Fillable PTAX 343 a Physician's Statement for the Homestead Exemption for Form

What is the PTAX 343 A Physician's Statement for the Homestead Exemption?

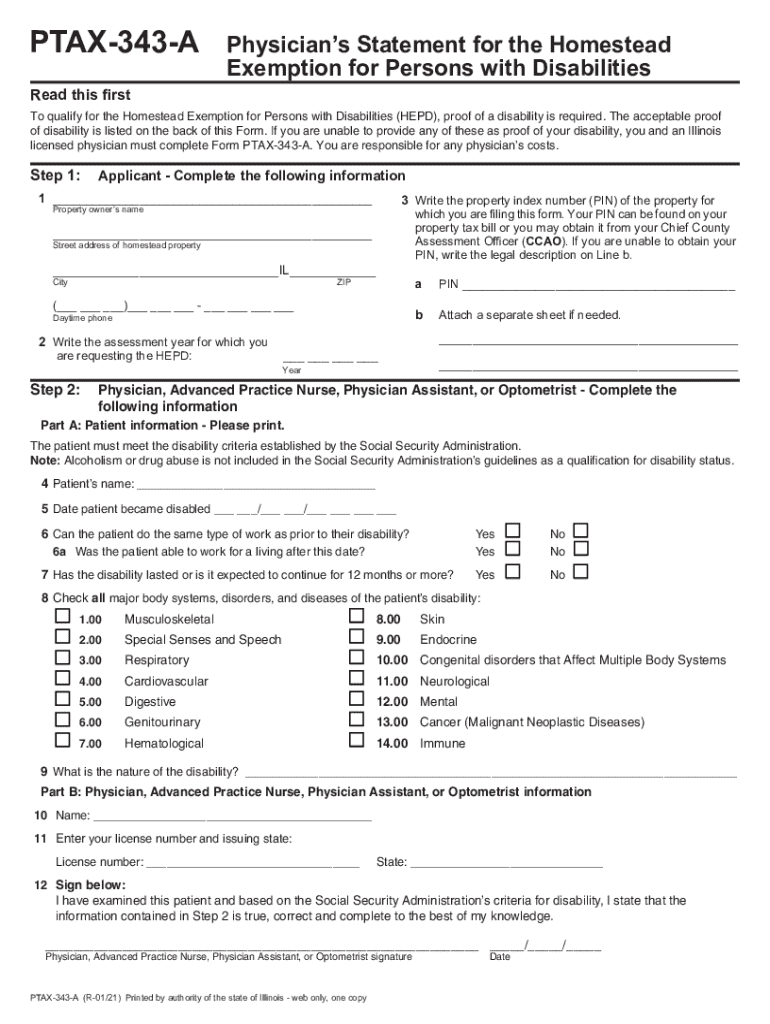

The PTAX 343 A form is a critical document used in Illinois to apply for a homestead exemption based on a physician's statement. This exemption is designed to provide tax relief to individuals with disabilities or certain medical conditions that limit their ability to work. The form requires specific information from a licensed physician to confirm the applicant's eligibility for the exemption. By completing this form, homeowners can potentially reduce their property tax burden, making homeownership more affordable for those facing health challenges.

Key Elements of the PTAX 343 A Physician's Statement

The PTAX 343 A form includes several essential components that must be accurately filled out to ensure the application is processed smoothly. Key elements include:

- Applicant Information: Personal details of the homeowner, including name, address, and property identification number.

- Physician's Information: Details about the physician providing the statement, including their name, contact information, and medical license number.

- Medical Condition Description: A section where the physician must describe the medical condition that qualifies the applicant for the exemption.

- Certification: A declaration by the physician affirming the accuracy of the information provided and the applicant's eligibility for the exemption.

Steps to Complete the PTAX 343 A Physician's Statement

Filling out the PTAX 343 A form involves several straightforward steps:

- Obtain the Form: Download the PTAX 343 A form from the appropriate Illinois state website or request a physical copy from your local assessor's office.

- Fill Out Applicant Information: Provide all required personal details accurately to avoid delays in processing.

- Consult Your Physician: Schedule an appointment with a licensed physician to discuss your condition and obtain their statement.

- Complete the Physician's Section: Ensure your physician fills out their information and certifies your eligibility on the form.

- Review for Accuracy: Double-check all entries for completeness and correctness before submission.

- Submit the Form: Send the completed form to your local assessor's office by the specified deadline.

Eligibility Criteria for the PTAX 343 A Physician's Statement

To qualify for the homestead exemption using the PTAX 343 A form, applicants must meet specific eligibility criteria. These typically include:

- The applicant must be the owner of the property for which the exemption is sought.

- The property must be the applicant's primary residence.

- The applicant must have a documented medical condition that impairs their ability to work, as certified by a licensed physician.

- The application must be submitted within the designated filing period set by the local assessor's office.

Form Submission Methods for the PTAX 343 A

Once the PTAX 343 A form is completed, it can be submitted through various methods, depending on local regulations:

- By Mail: Send the completed form to the local assessor's office via postal service.

- In-Person: Deliver the form directly to the local assessor's office during business hours.

- Online Submission: Some counties may offer an online portal for submitting the form electronically. Check with your local office for availability.

Filing Deadlines for the PTAX 343 A Form

It is essential to be aware of the filing deadlines for the PTAX 343 A form to ensure timely processing. Typically, the deadline to submit the form aligns with the property tax assessment cycle, which may vary by county. Applicants should confirm the specific deadline with their local assessor's office to avoid missing the opportunity for the exemption.

Quick guide on how to complete fillable ptax 343 a physicians statement for the homestead exemption for

Prepare Fillable PTAX 343 A Physician's Statement For The Homestead Exemption For with ease on any device

Online document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Fillable PTAX 343 A Physician's Statement For The Homestead Exemption For on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to change and eSign Fillable PTAX 343 A Physician's Statement For The Homestead Exemption For effortlessly

- Find Fillable PTAX 343 A Physician's Statement For The Homestead Exemption For and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Mark pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to secure your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, difficult form searching, or mistakes that require printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you prefer. Alter and eSign Fillable PTAX 343 A Physician's Statement For The Homestead Exemption For and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable ptax 343 a physicians statement for the homestead exemption for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois PTAX 343 A form?

The Illinois PTAX 343 A form is a property tax exemption application used in Illinois. It allows property owners to apply for various exemptions that can reduce their property tax burden. Understanding this form is crucial for homeowners looking to maximize their tax benefits.

-

How can airSlate SignNow help with the Illinois PTAX 343 A form?

airSlate SignNow simplifies the process of completing and submitting the Illinois PTAX 343 A form. With our eSignature capabilities, you can easily sign and send the form electronically, ensuring a faster and more efficient submission process. This helps you avoid delays and potential issues with your application.

-

Is there a cost associated with using airSlate SignNow for the Illinois PTAX 343 A form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solution ensures that you can manage your documents, including the Illinois PTAX 343 A form, without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Illinois PTAX 343 A form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are essential for managing the Illinois PTAX 343 A form. These tools streamline the process, making it easier to fill out and submit your application accurately and on time.

-

Can I integrate airSlate SignNow with other software for the Illinois PTAX 343 A form?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow when dealing with the Illinois PTAX 343 A form. This allows you to connect with tools you already use, making document management seamless and efficient.

-

What are the benefits of using airSlate SignNow for the Illinois PTAX 343 A form?

Using airSlate SignNow for the Illinois PTAX 343 A form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled securely while allowing you to focus on other important tasks.

-

How secure is airSlate SignNow when handling the Illinois PTAX 343 A form?

Security is a top priority at airSlate SignNow. When handling the Illinois PTAX 343 A form, we utilize advanced encryption and security protocols to protect your sensitive information. You can trust that your documents are safe and secure throughout the signing process.

Get more for Fillable PTAX 343 A Physician's Statement For The Homestead Exemption For

Find out other Fillable PTAX 343 A Physician's Statement For The Homestead Exemption For

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed