Form it 242

What is the Form IT-242

The Form IT-242 is a New York State tax form used for claiming a credit for taxes paid to other jurisdictions. It is specifically designed for individuals who have income from sources outside of New York and are subject to taxation in those jurisdictions. This form allows taxpayers to avoid double taxation on the same income, ensuring that they receive credit for taxes already paid elsewhere.

How to Use the Form IT-242

Using the Form IT-242 involves several steps to ensure accurate completion and submission. Taxpayers must first gather all necessary documentation, including proof of taxes paid to other states. The form requires detailed information about the taxpayer's income, the taxes paid, and the jurisdictions involved. Once completed, the form should be submitted along with the New York State income tax return.

Steps to Complete the Form IT-242

Completing the Form IT-242 requires careful attention to detail. Follow these steps:

- Gather all relevant information regarding income and taxes paid to other jurisdictions.

- Fill out the taxpayer's personal information, including name, address, and Social Security number.

- Provide details about the income earned outside New York and the corresponding taxes paid.

- Calculate the credit amount based on the instructions provided with the form.

- Review the completed form for accuracy before submission.

Legal Use of the Form IT-242

The legal use of Form IT-242 is governed by New York State tax laws. Taxpayers must ensure that they meet the eligibility criteria for claiming a credit and must provide accurate information to avoid penalties. The form is legally binding and must be submitted in compliance with state regulations to ensure its validity.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT-242 align with the general New York State income tax return deadlines. Typically, individual income tax returns are due by April fifteenth. It is essential for taxpayers to be aware of any changes to deadlines or extensions that may apply, especially in light of special circumstances that may arise in a given tax year.

Required Documents

To successfully complete the Form IT-242, taxpayers must provide several key documents, including:

- Proof of income earned in other jurisdictions.

- Documentation of taxes paid to those jurisdictions.

- Previous year’s tax returns, if applicable.

- Any additional forms that may support the claim for the credit.

Form Submission Methods

The Form IT-242 can be submitted through various methods, including:

- Online submission via the New York State Department of Taxation and Finance website.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if necessary.

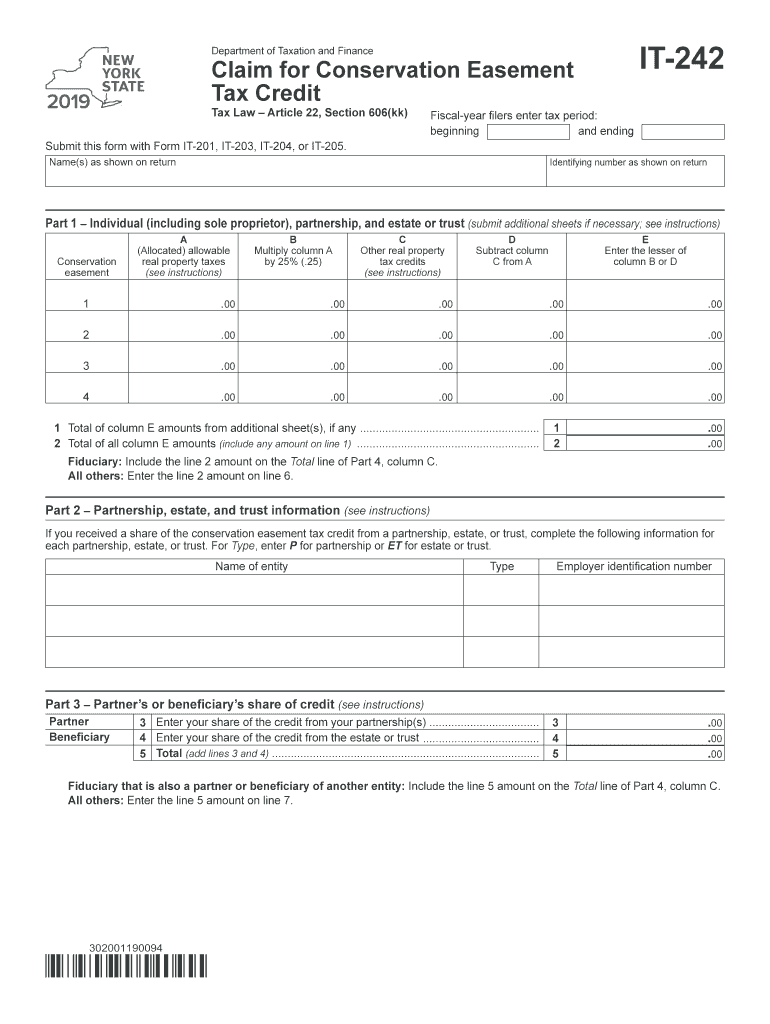

Quick guide on how to complete form it 2422019claim for conservation easement tax creditit242

Effortlessly Prepare Form It 242 on Any Device

Digital document management has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed materials, allowing you to access the correct document and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and without delays. Manage Form It 242 across any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Edit and Electronically Sign Form It 242 with Ease

- Find Form It 242 and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Select pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as an old-fashioned ink signature.

- Review the details and click the Done button to save your modifications.

- Decide how to submit your form, via email, SMS, an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, time-consuming document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and electronically sign Form It 242 to ensure outstanding communication at every step of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 2422019claim for conservation easement tax creditit242

How to make an eSignature for your Form It 2422019claim For Conservation Easement Tax Creditit242 in the online mode

How to make an eSignature for the Form It 2422019claim For Conservation Easement Tax Creditit242 in Google Chrome

How to create an electronic signature for signing the Form It 2422019claim For Conservation Easement Tax Creditit242 in Gmail

How to create an electronic signature for the Form It 2422019claim For Conservation Easement Tax Creditit242 right from your smart phone

How to make an electronic signature for the Form It 2422019claim For Conservation Easement Tax Creditit242 on iOS devices

How to create an electronic signature for the Form It 2422019claim For Conservation Easement Tax Creditit242 on Android devices

People also ask

-

What is the new yorkstyatetax it242 form used for?

The new yorkstyatetax it242 form is used by businesses to report business income and pay taxes to the state of New York. It is essential for ensuring compliance with state tax laws. Filling out this form accurately can help avoid potential penalties.

-

How can airSlate SignNow help with the new yorkstyatetax it242?

airSlate SignNow simplifies the process of completing and signing the new yorkstyatetax it242 form. Our platform allows you to easily fill out, eSign, and store your tax documents securely. This streamlines your tax filing process, saving you valuable time.

-

Is there a cost associated with using airSlate SignNow for the new yorkstyatetax it242?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, which include features for managing documents like the new yorkstyatetax it242. You can choose a plan that fits your budget while taking advantage of our comprehensive eSigning solutions.

-

What features does airSlate SignNow provide for the new yorkstyatetax it242?

airSlate SignNow offers features such as customizable templates, secure eSigning, and seamless document tracking for the new yorkstyatetax it242. These tools enhance efficiency and ensure that your tax documents are processed without hassle.

-

Can I integrate airSlate SignNow with other applications for managing the new yorkstyatetax it242?

Absolutely! airSlate SignNow provides integrations with various applications, allowing you to manage all aspects of the new yorkstyatetax it242 alongside your existing tools. This ensures a smooth workflow and improves overall productivity.

-

What are the benefits of using airSlate SignNow for my business's new yorkstyatetax it242 submission?

Using airSlate SignNow for your new yorkstyatetax it242 submission offers ease of use, security, and compliance with state regulations. Our eSigning solution ensures your documents are legally binding and safe, helping your business maintain its legal standing.

-

How secure is airSlate SignNow when using the new yorkstyatetax it242?

Security is a top priority for airSlate SignNow. When working with sensitive documents like the new yorkstyatetax it242, we implement industry-leading encryption and security measures to protect your data and maintain confidentiality.

Get more for Form It 242

Find out other Form It 242

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online