Form it 217 Claim for Farmers' School Tax Credit Tax Year 2023

What is the Form IT 217 Claim For Farmers' School Tax Credit Tax Year

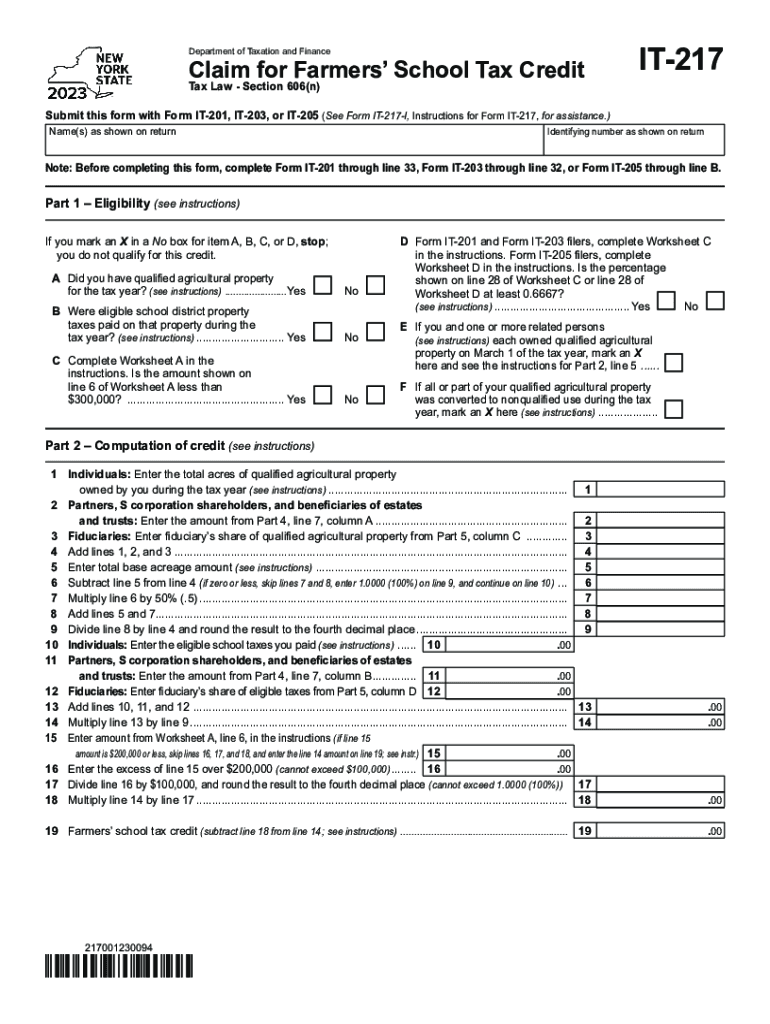

The Form IT 217 is specifically designed for farmers in the United States to claim a school tax credit. This form allows eligible farmers to receive a credit against their school property taxes, which can significantly reduce their tax burden. The credit is intended to support agricultural operations and promote the sustainability of farming in local communities. Understanding the purpose and eligibility criteria of this form is essential for farmers looking to benefit from this tax relief.

How to use the Form IT 217 Claim For Farmers' School Tax Credit Tax Year

Using the Form IT 217 involves several straightforward steps. First, gather all necessary documentation that proves eligibility, such as proof of farming income and property tax statements. Next, complete the form by providing accurate information regarding your farming operation and tax liabilities. After filling out the form, review it for accuracy before submission. It is important to follow any specific instructions provided for the form to ensure proper processing and avoid delays.

Steps to complete the Form IT 217 Claim For Farmers' School Tax Credit Tax Year

To complete the Form IT 217 effectively, follow these steps:

- Obtain the form from the appropriate state tax authority or download it from their website.

- Fill in your personal and business information, including your name, address, and farming operation details.

- Calculate your eligible credit based on the provided guidelines and your property tax information.

- Attach any required documentation that supports your claim, such as tax returns or proof of income.

- Sign and date the form before submitting it to ensure it is valid.

Eligibility Criteria

To qualify for the credit claimed on the Form IT 217, farmers must meet specific eligibility criteria. Generally, applicants must be actively engaged in farming and must own or lease property that is assessed for school taxes. Additionally, the farming operation must meet certain income thresholds as defined by state regulations. It is advisable for farmers to review these criteria carefully to determine their eligibility before completing the form.

Required Documents

When filing the Form IT 217, several documents are typically required to substantiate the claim. These may include:

- Proof of farming income, such as tax returns or financial statements.

- Property tax statements indicating the amount paid for school taxes.

- Any additional documentation that supports your eligibility for the credit.

Having these documents ready will facilitate a smoother filing process and help ensure that claims are processed without unnecessary delays.

Form Submission Methods

The Form IT 217 can be submitted through various methods, depending on the requirements of the state tax authority. Common submission methods include:

- Online submission through the state tax authority's website, if available.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices, which may provide immediate confirmation of receipt.

Farmers should verify the preferred submission method for their state to ensure compliance with local regulations.

Quick guide on how to complete form it 217 claim for farmers school tax credit tax year

Complete Form IT 217 Claim For Farmers' School Tax Credit Tax Year effortlessly on any device

Online document management has gained popularity among enterprises and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage Form IT 217 Claim For Farmers' School Tax Credit Tax Year on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Form IT 217 Claim For Farmers' School Tax Credit Tax Year without hassle

- Find Form IT 217 Claim For Farmers' School Tax Credit Tax Year and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Select your preferred method for sending your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form hunts, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from your device of choice. Modify and eSign Form IT 217 Claim For Farmers' School Tax Credit Tax Year, ensuring excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 217 claim for farmers school tax credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 217 claim for farmers school tax credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it217 farmers printable, and how can it benefit my business?

The it217 farmers printable is a customizable document template designed for farmers to easily manage their paperwork. It streamlines the process by allowing users to fill out necessary information and sign documents electronically. This not only saves time but also reduces the risk of errors, ensuring a smoother workflow.

-

How much does it cost to access the it217 farmers printable?

The it217 farmers printable is available through airSlate SignNow's subscription plans, which are designed to be cost-effective for businesses of all sizes. Pricing varies based on the plan you choose, but all options include access to various document templates, including the it217 farmers printable. You'll get great value with our tiered pricing model that scales with your needs.

-

Can I customize the it217 farmers printable for my specific needs?

Absolutely! The it217 farmers printable can be easily customized to fit your specific requirements. With airSlate SignNow's user-friendly interface, you can edit the document fields and branding elements to ensure it meets your business needs and reflects your brand identity accurately.

-

What features are included with the it217 farmers printable?

The it217 farmers printable comes with multiple features, including electronic signature capabilities, cloud storage, and document tracking. These features enhance your workflow by providing real-time updates and coordination with your team. Additionally, you can access templates for common documents related to farming operations.

-

Is the it217 farmers printable compatible with other software tools?

Yes, the it217 farmers printable seamlessly integrates with various software applications to enhance your productivity. With airSlate SignNow, you can connect with popular tools such as Google Drive, Dropbox, and CRM systems. This allows for a more streamlined document management process and ensures that all your documents are easily accessible.

-

How does the eSigning process work with the it217 farmers printable?

The eSigning process with the it217 farmers printable is simple and efficient. Once you've customized your document, you can send it to the necessary parties for electronic signatures. Signers receive an email notification and can sign the document from any device, ensuring a quick turnaround without the hassle of printing or scanning.

-

Are there any limitations to using the it217 farmers printable?

While the it217 farmers printable is versatile, it's important to note that it may have some limitations based on your chosen subscription plan. For instance, the number of documents you can send or sign may vary. However, airSlate SignNow offers various plans to accommodate businesses of all sizes, ensuring you find a solution that fits your needs.

Get more for Form IT 217 Claim For Farmers' School Tax Credit Tax Year

- Sample 42 cfr part 2 31 consent form medfusion medfusion

- Changes physical or chemical by cindy grigg form

- Multiplication drill 2x table busy teachers cafe form

- Seeing dupont within sewanee and student life ringling college ringling form

- Osrap vendor form

- Heirloom birth certificate form

- Sunnyvale tree removal permit form fill out and sign

- The institute for creation researchthe institute for creation form

Find out other Form IT 217 Claim For Farmers' School Tax Credit Tax Year

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word