Fillable Online Tax Ny it 255 New York State Department of 2023-2026

Understanding the New York IT-255 Form

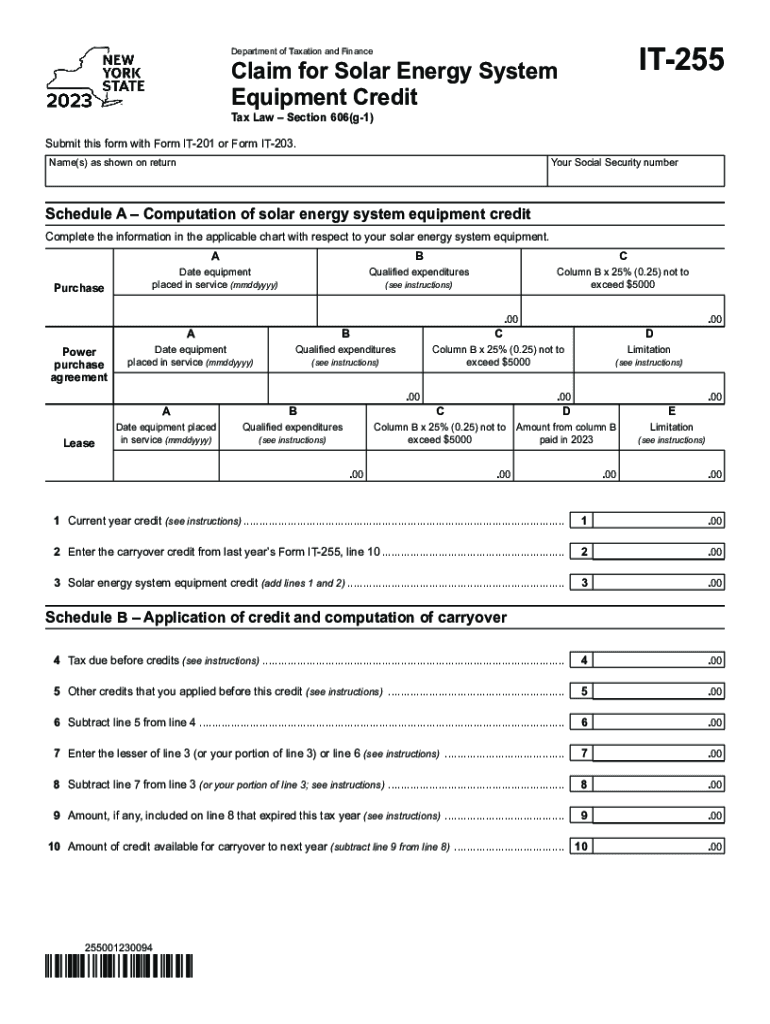

The New York IT-255 form is essential for taxpayers who have invested in a solar energy system. This form allows individuals to claim a tax credit for the purchase and installation of solar energy equipment. The solar credit can significantly reduce your state tax liability, making it a valuable resource for those looking to harness renewable energy. Familiarizing yourself with the IT-255 form is crucial for maximizing your potential savings on your tax return.

Steps to Complete the New York IT-255 Form

Completing the IT-255 form involves several key steps:

- Gather all required documents, including receipts for solar energy equipment and installation.

- Fill out the form accurately, ensuring that all personal information and financial details are correct.

- Calculate the total cost of your solar energy system and any applicable credits.

- Review the form for any errors before submission.

Following these steps can help ensure a smooth filing process and maximize your solar credit claim.

Eligibility Criteria for the IT-255 Solar Credit

To qualify for the solar credit using the IT-255 form, you must meet specific eligibility criteria:

- You must be a resident of New York State.

- The solar energy system must be installed on your primary residence or a property you own.

- The system must be certified and meet state regulations for solar energy equipment.

Confirming your eligibility before applying can help streamline the process and ensure you receive the appropriate credit.

Required Documents for Filing the IT-255 Form

When filing the IT-255 form, you will need to provide several key documents:

- Receipts or invoices for the purchase of solar energy equipment.

- Proof of installation, such as contracts or service agreements.

- Any additional documentation required by the New York State Department of Taxation and Finance.

Having these documents ready will facilitate a smoother filing experience and support your claims for the solar credit.

Form Submission Methods for the IT-255

The IT-255 form can be submitted in various ways to accommodate different preferences:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person submission at designated tax offices, if available.

Choosing the method that best suits your needs can help ensure timely processing of your tax credit claim.

IRS Guidelines Related to Solar Energy Credits

While the IT-255 form pertains to New York State, it's essential to be aware of IRS guidelines regarding solar energy credits. The federal government also offers tax incentives for solar energy systems, which may complement your state credit. Understanding the interplay between state and federal credits can enhance your overall savings and encourage investment in renewable energy.

Filing Deadlines for the IT-255 Form

Staying aware of filing deadlines is crucial to ensure you do not miss out on potential credits. The IT-255 form must be submitted by the same deadline as your state tax return. Typically, this is April fifteenth for most taxpayers. However, if you require an extension for your state tax return, ensure that you also extend your IT-255 submission accordingly.

Quick guide on how to complete fillable online tax ny it 255 new york state department of

Complete Fillable Online Tax Ny IT 255 New York State Department Of effortlessly on any gadget

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle Fillable Online Tax Ny IT 255 New York State Department Of on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Fillable Online Tax Ny IT 255 New York State Department Of without hassle

- Find Fillable Online Tax Ny IT 255 New York State Department Of and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

No more missing or lost documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your requirements in document management with just a few clicks from any device you choose. Modify and eSign Fillable Online Tax Ny IT 255 New York State Department Of and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online tax ny it 255 new york state department of

Create this form in 5 minutes!

How to create an eSignature for the fillable online tax ny it 255 new york state department of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a solar energy system and how does it work?

A solar energy system is a technology that captures sunlight and converts it into electricity or heat. This system typically includes solar panels, inverters, and other components that work together to harness solar energy efficiently. By using a solar energy system, you can generate your own clean energy, reduce utility bills, and contribute to a more sustainable environment.

-

What are the benefits of installing a solar energy system?

Installing a solar energy system offers numerous benefits, including signNow savings on electricity bills and increased energy independence. It also raises the value of your property and reduces your carbon footprint. Additionally, many governments provide incentives and tax credits for solar energy system installations, making it a financially smart choice.

-

How much does a solar energy system cost?

The cost of a solar energy system can vary widely based on size, location, and technology used. On average, residential systems can range from $15,000 to $30,000 before incentives. However, with federal tax credits and local rebates, the net cost can be signNowly lower, making solar energy more accessible to homeowners.

-

What features should I look for in a solar energy system?

When choosing a solar energy system, consider features like efficiency ratings, warranty duration, and the type of solar panels. Additionally, look for options that offer monitoring capabilities, which allow you to track energy production. Systems that integrate seamlessly with battery storage solutions will also provide added benefits for energy savings.

-

Can a solar energy system be integrated with my existing infrastructure?

Yes, a solar energy system can be easily integrated with most existing home and business infrastructures. With the right design, it can work in conjunction with your current energy setup. Most modern solar panels are adaptable and can be retrofitted to fit onto your roof or property without major modifications.

-

What are the maintenance requirements for a solar energy system?

Solar energy systems generally require minimal maintenance, making them a convenient energy solution. Regular cleaning of the panels and occasional inspections are usually sufficient to ensure optimal performance. With no moving parts, most solar energy systems can last 25 years or more with little upkeep.

-

How does a solar energy system perform in different weather conditions?

A solar energy system can generate electricity even in cloudy or rainy weather, though efficiency may be reduced compared to sunny conditions. Modern solar panels are designed to capture diffuse sunlight. Therefore, you can still benefit from a solar energy system year-round, regardless of typical weather patterns.

Get more for Fillable Online Tax Ny IT 255 New York State Department Of

- Cuny employee tuition waiver form

- Alg ii weiterbewilligungsantrag antrag auf weiterbewilligung der leistungen zur sicherung des lebensunterhalts nach dem zweiten 521834731 form

- Ssa 3379 bk function report child age 12 to 18th birthday form

- Www sunderland gov ukmedia20619housing application form sunderland city council

- Enrolment form heretaunga college heretaunga school

- Pnb omnibus form appdownloadv4editedtrial 7

- Hdfcergo kyc form

- The green pages stokes seeds ltd garden org form

Find out other Fillable Online Tax Ny IT 255 New York State Department Of

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy