FORM XLV Department of Commercial Taxes, Government of Uttar

What is the FORM XLV Department Of Commercial Taxes, Government Of Uttar

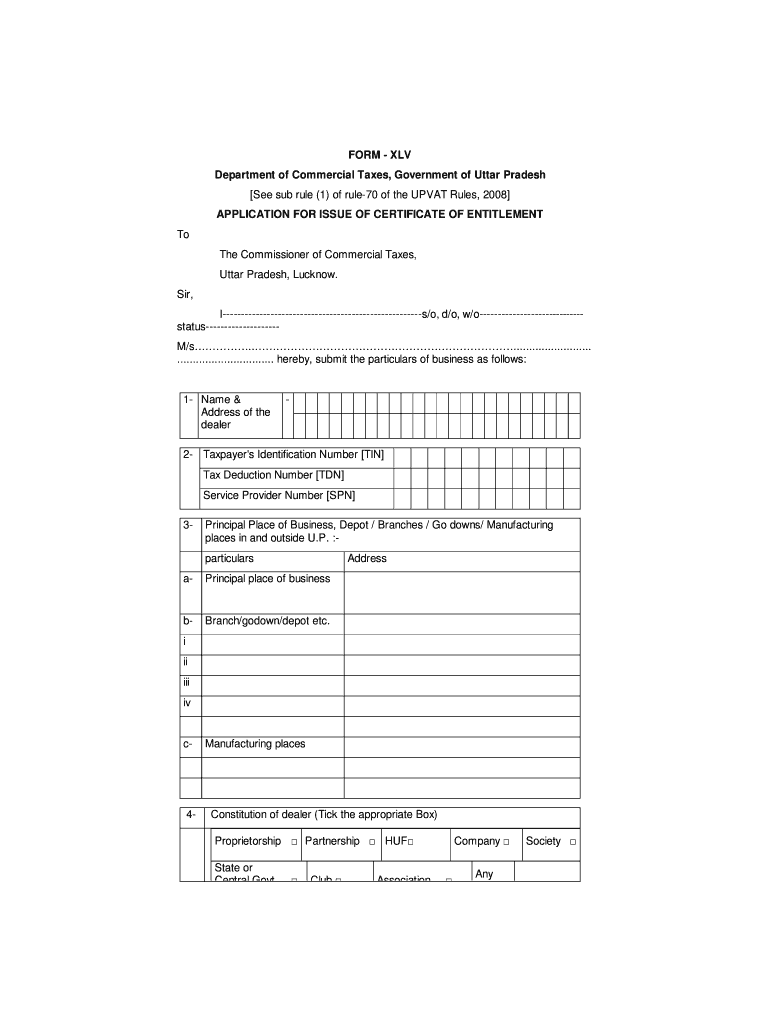

The FORM XLV is a specific document issued by the Department of Commercial Taxes in the Government of Uttar. It serves as a crucial tool for businesses and individuals to report and comply with tax regulations. This form is primarily used for the assessment and collection of commercial taxes, ensuring that all taxable activities are accurately documented. Understanding its purpose is essential for maintaining compliance with state tax laws.

How to use the FORM XLV Department Of Commercial Taxes, Government Of Uttar

Using the FORM XLV involves several key steps. First, gather all necessary information related to your business activities, including sales data and tax liabilities. Next, accurately fill out the form, ensuring that all sections are completed with the required details. Once completed, review the form for accuracy to avoid potential penalties. Finally, submit the form through the designated channels, which may include online submission or mailing to the appropriate tax office.

Steps to complete the FORM XLV Department Of Commercial Taxes, Government Of Uttar

Completing the FORM XLV requires a systematic approach. Follow these steps for a successful submission:

- Collect all relevant financial documents, including invoices and receipts.

- Access the FORM XLV from the official government website or your local tax office.

- Fill in the required fields, ensuring that all information is accurate and up-to-date.

- Double-check calculations related to tax amounts owed.

- Sign and date the form before submission.

Required Documents

To complete the FORM XLV, certain documents are necessary. These include:

- Sales records for the reporting period.

- Tax identification number for your business.

- Any previous tax returns or related documentation.

- Proof of any exemptions or deductions claimed.

Form Submission Methods (Online / Mail / In-Person)

The FORM XLV can be submitted through various methods, depending on the preferences of the taxpayer. Options include:

- Online Submission: Many jurisdictions allow for electronic filing through their official tax websites.

- Mail: Completed forms can be sent to the appropriate tax office via postal service.

- In-Person: Taxpayers may also choose to deliver the form directly to their local tax office.

Penalties for Non-Compliance

Failure to properly complete and submit the FORM XLV can result in significant penalties. These may include:

- Monetary fines based on the amount of tax owed.

- Interest on unpaid taxes accruing over time.

- Potential legal action for persistent non-compliance.

Quick guide on how to complete form xlv department of commercial taxes government of uttar

Complete [SKS] effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform using the airSlate SignNow apps for Android or iOS and streamline your document-related operations today.

The most effective way to edit and eSign [SKS] easily

- Find [SKS] and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Verify all information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from your preferred device. Modify and eSign [SKS] and ensure outstanding communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to FORM XLV Department Of Commercial Taxes, Government Of Uttar

Create this form in 5 minutes!

How to create an eSignature for the form xlv department of commercial taxes government of uttar

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FORM XLV Department Of Commercial Taxes, Government Of Uttar?

The FORM XLV Department Of Commercial Taxes, Government Of Uttar is a crucial document required for various tax-related processes in the state. It serves as a declaration for businesses to comply with local tax regulations. Understanding this form is essential for ensuring compliance and avoiding penalties.

-

How can airSlate SignNow help with the FORM XLV Department Of Commercial Taxes, Government Of Uttar?

airSlate SignNow simplifies the process of completing and submitting the FORM XLV Department Of Commercial Taxes, Government Of Uttar by allowing users to eSign and send documents securely. Our platform ensures that your submissions are timely and compliant with government regulations. This streamlines your workflow and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for the FORM XLV Department Of Commercial Taxes, Government Of Uttar?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our plans are designed to be cost-effective, ensuring that you can manage the FORM XLV Department Of Commercial Taxes, Government Of Uttar without breaking the bank. You can choose a plan that fits your needs and budget.

-

What features does airSlate SignNow provide for managing the FORM XLV Department Of Commercial Taxes, Government Of Uttar?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for the FORM XLV Department Of Commercial Taxes, Government Of Uttar. These features enhance efficiency and ensure that all necessary information is accurately captured. Additionally, our user-friendly interface makes it easy to navigate the process.

-

Are there any benefits to using airSlate SignNow for the FORM XLV Department Of Commercial Taxes, Government Of Uttar?

Using airSlate SignNow for the FORM XLV Department Of Commercial Taxes, Government Of Uttar offers numerous benefits, including increased efficiency and reduced paperwork. Our platform allows for quick turnaround times, ensuring that your documents are processed promptly. This can lead to improved compliance and peace of mind for your business.

-

Can airSlate SignNow integrate with other software for handling the FORM XLV Department Of Commercial Taxes, Government Of Uttar?

Yes, airSlate SignNow seamlessly integrates with various software applications to enhance your workflow for the FORM XLV Department Of Commercial Taxes, Government Of Uttar. This integration allows you to connect with your existing tools, making it easier to manage documents and data. Our API supports a wide range of applications to fit your business needs.

-

Is airSlate SignNow secure for submitting the FORM XLV Department Of Commercial Taxes, Government Of Uttar?

Absolutely! airSlate SignNow prioritizes security, ensuring that all documents, including the FORM XLV Department Of Commercial Taxes, Government Of Uttar, are protected with advanced encryption. We comply with industry standards to safeguard your sensitive information. You can trust us to keep your data secure throughout the signing process.

Get more for FORM XLV Department Of Commercial Taxes, Government Of Uttar

Find out other FORM XLV Department Of Commercial Taxes, Government Of Uttar

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed