Form W 9 Rev October OAEP

What is the Form W-9 Rev October OAEP

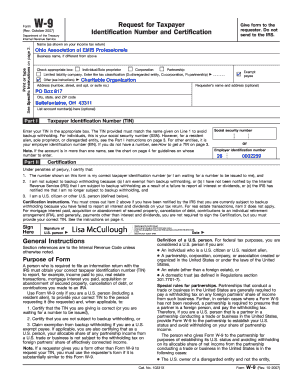

The Form W-9 Rev October OAEP is an official document used in the United States for tax purposes. It is primarily utilized by individuals and businesses to provide their taxpayer identification information to other parties. This form is essential for reporting income and ensuring compliance with the Internal Revenue Service (IRS) regulations. The information collected on this form is used by the requester to prepare various tax documents, including Form 1099, which reports income paid to independent contractors and freelancers.

How to use the Form W-9 Rev October OAEP

The Form W-9 Rev October OAEP is straightforward to use. It requires the individual or business to fill in their name, business name (if applicable), address, and taxpayer identification number (TIN). Once completed, the form should be submitted to the requester, not the IRS. The requester uses the information provided to report payments made to the individual or business. It is important to ensure that the information is accurate to avoid any potential issues with tax reporting.

Steps to complete the Form W-9 Rev October OAEP

Completing the Form W-9 Rev October OAEP involves several key steps:

- Download the form from the IRS website or obtain a copy from the requester.

- Enter your name as it appears on your tax return.

- If applicable, fill in your business name.

- Provide your address, ensuring it matches the address on your tax return.

- Input your taxpayer identification number, which can be your Social Security number or Employer Identification Number (EIN).

- Sign and date the form to certify that the information is accurate.

Legal use of the Form W-9 Rev October OAEP

The Form W-9 Rev October OAEP is legally required when a business or individual needs to report payments made to another entity. It is important for compliance with IRS regulations. Failure to provide a completed W-9 when requested can lead to backup withholding, where the payer must withhold a percentage of the payment for tax purposes. Therefore, it is crucial to respond to requests for this form promptly and accurately.

Key elements of the Form W-9 Rev October OAEP

Key elements of the Form W-9 Rev October OAEP include:

- Name: The legal name of the individual or business.

- Business Name: If applicable, the name under which the business operates.

- Address: The complete mailing address.

- Taxpayer Identification Number (TIN): Either the Social Security number or Employer Identification Number.

- Certification: A signature certifying that the information provided is accurate.

Filing Deadlines / Important Dates

While the Form W-9 Rev October OAEP itself does not have a specific filing deadline, it is important to submit it promptly when requested. The requester typically needs the W-9 to prepare other tax forms, such as the 1099, which do have filing deadlines. For example, Form 1099 must be filed with the IRS by January thirty-first of the following year for payments made in the previous year. Timely submission of the W-9 helps ensure that all tax reporting is accurate and on schedule.

Quick guide on how to complete form w 9 rev october oaep

Complete [SKS] effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, as you can obtain the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important parts of your documents or conceal sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and has the same legal validity as a traditional ink signature.

- Review all information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and eSign [SKS] and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form W 9 Rev October OAEP

Create this form in 5 minutes!

How to create an eSignature for the form w 9 rev october oaep

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form W 9 Rev October OAEP?

The Form W 9 Rev October OAEP is a tax form used by individuals and businesses to provide their taxpayer identification information to others. This form is essential for reporting income and ensuring compliance with IRS regulations. By using airSlate SignNow, you can easily fill out and eSign the Form W 9 Rev October OAEP securely.

-

How can airSlate SignNow help with the Form W 9 Rev October OAEP?

airSlate SignNow simplifies the process of completing and signing the Form W 9 Rev October OAEP. Our platform allows users to fill out the form electronically, ensuring accuracy and saving time. Additionally, you can send the completed form directly to recipients without any hassle.

-

Is there a cost associated with using airSlate SignNow for the Form W 9 Rev October OAEP?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective while providing all the necessary features for managing documents like the Form W 9 Rev October OAEP. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Form W 9 Rev October OAEP?

airSlate SignNow provides a range of features for managing the Form W 9 Rev October OAEP, including customizable templates, secure eSigning, and document tracking. These features enhance the efficiency of your document workflow and ensure that you can manage your forms seamlessly.

-

Can I integrate airSlate SignNow with other applications for the Form W 9 Rev October OAEP?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the Form W 9 Rev October OAEP. Whether you use CRM systems or cloud storage solutions, our platform can connect with them to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the Form W 9 Rev October OAEP?

Using airSlate SignNow for the Form W 9 Rev October OAEP provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are stored securely and can be accessed anytime, making it easier to manage your tax forms.

-

Is airSlate SignNow compliant with regulations for the Form W 9 Rev October OAEP?

Yes, airSlate SignNow is designed to comply with all relevant regulations for handling documents like the Form W 9 Rev October OAEP. We prioritize data security and compliance, ensuring that your information is protected while you complete and eSign your forms.

Get more for Form W 9 Rev October OAEP

- Hipaa reference for medical office form

- Dock warrant form

- Piq form ssbguru com

- Ndis worker screening check manual application form pdf

- Mri order form 248557035

- Daughters of the republic of texas application form

- Tsunamis know what to do 1st 2nd grade ready san diego readysandiego form

- Us rx care prior authorization form

Find out other Form W 9 Rev October OAEP

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure