Ct 5 1 Form

What is the CT-5.1 Form?

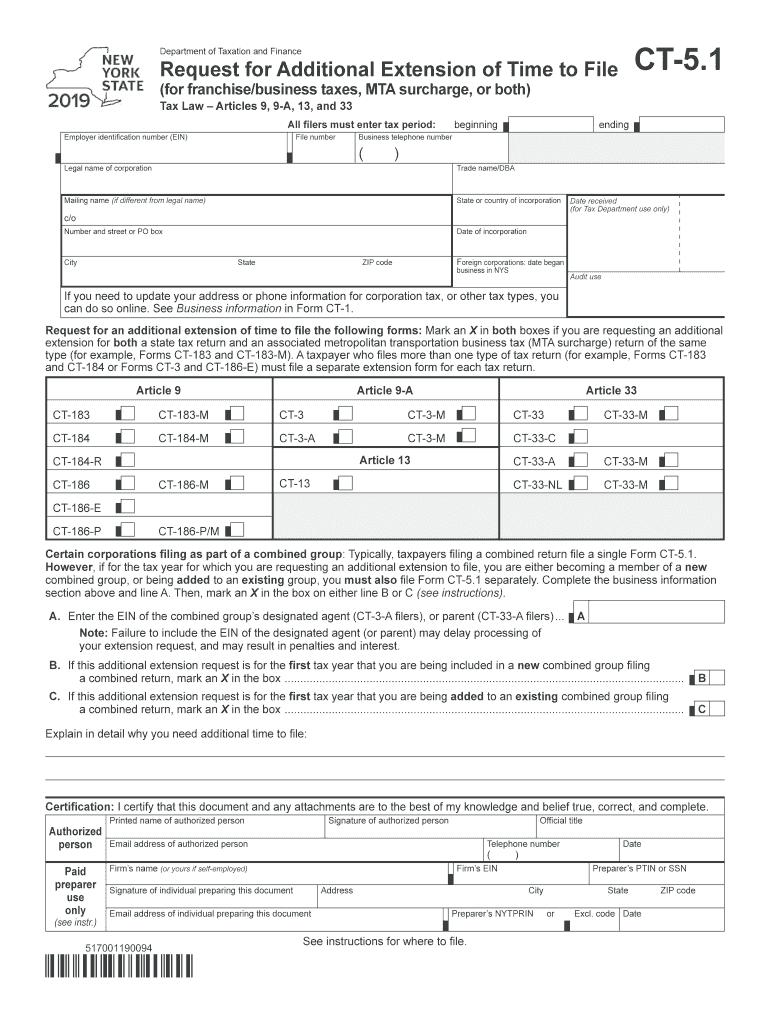

The CT-5.1 form, also known as the CT Form Extension, is a document used by businesses in New York to request an extension for filing their corporate tax returns. This form allows taxpayers additional time to prepare and submit their returns without incurring penalties. The CT-5.1 form is essential for maintaining compliance with New York State tax regulations, ensuring that businesses can manage their tax obligations effectively while avoiding unnecessary stress.

How to Use the CT-5.1 Form

To use the CT-5.1 form effectively, businesses must complete it accurately and submit it within the designated timeframe. The form requires basic information about the business, including the entity's name, address, and Employer Identification Number (EIN). Additionally, taxpayers must indicate the type of extension they are requesting and provide any relevant financial information. Once completed, the form can be submitted online or via mail to the appropriate tax authority.

Steps to Complete the CT-5.1 Form

Completing the CT-5.1 form involves several key steps:

- Gather necessary information, including your business name, address, and EIN.

- Indicate the type of extension you are requesting on the form.

- Provide any required financial details, such as estimated tax liability.

- Review the form for accuracy to avoid delays or rejections.

- Submit the completed form through your preferred method, either online or by mail.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the CT-5.1 form. Generally, the form must be submitted by the original due date of the corporate tax return to qualify for an extension. For most corporations, this deadline falls on the 15th day of the third month following the end of the tax year. Missing this deadline may result in penalties and interest on unpaid taxes.

Form Submission Methods

The CT-5.1 form can be submitted through various methods, providing flexibility for taxpayers:

- Online Submission: Many businesses prefer to file electronically through the New York State Department of Taxation and Finance website.

- Mail: Taxpayers can also print the completed form and send it to the appropriate address listed on the form.

- In-Person: Some may choose to submit the form in person at local tax offices, although this option may be less common.

Legal Use of the CT-5.1 Form

The CT-5.1 form is legally recognized as a valid request for an extension of time to file corporate tax returns in New York. When completed and submitted correctly, it protects businesses from penalties associated with late filings. It is important for taxpayers to understand that the extension granted does not extend the time to pay any taxes due; it only allows additional time to file the return.

Quick guide on how to complete form ct 512019request for additional extension of time to file for franchisebusiness taxes mta surcharge or bothct51

Complete Ct 5 1 Form effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Ct 5 1 Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Ct 5 1 Form with ease

- Locate Ct 5 1 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight relevant sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your requirements in document management in just a few clicks from any device you choose. Modify and electronically sign Ct 5 1 Form and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 512019request for additional extension of time to file for franchisebusiness taxes mta surcharge or bothct51

How to generate an eSignature for your Form Ct 512019request For Additional Extension Of Time To File For Franchisebusiness Taxes Mta Surcharge Or Bothct51 online

How to make an electronic signature for your Form Ct 512019request For Additional Extension Of Time To File For Franchisebusiness Taxes Mta Surcharge Or Bothct51 in Chrome

How to make an eSignature for signing the Form Ct 512019request For Additional Extension Of Time To File For Franchisebusiness Taxes Mta Surcharge Or Bothct51 in Gmail

How to make an eSignature for the Form Ct 512019request For Additional Extension Of Time To File For Franchisebusiness Taxes Mta Surcharge Or Bothct51 straight from your smartphone

How to create an eSignature for the Form Ct 512019request For Additional Extension Of Time To File For Franchisebusiness Taxes Mta Surcharge Or Bothct51 on iOS devices

How to generate an eSignature for the Form Ct 512019request For Additional Extension Of Time To File For Franchisebusiness Taxes Mta Surcharge Or Bothct51 on Android OS

People also ask

-

What is a CT form extension and how does it work with airSlate SignNow?

The CT form extension is a feature that allows users to easily manage and sign Connecticut-specific forms. With airSlate SignNow, you can create, share, and eSign these forms seamlessly, ensuring compliance with state regulations and enhancing productivity.

-

How much does the CT form extension feature cost with airSlate SignNow?

The CT form extension is included in various pricing plans offered by airSlate SignNow. Depending on your subscription level, you can access this feature at a competitive rate, making it a cost-effective solution for businesses of all sizes.

-

What are the main benefits of using the CT form extension?

Using the CT form extension streamlines your document management process, saving time and reducing errors. It simplifies the eSignature workflow for Connecticut forms, allowing for quick approvals that help your business operate more efficiently.

-

Can I integrate the CT form extension with other applications?

Yes, airSlate SignNow offers robust integrations with various applications such as Google Drive, Dropbox, and CRMs. This means you can use the CT form extension seamlessly alongside your existing tools, enhancing overall functionality and productivity.

-

Is the CT form extension compatible with mobile devices?

Absolutely! The CT form extension and airSlate SignNow platform are mobile-friendly, allowing you to manage and eSign documents from your smartphone or tablet. This flexibility ensures that you can stay productive on the go.

-

How secure is my data when using the CT form extension?

airSlate SignNow prioritizes security and employs advanced encryption protocols to protect your data. Using the CT form extension, you can confidently eSign documents, knowing that your information remains safe and secure throughout the process.

-

Can the CT form extension automate any workflows?

Yes, the CT form extension can be incorporated into automated workflows. With airSlate SignNow's automation features, you can streamline document routing and eSigatures for Connecticut forms, ensuring a faster and more efficient process.

Get more for Ct 5 1 Form

- Form 4 notice from tenant to landlord withholding rent

- Pdf download of ventures grade 6 new curriculum textbooks in zimbabwe form

- Matlosana gardens online application form

- Route 33 crossfit liability waiver form

- Sew seamstress contract template form

- Shared ownership contract template form

- Shared savs contract template form

- Shareholders contract template form

Find out other Ct 5 1 Form

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement