Nys Dtf Ct Tax Payment Form

What is the Nys Dtf Ct Tax Payment

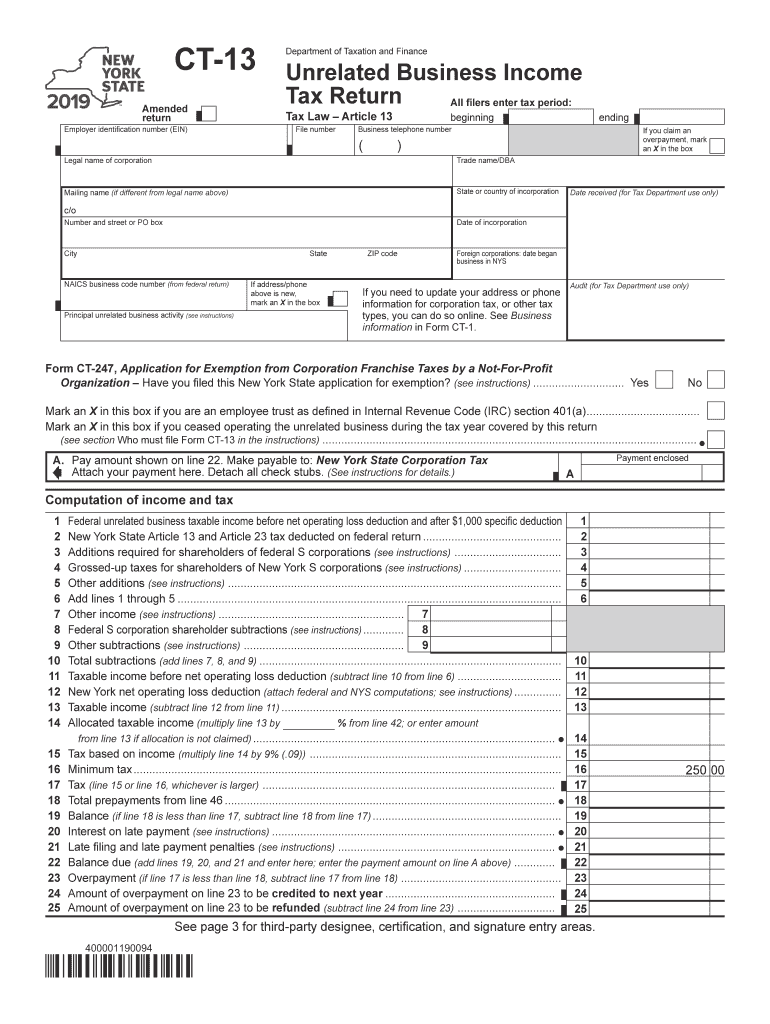

The Nys Dtf Ct Tax Payment refers to the New York State Department of Taxation and Finance's tax payment system for individuals and businesses. This payment is essential for fulfilling state tax obligations, including personal income tax and corporate taxes. Understanding this payment process is crucial for compliance and avoiding penalties. The Nys Dtf Ct Tax Payment ensures that taxpayers can settle their dues promptly and accurately, contributing to the state's revenue.

Steps to Complete the Nys Dtf Ct Tax Payment

Completing the Nys Dtf Ct Tax Payment involves several key steps to ensure accuracy and compliance:

- Gather necessary documentation, including income statements and previous tax returns.

- Access the New York State Department of Taxation and Finance website or use authorized software.

- Fill out the required forms accurately, ensuring all information is correct.

- Select a payment method, such as electronic funds transfer or credit card payment.

- Review the completed form for errors before submission.

- Submit the form electronically or via mail, depending on your chosen method.

Legal Use of the Nys Dtf Ct Tax Payment

The legal use of the Nys Dtf Ct Tax Payment is governed by state tax laws and regulations. This payment must be made in compliance with the New York State Tax Code to avoid legal repercussions. Proper documentation and timely payments are essential to maintain compliance. Failure to adhere to these regulations can result in penalties, interest charges, and potential legal action.

Required Documents

To successfully complete the Nys Dtf Ct Tax Payment, specific documents are required. These may include:

- W-2 forms for employees, detailing annual income.

- 1099 forms for independent contractors and other income sources.

- Previous year’s tax returns for reference and consistency.

- Any relevant deductions or credits documentation.

Having these documents ready can streamline the payment process and ensure accuracy.

Form Submission Methods

The Nys Dtf Ct Tax Payment can be submitted through various methods, allowing flexibility for taxpayers. The available submission methods include:

- Online submission via the New York State Department of Taxation and Finance website.

- Mailing a physical form to the designated tax office address.

- In-person submission at local tax offices, if preferred.

Choosing the right submission method can enhance convenience and ensure timely processing.

Filing Deadlines / Important Dates

Deadlines for the Nys Dtf Ct Tax Payment are critical for avoiding penalties. Typically, the primary filing deadline aligns with the federal tax deadline, which is April fifteenth for individuals. Businesses may have different deadlines based on their fiscal year. It is essential to stay informed about any changes to these dates to ensure compliance.

Quick guide on how to complete form ct 132019unrelated business income tax returnct13

Complete Nys Dtf Ct Tax Payment effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal sustainable alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Nys Dtf Ct Tax Payment on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Nys Dtf Ct Tax Payment seamlessly

- Obtain Nys Dtf Ct Tax Payment and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Nys Dtf Ct Tax Payment and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 132019unrelated business income tax returnct13

How to make an eSignature for your Form Ct 132019unrelated Business Income Tax Returnct13 in the online mode

How to create an eSignature for your Form Ct 132019unrelated Business Income Tax Returnct13 in Google Chrome

How to generate an electronic signature for putting it on the Form Ct 132019unrelated Business Income Tax Returnct13 in Gmail

How to generate an electronic signature for the Form Ct 132019unrelated Business Income Tax Returnct13 straight from your mobile device

How to create an eSignature for the Form Ct 132019unrelated Business Income Tax Returnct13 on iOS devices

How to make an eSignature for the Form Ct 132019unrelated Business Income Tax Returnct13 on Android OS

People also ask

-

What is the nys dtf pit?

The nys dtf pit refers to the New York State Department of Taxation and Finance PIT (Personal Income Tax) program. It is designed to streamline the process of filing personal income taxes in New York. Utilizing airSlate SignNow can enhance your experience with the nys dtf pit by allowing you to easily sign and send documents digitally.

-

How can airSlate SignNow help with the nys dtf pit?

airSlate SignNow offers a user-friendly platform that simplifies eSigning documents required for the nys dtf pit. With our digital solution, you can quickly sign forms, approve documents, and ensure compliance with New York tax regulations without the hassle of printing or mailing.

-

What are the pricing options for airSlate SignNow when dealing with the nys dtf pit?

airSlate SignNow provides various pricing plans tailored for businesses that utilize the nys dtf pit. Our packages are designed to fit different organizational needs and budgets, ensuring you get the tools necessary to handle personal income tax documentation efficiently.

-

Does airSlate SignNow integrate with other systems for the nys dtf pit?

Yes, airSlate SignNow offers integrations with numerous platforms that are useful when managing the nys dtf pit. This ensures that you can seamlessly connect with accounting software, CRM systems, and other applications to enhance your document management and eSigning workflow.

-

What benefits does airSlate SignNow provide for businesses using the nys dtf pit?

By using airSlate SignNow for the nys dtf pit, businesses gain the advantage of increased efficiency and reduced turnaround time for document handling. Our solution allows for secure signing and storage of important tax documents, ensuring that businesses stay organized and compliant.

-

Is airSlate SignNow secure for the nys dtf pit documentation?

Absolutely! airSlate SignNow prioritizes security, especially for sensitive documentation related to the nys dtf pit. We use robust encryption protocols and comply with industry standards to protect your data and ensure the integrity of your signed documents.

-

How easy is it to use airSlate SignNow for the nys dtf pit?

airSlate SignNow is designed with ease of use in mind, making it simple for anyone to navigate and utilize when dealing with the nys dtf pit. Our intuitive interface allows users to create, send, and manage documents quickly, enhancing your overall productivity.

Get more for Nys Dtf Ct Tax Payment

- English awareness and skill test class 1 question paper form

- Font detector online form

- Dapl scholarship fund inc application bill dapldenver form

- Construction work construction contract template form

- Service agreement contract template form

- Service addendum contract template form

- Service amendment contract template form

- Service contract template form

Find out other Nys Dtf Ct Tax Payment

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile