Ct 3m Form

What is the CT-3M?

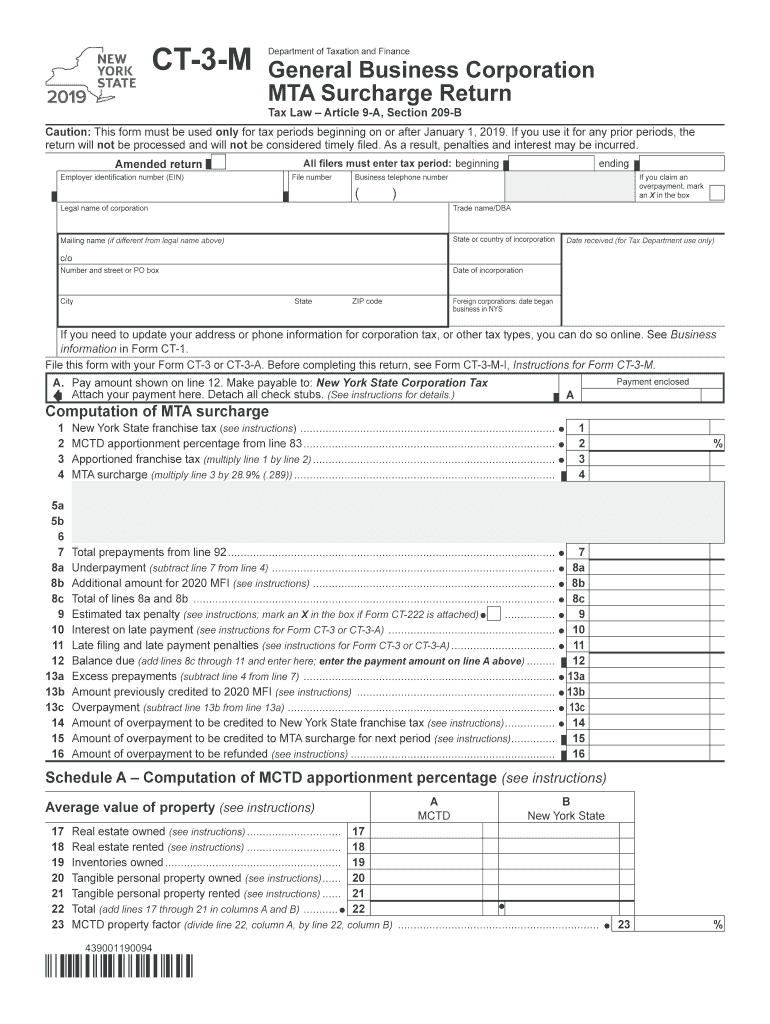

The CT-3M is a New York State tax form specifically designed for corporations. It serves as an annual report for the Metropolitan Transportation Authority (MTA) surcharge. This form is essential for businesses that are subject to the MTA surcharge, as it helps determine the amount owed based on the corporation's income and other factors. Understanding the CT-3M is crucial for compliance with state tax regulations and ensuring accurate reporting of financial obligations.

How to Use the CT-3M

Using the CT-3M involves several steps to ensure that the form is filled out correctly. First, gather all necessary financial documents that reflect the corporation's income and expenses. Next, complete the form by providing accurate information regarding the business's financial performance and any applicable deductions. After filling out the CT-3M, review the information for accuracy before submitting it to the New York State Department of Taxation and Finance.

Steps to Complete the CT-3M

Completing the CT-3M requires careful attention to detail. Follow these steps:

- Gather financial records, including income statements and balance sheets.

- Fill in the corporation's name, address, and identification number at the top of the form.

- Report total income and any deductions applicable to the MTA surcharge.

- Calculate the surcharge amount based on the provided income figures.

- Review the completed form for accuracy and completeness.

- Submit the CT-3M by the designated filing deadline.

Legal Use of the CT-3M

The CT-3M is legally required for corporations that fall under the jurisdiction of the MTA surcharge. Filing this form accurately ensures compliance with New York State tax laws. Failure to submit the CT-3M or submitting it with incorrect information can result in penalties or additional scrutiny from tax authorities. It is essential for businesses to understand their obligations under the law to avoid potential legal issues.

Filing Deadlines / Important Dates

Timely filing of the CT-3M is critical for compliance. The form must be submitted annually, typically by the fifteenth day of the third month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the CT-3M is due by March 15. Staying aware of these deadlines helps avoid late fees and ensures that the corporation remains in good standing with tax authorities.

Penalties for Non-Compliance

Non-compliance with the CT-3M filing requirements can lead to significant penalties. These may include monetary fines and interest on unpaid surcharges. Additionally, failing to file the form can result in the corporation being subject to audits or further investigation by tax authorities. It is vital for businesses to prioritize the timely and accurate submission of the CT-3M to mitigate these risks.

Quick guide on how to complete form ct 3 m2019general business corporation mta surcharge returnct3m

Complete Ct 3m effortlessly on any gadget

Online document management has become increasingly popular among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Ct 3m on any device using airSlate SignNow's Android or iOS applications and streamline any document-based workflow today.

The simplest way to modify and eSign Ct 3m with ease

- Locate Ct 3m and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method of sending your form—by email, SMS, invite link, or download it to your computer.

No more lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Ct 3m and ensure superior communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 3 m2019general business corporation mta surcharge returnct3m

How to create an eSignature for your Form Ct 3 M2019general Business Corporation Mta Surcharge Returnct3m online

How to generate an electronic signature for your Form Ct 3 M2019general Business Corporation Mta Surcharge Returnct3m in Google Chrome

How to create an eSignature for signing the Form Ct 3 M2019general Business Corporation Mta Surcharge Returnct3m in Gmail

How to generate an eSignature for the Form Ct 3 M2019general Business Corporation Mta Surcharge Returnct3m from your smartphone

How to make an electronic signature for the Form Ct 3 M2019general Business Corporation Mta Surcharge Returnct3m on iOS

How to create an electronic signature for the Form Ct 3 M2019general Business Corporation Mta Surcharge Returnct3m on Android

People also ask

-

What is the MTA 3 form and how is it used?

The MTA 3 form is a crucial document used for transferring vehicle ownership in various states. It serves as a record of sale that both the buyer and seller must complete to formalize the transaction. Using airSlate SignNow, you can easily fill, sign, and send the MTA 3 form securely online.

-

Is there a cost to use airSlate SignNow for MTA 3 form signing?

airSlate SignNow offers a variety of pricing plans tailored to meet different business needs, including options for individuals and enterprises. You can utilize our platform to eSign the MTA 3 form at a competitive price, ensuring accessibility without compromising on quality. Additionally, we offer a free trial so you can experience the benefits before committing.

-

What are the key features of airSlate SignNow for managing the MTA 3 form?

AirSlate SignNow provides a range of features designed to simplify the signing process for the MTA 3 form, including customizable templates, automatic reminders, and real-time tracking. Our user-friendly interface allows anyone to create, send, and manage their documents seamlessly. Furthermore, our platform ensures the security of your documents with advanced encryption.

-

How does airSlate SignNow enhance the benefits of using the MTA 3 form?

Using airSlate SignNow to manage the MTA 3 form streamlines the entire process, saving you time and reducing the risk of errors. With our electronic signatures, you can finalize the document from anywhere at any time. This convenience allows for quicker turnarounds, which is especially beneficial in busy market conditions.

-

Can I integrate airSlate SignNow with other tools for processing the MTA 3 form?

Absolutely! AirSlate SignNow supports a variety of integrations with popular applications such as Google Drive, Salesforce, and Zapier. This flexibility allows you to streamline your workflow when handling the MTA 3 form, making it easier to manage documents alongside other business operations.

-

Is it safe to eSign the MTA 3 form using airSlate SignNow?

Yes, eSigning the MTA 3 form with airSlate SignNow is safe and reliable. Our platform complies with industry-leading security standards and legal regulations, ensuring that your electronic signatures are legally binding. We utilize encryption and secure servers to protect your data at every step of the signing process.

-

What types of businesses benefit from using the MTA 3 form with airSlate SignNow?

Any business involved in vehicle sales or transfers can benefit from using the MTA 3 form with airSlate SignNow. Whether you're a dealership, an independent seller, or even a vehicle management company, our platform can optimize your documentation process. By facilitating smoother transactions, you enhance customer satisfaction and improve operational efficiency.

Get more for Ct 3m

- Instructions for form nyc 204 partnership return

- Form it 217 claim for farmers school tax credit tax year

- New india assurance policy schedule cum certificate of insurance pdffiller form

- Events contract template form

- Smma contract template form

- Snow clear contract template form

- Snow contract template form

- Snow plow contract template form

Find out other Ct 3m

- eSign California Sublease Agreement Template Safe

- How To eSign Colorado Sublease Agreement Template

- How Do I eSign Colorado Sublease Agreement Template

- eSign Florida Sublease Agreement Template Free

- How Do I eSign Hawaii Lodger Agreement Template

- eSign Arkansas Storage Rental Agreement Now

- How Can I eSign Texas Sublease Agreement Template

- eSign Texas Lodger Agreement Template Free

- eSign Utah Lodger Agreement Template Online

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template

- eSignature Illinois Postnuptial Agreement Template Easy

- eSignature Kentucky Postnuptial Agreement Template Computer

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application