Ct 6 1 Editable Form

What is the CT 6 1 Editable?

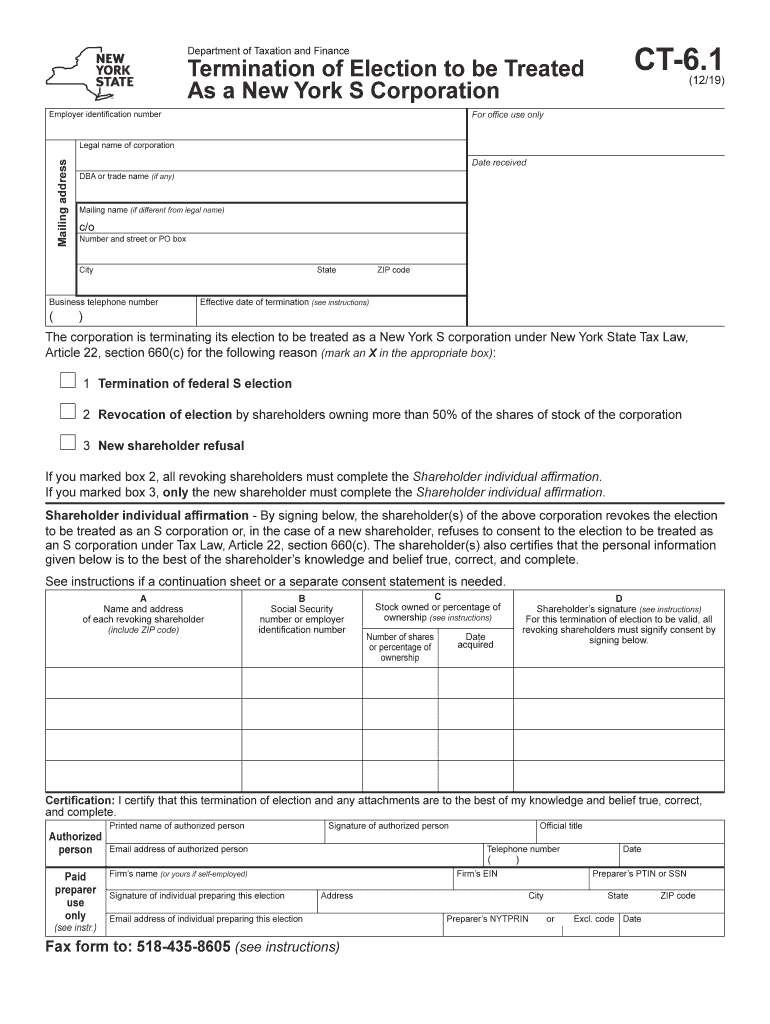

The CT 6 1 Editable is a form used in New York for S corporations to make a termination election. This form allows businesses to formally notify the state of their decision to terminate their S corporation status. The editable version of the form provides flexibility for users to fill it out digitally, ensuring accuracy and ease of submission. It is essential for businesses to understand the implications of this form, as it affects their tax status and obligations moving forward.

Steps to Complete the CT 6 1 Editable

Completing the CT 6 1 Editable involves several key steps to ensure compliance with New York state regulations. First, gather necessary information about the corporation, including its legal name, address, and federal employer identification number (EIN). Next, accurately fill out each section of the form, providing details about the termination election. It is crucial to double-check all entries for accuracy before proceeding. Once completed, the form must be signed by an authorized officer of the corporation to validate the submission.

Legal Use of the CT 6 1 Editable

The CT 6 1 Editable serves a significant legal purpose in the context of business taxation in New York. By submitting this form, a corporation officially communicates its decision to terminate its S corporation status, which can have substantial tax implications. It is vital for businesses to comply with the legal requirements surrounding this form to avoid potential penalties or issues with the state tax authority. Understanding the legal framework governing this form ensures that businesses remain compliant throughout the termination process.

Filing Deadlines / Important Dates

Timely submission of the CT 6 1 Editable is critical to ensure that the termination election is effective. Businesses must be aware of specific deadlines associated with this form to avoid complications. Generally, the form should be filed within a certain period following the decision to terminate the S corporation status. It is advisable to consult the New York State Department of Taxation and Finance for the most current deadlines and any updates that may affect filing requirements.

Required Documents

When completing the CT 6 1 Editable, certain documents may be required to support the termination election. This may include the corporation's articles of incorporation, previous tax returns, and any relevant resolutions from the board of directors. Having these documents ready can facilitate a smoother filing process and ensure that all necessary information is provided to the state. It is essential to review the specific requirements outlined by the New York State Department of Taxation and Finance to ensure compliance.

Form Submission Methods

The CT 6 1 Editable can be submitted through various methods, providing flexibility for businesses. Options typically include online submission through the New York State Department of Taxation and Finance website, mailing a printed version of the form, or delivering it in person to the appropriate office. Each method has its own set of guidelines and processing times, so it is important for businesses to choose the method that best suits their needs and timelines.

Who Issues the Form

The CT 6 1 Editable is issued by the New York State Department of Taxation and Finance. This agency oversees the administration of tax laws in New York, including those related to business entities. Understanding the role of this department is essential for businesses as they navigate the process of terminating their S corporation status. The department provides resources and guidance to assist corporations in completing and submitting the form correctly.

Quick guide on how to complete form ct 611219termination of election to be treated as a new york s corporationct61

Complete Ct 6 1 Editable effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a perfect environmentally friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle Ct 6 1 Editable on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Ct 6 1 Editable with ease

- Find Ct 6 1 Editable and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Ct 6 1 Editable and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 611219termination of election to be treated as a new york s corporationct61

How to generate an eSignature for the Form Ct 611219termination Of Election To Be Treated As A New York S Corporationct61 online

How to create an electronic signature for the Form Ct 611219termination Of Election To Be Treated As A New York S Corporationct61 in Chrome

How to make an electronic signature for signing the Form Ct 611219termination Of Election To Be Treated As A New York S Corporationct61 in Gmail

How to generate an electronic signature for the Form Ct 611219termination Of Election To Be Treated As A New York S Corporationct61 straight from your smartphone

How to generate an electronic signature for the Form Ct 611219termination Of Election To Be Treated As A New York S Corporationct61 on iOS devices

How to make an eSignature for the Form Ct 611219termination Of Election To Be Treated As A New York S Corporationct61 on Android OS

People also ask

-

What is the purpose of form ct 6?

Form CT 6 is used for the Connecticut Business Entity Tax. It serves to report the tax for corporations, limited liability companies, and other business entities operating in Connecticut. Understanding how to properly complete form ct 6 is essential for compliance and avoiding penalties.

-

How can airSlate SignNow help with completing form ct 6?

airSlate SignNow simplifies the process of completing form ct 6 by enabling users to easily fill out and eSign documents. With our user-friendly platform, you can ensure that your form ct 6 is completed accurately and efficiently, streamlining your tax reporting process.

-

Is airSlate SignNow cost-effective for submitting form ct 6?

Yes, airSlate SignNow is a cost-effective solution for submitting form ct 6. Our pricing plans are designed to accommodate businesses of all sizes, ensuring that you can manage your documents without breaking the bank while meeting your compliance needs.

-

What features does airSlate SignNow offer for form ct 6 preparation?

airSlate SignNow provides various features for preparing form ct 6, including customizable templates, cloud storage, and automated reminders. These tools enhance your productivity, enabling you to focus on your business while ensuring your documentation is precise and on time.

-

Can I integrate airSlate SignNow with other applications for form ct 6?

Absolutely! airSlate SignNow integrates seamlessly with many popular applications, enhancing your workflow for form ct 6. Whether it's accounting software or CRM tools, our integration capabilities help you manage your processes efficiently and keep your data synchronized.

-

What are the benefits of using airSlate SignNow for form ct 6 submissions?

Using airSlate SignNow for form ct 6 submissions offers benefits like increased efficiency and reduced errors. Our platform allows for easy collaboration, ensuring all stakeholders can review and approve the document before submission, which minimizes the risk of mistakes.

-

How secure is my information when using airSlate SignNow for form ct 6?

Security is a top priority at airSlate SignNow. When using our platform for form ct 6, your sensitive information is protected with industry-standard encryption and compliance with data protection regulations, ensuring that your documents remain confidential and secure.

Get more for Ct 6 1 Editable

- Form it 612 claim for remediated brownfield credit for

- Grade 4 test papers mauritius pdf download form

- Fillable ptax 343 a physicians statement for the homestead exemption for form

- Small construction project contract maine form

- Service service contract template form

- Servicenow create a for the form contract template

- Session musician contract template form

- Sessional worker contract template form

Find out other Ct 6 1 Editable

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile