Nys Ct 636 Form

What is the Nys Ct 636

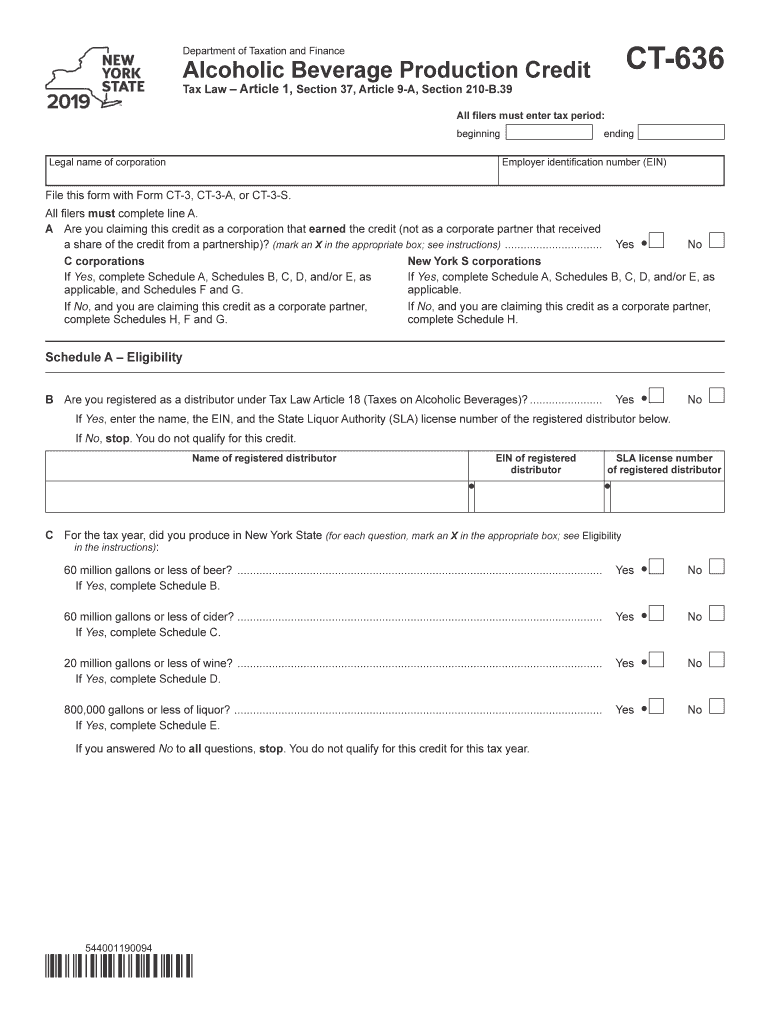

The Nys Ct 636, also known as the New York State Production Credit form, is a tax document used by businesses to claim production credits in New York. This form is essential for entities engaged in qualifying production activities, allowing them to receive tax benefits for their contributions to the state's economy. It is specifically designed to streamline the process of claiming these credits, ensuring compliance with state tax regulations.

How to Use the Nys Ct 636

Using the Nys Ct 636 involves several steps to ensure accurate completion and submission. First, gather all necessary information related to your production activities, including financial data and project details. Next, fill out the form carefully, providing all required information. Ensure that you double-check for accuracy to avoid delays in processing. Once completed, submit the form through the appropriate channels, whether electronically or via mail, as specified by the New York State Department of Taxation and Finance.

Steps to Complete the Nys Ct 636

Completing the Nys Ct 636 requires attention to detail. Follow these steps:

- Collect all relevant documentation, including financial records and project descriptions.

- Fill in the required fields on the form, ensuring accuracy in all entries.

- Review the form for any errors or omissions.

- Submit the completed form through the designated method, either online or by mail.

Legal Use of the Nys Ct 636

The Nys Ct 636 is legally binding when completed correctly and submitted according to state guidelines. It must adhere to the regulations set forth by the New York State Department of Taxation and Finance. Proper use of the form can provide significant tax benefits, but failure to comply with legal requirements may result in penalties or denial of credits.

Required Documents

To successfully complete the Nys Ct 636, you will need several documents, including:

- Financial statements detailing production costs.

- Project descriptions that qualify for production credits.

- Any prior correspondence with tax authorities regarding production activities.

Form Submission Methods

The Nys Ct 636 can be submitted through various methods, ensuring flexibility for users. Options include:

- Online submission through the New York State Department of Taxation and Finance portal.

- Mailing a hard copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if applicable.

Eligibility Criteria

Eligibility for using the Nys Ct 636 is determined by specific criteria set by the state. Generally, businesses must be engaged in qualifying production activities within New York. This includes meeting certain financial thresholds and project requirements. It is essential to review the eligibility guidelines to ensure compliance before submitting the form.

Quick guide on how to complete form ct 6362019alcoholic beverage production creditct636

Complete Nys Ct 636 effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow offers all the features you need to create, modify, and eSign your documents swiftly without complications. Manage Nys Ct 636 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Nys Ct 636 with ease

- Find Nys Ct 636 and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, via email, SMS, invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or mistakes that require creating new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Nys Ct 636 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 6362019alcoholic beverage production creditct636

How to generate an eSignature for the Form Ct 6362019alcoholic Beverage Production Creditct636 in the online mode

How to create an electronic signature for your Form Ct 6362019alcoholic Beverage Production Creditct636 in Google Chrome

How to generate an electronic signature for putting it on the Form Ct 6362019alcoholic Beverage Production Creditct636 in Gmail

How to make an electronic signature for the Form Ct 6362019alcoholic Beverage Production Creditct636 straight from your smartphone

How to make an electronic signature for the Form Ct 6362019alcoholic Beverage Production Creditct636 on iOS

How to generate an eSignature for the Form Ct 6362019alcoholic Beverage Production Creditct636 on Android devices

People also ask

-

What is CT 636 and how does it relate to airSlate SignNow?

CT 636 refers to a specific compliance requirement that can be managed effectively using airSlate SignNow. It allows businesses to ensure that their document workflows align with legal standards while simplifying the eSigning process. By integrating CT 636 compliance into our platform, airSlate SignNow helps organizations streamline their documentation needs.

-

How does airSlate SignNow help with CT 636 compliance?

airSlate SignNow provides features that support CT 636 compliance by ensuring that all electronic signatures meet legal requirements. The platform offers secure and auditable eSignatures, which are vital for documents governed by CT 636 regulations. Utilizing airSlate SignNow, businesses can confidently manage their documentation while adhering to compliance standards.

-

What are the pricing options for airSlate SignNow related to CT 636?

airSlate SignNow offers various pricing plans to accommodate different needs relating to CT 636 compliance. The plans are designed to fit business sizes from small enterprises to large corporations. By selecting the appropriate plan, users can access features tailored to meet CT 636 requirements at competitive rates.

-

What features does airSlate SignNow offer for managing CT 636 documents?

airSlate SignNow includes robust features specifically designed for managing CT 636 documents, such as custom templates, automated workflows, and real-time editing. Users can easily create, send, and eSign documents while ensuring that all CT 636 compliance measures are met. These features enhance efficiency and reduce turnaround times for document approval.

-

Can airSlate SignNow integrate with other software for CT 636 compliance?

Yes, airSlate SignNow integrates seamlessly with various third-party applications to enhance CT 636 compliance workflows. By connecting with tools like CRM and project management software, businesses can automate their document processes and ensure that CT 636 requirements are always in check. This flexibility allows for a more streamlined approach to compliance.

-

What benefits does airSlate SignNow provide for businesses concerned with CT 636?

Businesses using airSlate SignNow benefit from improved efficiency, cost savings, and compliance assurance regarding CT 636. The platform simplifies the entire eSigning process, allowing for faster turnaround times and reduced paper usage. By leveraging these benefits, organizations can focus more on their core activities while staying compliant with CT 636.

-

How user-friendly is airSlate SignNow for managing CT 636 documents?

airSlate SignNow is designed with user experience in mind, making it easy to manage CT 636 documents. The intuitive interface allows users of all skill levels to navigate the platform efficiently. Whether creating a document or adding eSignatures, the user-friendly design minimizes the learning curve.

Get more for Nys Ct 636

- Oregon death certificate form

- Formula authorization form pennsylvania wic

- Www uslegalforms comform library258314procedure consent form se pa pain management fill and

- Security contract template form

- Security deposit contract template form

- Security guard contract template form

- Security guard service contract template form

- Security proposal contract template form

Find out other Nys Ct 636

- Electronic signature California Divorce Settlement Agreement Template Free

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer