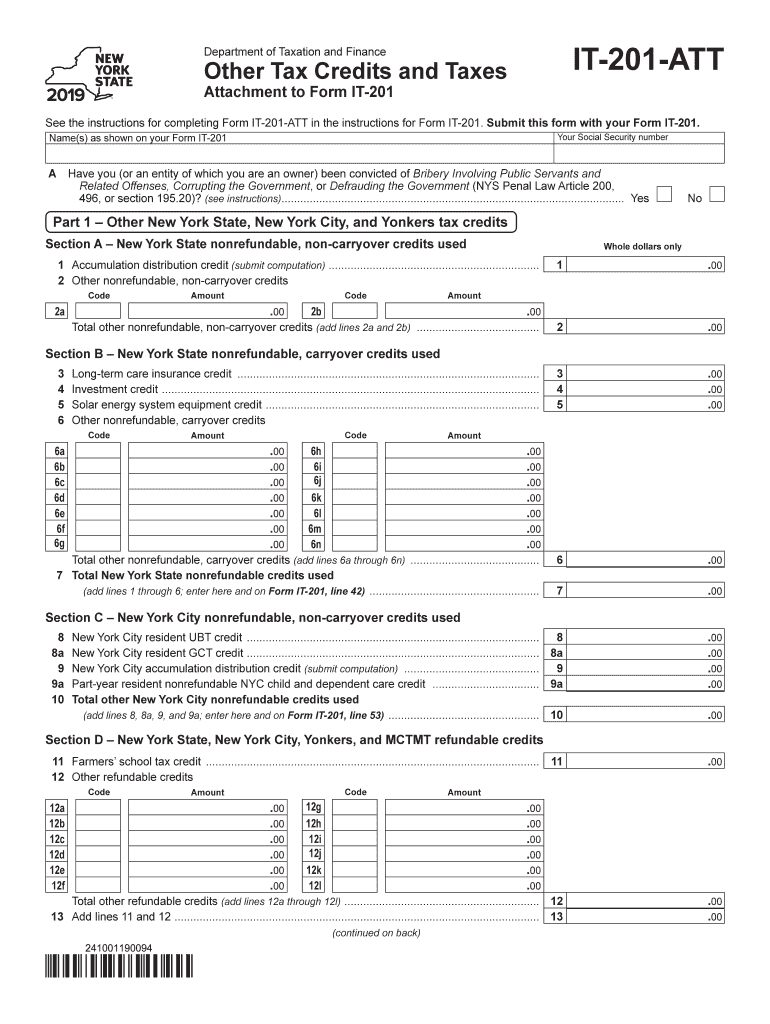

The Att Tax Form It 201 is a specific tax form used primarily in New York State for reporting various types of income and claiming credits. It is designed for individuals and businesses to accurately report their tax obligations. This form is essential for ensuring compliance with state tax laws and for determining the amount of tax owed or refundable. Understanding the purpose and requirements of the 2019 it 201 att form is crucial for taxpayers to avoid penalties and ensure proper filing.

Steps to complete the Att Tax Form It 201

Completing the Att Tax Form It 201 requires careful attention to detail. Here are the key steps involved:

- Gather all necessary financial documents, including income statements, previous tax returns, and any relevant deductions.

- Begin filling out the form by entering your personal information, such as name, address, and Social Security number.

- Report your income accurately, ensuring that all sources of income are included.

- Claim any applicable credits and deductions that you qualify for, as these can significantly affect your tax liability.

- Review the completed form for accuracy, ensuring that all calculations are correct.

- Sign and date the form, acknowledging that the information provided is true and complete.

Legal use of the Att Tax Form It 201

The legal use of the Att Tax Form It 201 is governed by New York State tax laws. This form must be filled out accurately and submitted by the required deadlines to ensure compliance. Failure to use the form correctly can result in penalties, including fines or interest on unpaid taxes. It is important for taxpayers to understand their rights and responsibilities when using this form to avoid legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Att Tax Form It 201 are critical for compliance. Typically, the deadline for submitting this form aligns with the federal tax filing deadline, which is usually April fifteenth. However, taxpayers should verify specific dates each year, as they can vary. Additionally, if you require an extension, it is essential to file the appropriate forms by the original deadline to avoid penalties.

Who Issues the Form

The Att Tax Form It 201 is issued by the New York State Department of Taxation and Finance. This agency is responsible for overseeing tax collection and ensuring compliance with state tax laws. Taxpayers can obtain the form directly from the department's official website or through authorized tax preparation services.

Examples of using the Att Tax Form It 201

There are several scenarios in which the Att Tax Form It 201 is utilized:

- Individuals reporting wages from employment or self-employment.

- Businesses claiming deductions for operational expenses.

- Taxpayers applying for credits related to education or energy efficiency improvements.

Each of these examples highlights the importance of accurately completing the form to ensure that all eligible credits and deductions are claimed.

Quick guide on how to complete form it 201 i instructions for form it 201 taxnygov

Effortlessly Prepare Att Tax Form It 201 on Any Device

Managing documents online has gained popularity among both businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly and efficiently. Handle Att Tax Form It 201 on any platform with airSlate SignNow's Android or iOS applications and streamline your document processes today.

The easiest method to modify and electronically sign Att Tax Form It 201 without hassle

- Obtain Att Tax Form It 201 and then click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize signNow sections of your documents or cover sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form: via email, SMS, or an invitation link, or download it onto your computer.

Eliminate worries about lost or misplaced documents, cumbersome form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Att Tax Form It 201 to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 201 i instructions for form it 201 taxnygov

How to make an electronic signature for your Form It 201 I Instructions For Form It 201 Taxnygov in the online mode

How to create an eSignature for the Form It 201 I Instructions For Form It 201 Taxnygov in Chrome

How to make an electronic signature for signing the Form It 201 I Instructions For Form It 201 Taxnygov in Gmail

How to generate an electronic signature for the Form It 201 I Instructions For Form It 201 Taxnygov right from your smart phone

How to create an electronic signature for the Form It 201 I Instructions For Form It 201 Taxnygov on iOS

How to make an electronic signature for the Form It 201 I Instructions For Form It 201 Taxnygov on Android

People also ask

-

What features does airSlate SignNow offer for the 2019 it 201 att. users?

airSlate SignNow provides an extensive range of features for the 2019 it 201 att. users, including document editing, eSignature capabilities, and workflow automation. These features make it easy for businesses to streamline their document processes. With a user-friendly interface, users can quickly get documents signed without any hassle.

-

How much does airSlate SignNow cost for 2019 it 201 att. plans?

The pricing for airSlate SignNow varies depending on the plan chosen, with options designed for both individual users and businesses. For users associated with the 2019 it 201 att. category, competitive rates provide access to valuable features. Additionally, a free trial is available for potential customers to evaluate the platform.

-

What are the benefits of using airSlate SignNow for 2019 it 201 att. specifically?

Users in the 2019 it 201 att. space can benefit from increased efficiency, reduced turnaround times, and enhanced security with airSlate SignNow. This solution allows businesses to manage their documents digitally, saving time and reducing paper waste. By using airSlate SignNow, companies can ensure compliance and boost their overall productivity.

-

Can airSlate SignNow integrate with other tools for 2019 it 201 att. users?

Yes, airSlate SignNow offers integrations with various tools that are essential for 2019 it 201 att. users. These integrations include popular platforms like Google Drive, Salesforce, and Dropbox. This connectivity allows for seamless document management and enhances collaboration across different workflows.

-

Is airSlate SignNow compliant with regulations for 2019 it 201 att.?

Absolutely! airSlate SignNow is designed to meet the compliance requirements essential for 2019 it 201 att. users. This includes adherence to eSignature laws, data protection regulations, and other industry standards. By prioritizing compliance, users can confidently utilize the platform for sensitive documents.

-

How secure is airSlate SignNow for 2019 it 201 att. customers?

Security is a top priority for airSlate SignNow, particularly for 2019 it 201 att. customers who handle sensitive documents. The platform employs advanced encryption, secure data storage, and multiple authentication methods to protect users' information. This ensures that all transactions and documents remain confidential and secure.

-

What support options are available for 2019 it 201 att. users of airSlate SignNow?

airSlate SignNow offers a range of support options to assist 2019 it 201 att. users, including a comprehensive help center, tutorials, and customer support via chat and email. This ensures that users can receive assistance whenever they encounter challenges. The dedicated support team is committed to helping users make the most of the platform.

Get more for Att Tax Form It 201

Find out other Att Tax Form It 201

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document