Nys Form Ct 3

What is the NYS Form CT 3?

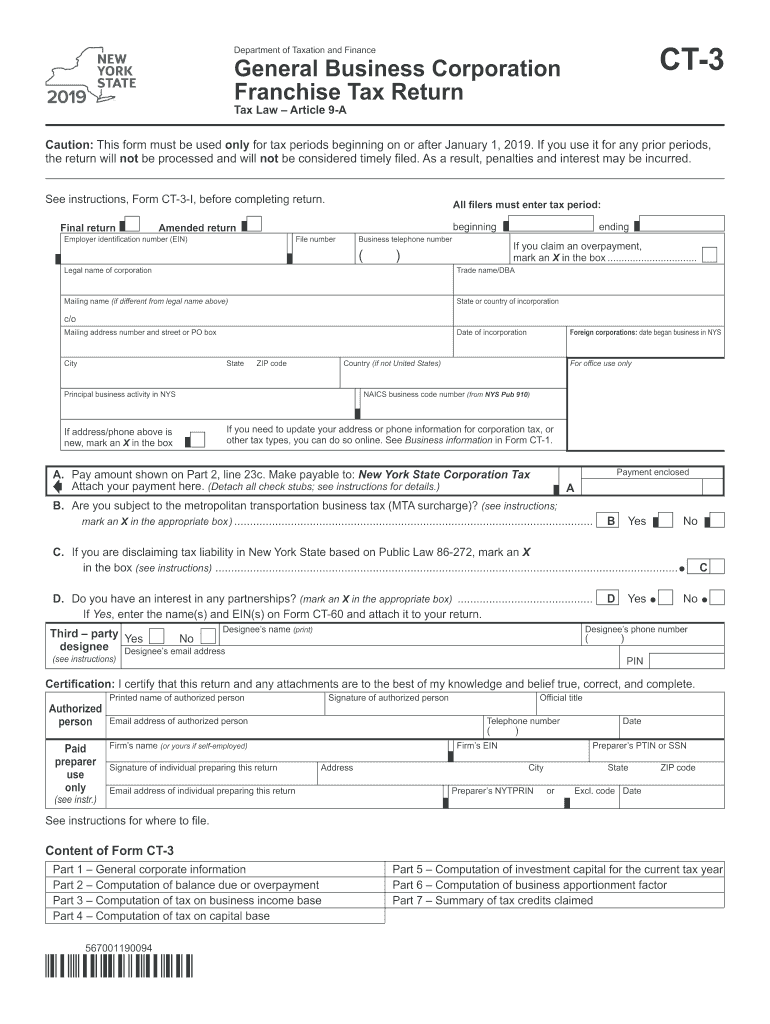

The NYS Form CT 3, officially known as the General Business Corporation Franchise Tax Return, is a tax form used by corporations operating in New York State. This form is essential for reporting income, calculating franchise taxes, and ensuring compliance with state tax regulations. It is specifically designed for corporations that are not classified as S corporations and must be filed annually. The form captures various financial details, including gross income, deductions, and tax credits, which are critical for determining the corporation's tax liability.

Steps to Complete the NYS Form CT 3

Completing the NYS Form CT 3 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, follow these steps:

- Enter the corporation's name, address, and federal employer identification number (EIN) at the top of the form.

- Report total income from all sources, ensuring to include all relevant revenue streams.

- Calculate allowable deductions, such as business expenses and tax credits, to determine taxable income.

- Apply the appropriate tax rate to the taxable income to compute the franchise tax due.

- Review the completed form for accuracy and completeness before submitting.

Legal Use of the NYS Form CT 3

The NYS Form CT 3 is legally binding and must be completed accurately to avoid penalties. Filing this form is a requirement for corporations to maintain good standing with the New York State Department of Taxation and Finance. Accurate reporting ensures compliance with state laws and helps avoid issues such as audits or fines. Additionally, the form must be signed by an authorized corporate officer, affirming the truthfulness of the information provided.

Filing Deadlines / Important Dates

Corporations must be aware of specific deadlines for filing the NYS Form CT 3 to avoid late fees. The form is typically due on the fifteenth day of the fourth month following the end of the corporation's tax year. For most corporations operating on a calendar year, this means the form is due by April 15. It is important to mark this date on your calendar and ensure that all necessary documentation is prepared in advance to facilitate timely filing.

Form Submission Methods

The NYS Form CT 3 can be submitted through various methods, providing flexibility for corporations. Options include:

- Online Submission: Corporations can file electronically through the New York State Department of Taxation and Finance website.

- Mail: The completed form can be printed and mailed to the appropriate address as specified in the form instructions.

- In-Person: Corporations may also submit the form in person at designated tax offices, although this option is less common.

Who Issues the Form?

The NYS Form CT 3 is issued by the New York State Department of Taxation and Finance. This department is responsible for overseeing tax compliance and administration within the state. They provide guidance and resources for corporations to ensure that they understand their filing requirements and deadlines. Additionally, the department updates the form and its instructions regularly to reflect changes in tax law.

Quick guide on how to complete form ct 32019general business corporation franchise tax returnct3

Complete Nys Form Ct 3 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Nys Form Ct 3 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to alter and eSign Nys Form Ct 3 effortlessly

- Locate Nys Form Ct 3 and click on Get Form to begin.

- Use the available tools to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Nys Form Ct 3 to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 32019general business corporation franchise tax returnct3

How to create an eSignature for the Form Ct 32019general Business Corporation Franchise Tax Returnct3 online

How to make an electronic signature for the Form Ct 32019general Business Corporation Franchise Tax Returnct3 in Chrome

How to create an eSignature for signing the Form Ct 32019general Business Corporation Franchise Tax Returnct3 in Gmail

How to generate an eSignature for the Form Ct 32019general Business Corporation Franchise Tax Returnct3 straight from your smart phone

How to generate an electronic signature for the Form Ct 32019general Business Corporation Franchise Tax Returnct3 on iOS

How to make an electronic signature for the Form Ct 32019general Business Corporation Franchise Tax Returnct3 on Android OS

People also ask

-

What is nys ct 3 2019 and how does it relate to airSlate SignNow?

The nys ct 3 2019 form is a crucial document for businesses operating in New York. airSlate SignNow allows for the easy sending and eSigning of this form, ensuring compliance while simplifying the entire process. With our platform, you can manage your nys ct 3 2019 swiftly and efficiently, making paperwork hassle-free.

-

What are the pricing plans for using airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including the handling of documents like nys ct 3 2019. You can choose from monthly or yearly subscriptions, with options to scale as your business grows. Our affordable pricing ensures you get the best value for eSigning your important documents.

-

Can I integrate airSlate SignNow with other tools I use?

Yes, airSlate SignNow easily integrates with a variety of popular business applications. This capability allows you to streamline your workflows while handling documents like nys ct 3 2019. Whether you’re using CRM systems, project management tools, or any other software, our integrations ensure a seamless experience.

-

What features make airSlate SignNow suitable for handling nys ct 3 2019?

airSlate SignNow comes equipped with features tailored for efficient document management, including templates, reminders, and secure cloud storage. Specifically for nys ct 3 2019, these features help you track submission statuses and ensure timely compliance. Our user-friendly interface also makes it easy to navigate and manage your documents.

-

How secure is airSlate SignNow when signing documents like nys ct 3 2019?

Security is a top priority at airSlate SignNow. When you sign documents such as nys ct 3 2019, our platform employs advanced encryption technologies to protect your data. Additionally, we adhere to industry standards for electronic signatures, ensuring that your information remains secure and confidential.

-

How can airSlate SignNow improve my document workflow for nys ct 3 2019?

By utilizing airSlate SignNow, you can signNowly enhance your document workflow, especially for forms like nys ct 3 2019. Our automated processes help reduce manual errors and speed up the signing process. This efficiency translates to faster turnaround times and improved productivity for your team.

-

Is there a mobile app for airSlate SignNow to manage nys ct 3 2019?

Yes, airSlate SignNow offers a mobile app that allows you to manage documents like nys ct 3 2019 on the go. With our app, you can send, sign, and receive documents anytime, anywhere, making it convenient for busy professionals. This flexibility ensures that you can handle important paperwork immediately without being tied to your desk.

Get more for Nys Form Ct 3

Find out other Nys Form Ct 3

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free