It 2105 9 Form

What is the IT-2105?

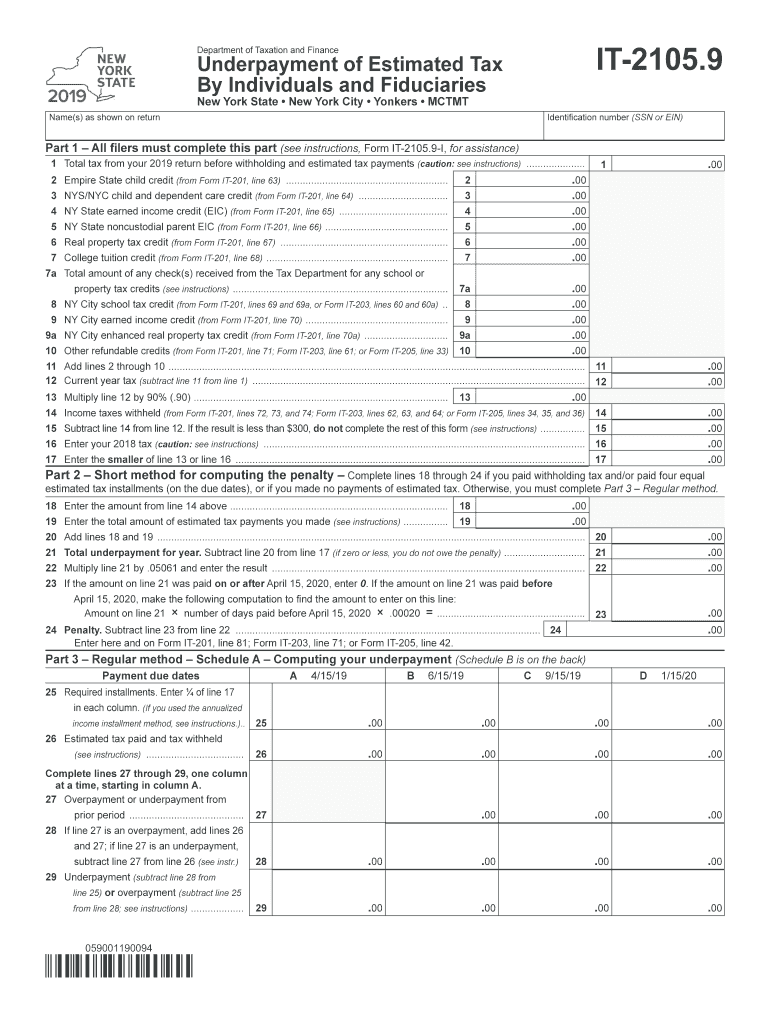

The IT-2105 is a New York State tax form used to calculate and report estimated income tax payments for individuals. This form is particularly relevant for those who expect to owe tax of one thousand dollars or more when filing their annual return. The IT-2105 helps taxpayers determine their estimated tax liability based on their expected income and applicable deductions. Proper completion of this form ensures compliance with New York tax regulations and helps avoid penalties for underpayment.

How to Use the IT-2105

Using the IT-2105 involves a few straightforward steps. First, gather necessary financial information, including your expected income, deductions, and credits for the tax year. Next, follow the instructions on the form to calculate your estimated tax liability. This may involve using tax tables or worksheets provided by the New York State Department of Taxation and Finance. Once completed, you can submit the form along with your payment to ensure timely processing.

Steps to Complete the IT-2105

Completing the IT-2105 requires careful attention to detail. Here are the essential steps:

- Gather your financial documents, including income statements and prior year tax returns.

- Fill out your personal information at the top of the form.

- Calculate your estimated income for the year.

- Determine your allowable deductions and credits.

- Use the provided tax tables to find your estimated tax liability.

- Complete the payment section, indicating how much you plan to pay with your submission.

- Review the form for accuracy before signing and dating it.

Legal Use of the IT-2105

The IT-2105 is legally recognized for estimating tax liabilities in New York State. It is essential to complete this form accurately to avoid potential legal issues with tax compliance. The form adheres to the guidelines set forth by the New York State Department of Taxation and Finance, ensuring that all calculations and submissions are in line with state tax laws. Failure to comply with the requirements of the IT-2105 may result in penalties or interest on unpaid taxes.

Filing Deadlines / Important Dates

Timely filing of the IT-2105 is crucial to avoid penalties. The estimated tax payments are typically due on the following dates:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

It is important to mark these dates on your calendar to ensure that payments are made on time.

Required Documents

To complete the IT-2105, you will need several documents, including:

- Previous year’s tax return for reference

- Income statements, such as W-2s or 1099s

- Records of any deductions or credits you plan to claim

Having these documents ready will streamline the completion process and help ensure accuracy.

Quick guide on how to complete form it 210592019underpayment of estimated income tax by individuals and fiduciariesit21059

Effortlessly Complete It 2105 9 on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without any hold-ups. Manage It 2105 9 on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The Easiest Way to Edit and eSign It 2105 9 with Ease

- Find It 2105 9 and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign It 2105 9 for clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 210592019underpayment of estimated income tax by individuals and fiduciariesit21059

How to generate an electronic signature for the Form It 210592019underpayment Of Estimated Income Tax By Individuals And Fiduciariesit21059 online

How to make an electronic signature for the Form It 210592019underpayment Of Estimated Income Tax By Individuals And Fiduciariesit21059 in Google Chrome

How to generate an electronic signature for putting it on the Form It 210592019underpayment Of Estimated Income Tax By Individuals And Fiduciariesit21059 in Gmail

How to make an eSignature for the Form It 210592019underpayment Of Estimated Income Tax By Individuals And Fiduciariesit21059 straight from your mobile device

How to make an eSignature for the Form It 210592019underpayment Of Estimated Income Tax By Individuals And Fiduciariesit21059 on iOS devices

How to make an electronic signature for the Form It 210592019underpayment Of Estimated Income Tax By Individuals And Fiduciariesit21059 on Android devices

People also ask

-

What features does airSlate SignNow offer for managing it2105 9 documents?

airSlate SignNow provides a comprehensive set of features for managing it2105 9 documents, including customizable templates, advanced eSignature capabilities, and real-time tracking. These tools streamline the signing process, making it easier for users to create, send, and sign documents with minimal effort. Additionally, it2105 9 documents can be easily managed from any device.

-

How can airSlate SignNow benefit my business's workflow for it2105 9?

By using airSlate SignNow for it2105 9, businesses can signNowly enhance their workflow efficiency. The platform allows for quick document generation and signing, reducing turnaround time and minimizing delays. Moreover, integration with various applications ensures a seamless experience throughout the business processes.

-

What is the pricing structure for airSlate SignNow related to it2105 9 usage?

airSlate SignNow offers competitive pricing plans that suit various business needs for it2105 9 usage. There are tiered plans allowing businesses to scale their usage based on the number of users and volume of documents. Each plan includes essential features, so businesses only pay for what they need.

-

Does airSlate SignNow support integrations with other tools for it2105 9?

Yes, airSlate SignNow supports a wide range of integrations with popular tools and applications beneficial for it2105 9 management. These integrations allow users to connect with CRM systems, document management software, and collaboration tools, enhancing the overall workflow. This flexibility means users can maintain their existing tools while leveraging the power of airSlate SignNow.

-

Is airSlate SignNow secure for handling it2105 9 documents?

Absolutely! airSlate SignNow employs advanced security measures to protect it2105 9 documents throughout the signing process. With encryption and compliance with various security standards, businesses can confidently manage sensitive information without fear of bsignNowes. User authentication and audit trails further enhance security.

-

How easy is it to get started with airSlate SignNow for it2105 9?

Getting started with airSlate SignNow for it2105 9 is simple and user-friendly. Users can sign up, access a variety of templates, and start sending documents for signature within minutes. The intuitive interface ensures that even those with minimal technical skills can navigate the platform effortlessly.

-

Can I customize templates for it2105 9 in airSlate SignNow?

Yes, airSlate SignNow allows extensive customization of templates for it2105 9. Users can add field types, branding elements, and specific text to tailor each document to their needs. This level of customization helps enhance brand identity and ensures all necessary information is captured.

Get more for It 2105 9

- Glen j tdi texas form

- Fillable online tax ny it 255 new york state department of form

- Small business contract template form

- Small business consult contract template form

- Small business employee contract template form

- Small business investment contract template form

- Small business loan contract template form

- Small business investor contract template form

Find out other It 2105 9

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free