It213 Form

What is the IT-213?

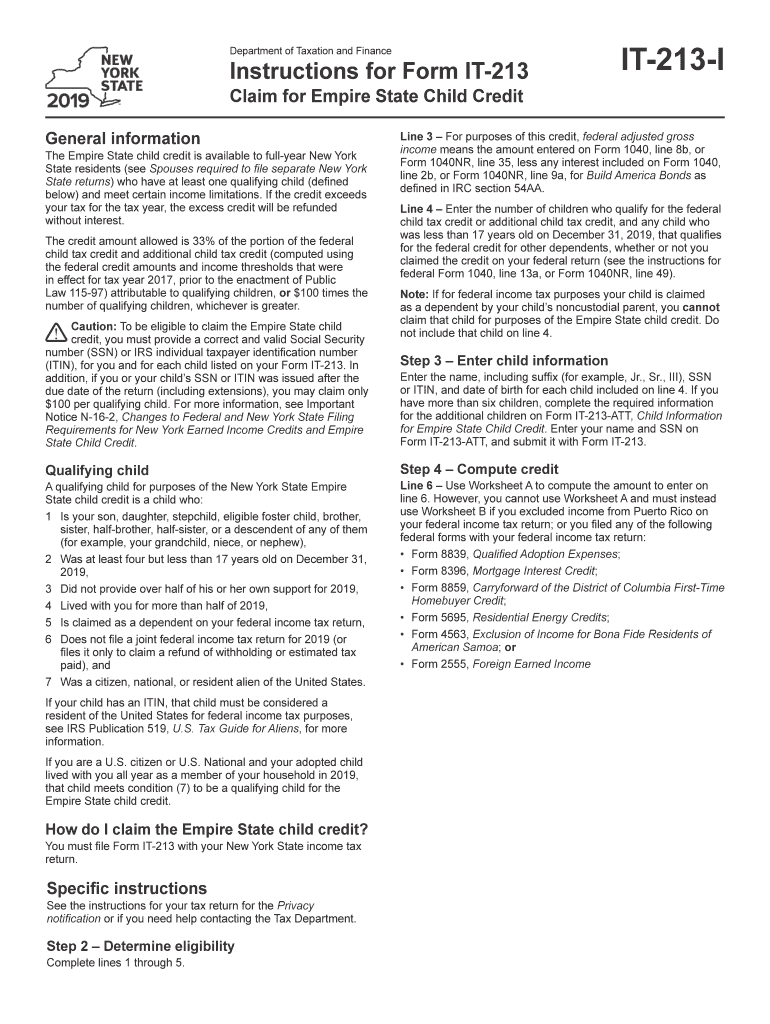

The IT-213 form, also known as the 2019 IT-213 form, is a tax document used by residents of New York State to claim a credit for taxes paid to other jurisdictions. This form is essential for individuals who work in a different state than where they reside, allowing them to receive a tax credit for taxes withheld in their work state. By accurately completing the IT-213, taxpayers can ensure they are not taxed twice on the same income, thereby optimizing their tax obligations.

Steps to Complete the IT-213

Completing the IT-213 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including W-2 forms from employers in both your home state and the state where you worked. Next, fill out your personal information, including your name, address, and Social Security number. Then, report your income earned in the other jurisdiction and the taxes paid. Calculate the credit amount by following the instructions provided on the form. Finally, review your entries for accuracy before submitting the form.

Legal Use of the IT-213

The IT-213 form is legally binding when filled out correctly and submitted on time. It is designed to comply with New York State tax laws, ensuring that taxpayers receive the appropriate credits for taxes paid to other states. To maintain legal validity, it is crucial to provide accurate information and retain copies of all supporting documents, such as tax returns and W-2 forms, in case of future audits.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the IT-213 form to avoid penalties. Generally, the IT-213 must be filed by the same deadline as your New York State income tax return, which is typically April fifteenth. If you require an extension, ensure that the IT-213 is submitted by the extended deadline to maintain eligibility for the credit.

Required Documents

To successfully file the IT-213 form, several documents are required. These include:

- W-2 forms from all employers

- Proof of taxes paid to the other jurisdiction

- New York State income tax return

- Any additional documentation that supports your claim for the credit

Having these documents readily available will streamline the completion and submission process.

Form Submission Methods

The IT-213 form can be submitted through various methods. Taxpayers have the option to file online through the New York State Department of Taxation and Finance website, or they can mail a paper copy of the form to the appropriate tax office. In-person submissions are also possible at local tax offices, allowing for direct assistance if needed. Choosing the right method depends on personal preference and the complexity of the tax situation.

Quick guide on how to complete form it 213 i2019instructions for form it 213 claim for empire state child creditit213i

Effortlessly Prepare It213 on Any Device

The management of documents online has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without hassles. Manage It213 on any device using airSlate SignNow's Android or iOS applications, and simplify any document-based task today.

The easiest method to modify and electronically sign It213 without stress

- Locate It213 and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight essential sections of the documents or mask sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details, and then click the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign It213 to ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 213 i2019instructions for form it 213 claim for empire state child creditit213i

How to create an electronic signature for the Form It 213 I2019instructions For Form It 213 Claim For Empire State Child Creditit213i online

How to make an eSignature for your Form It 213 I2019instructions For Form It 213 Claim For Empire State Child Creditit213i in Chrome

How to make an eSignature for signing the Form It 213 I2019instructions For Form It 213 Claim For Empire State Child Creditit213i in Gmail

How to generate an eSignature for the Form It 213 I2019instructions For Form It 213 Claim For Empire State Child Creditit213i straight from your mobile device

How to make an electronic signature for the Form It 213 I2019instructions For Form It 213 Claim For Empire State Child Creditit213i on iOS

How to make an electronic signature for the Form It 213 I2019instructions For Form It 213 Claim For Empire State Child Creditit213i on Android OS

People also ask

-

What is 2019 it 213 in relation to airSlate SignNow?

2019 it 213 refers to a specific standard for electronic signatures that airSlate SignNow complies with. By adhering to this guideline, airSlate SignNow ensures that your eSigning process is secure, reliable, and legally binding, which provides peace of mind for businesses.

-

How does airSlate SignNow pricing work for businesses using 2019 it 213?

airSlate SignNow offers competitive pricing plans that cater to various business sizes and needs while ensuring compliance with 2019 it 213. Each plan includes features that enhance the eSigning experience, allowing you to choose the option that provides the best value based on your document volume and usage.

-

What are the key features of airSlate SignNow compliant with 2019 it 213?

Key features of airSlate SignNow that comply with 2019 it 213 include advanced security measures, customizable workflows, and audit trails. These features ensure that your documents are processed efficiently and securely, giving you full control over your eSigning tasks.

-

How does airSlate SignNow enhance document security under 2019 it 213?

Under the framework of 2019 it 213, airSlate SignNow implements top-notch encryption and authentication methods to safeguard your documents. These security features prevent unauthorized access and ensure that all signed documents remain legitimate and tamper-proof.

-

What benefits does airSlate SignNow offer businesses with 2019 it 213 compliance?

By utilizing airSlate SignNow with 2019 it 213 compliance, businesses can streamline their signing process, reduce paper usage, and improve operational efficiency. The integration of eSigning allows for faster contract turnaround times, which can signNowly boost productivity.

-

Can airSlate SignNow integrate with other software to support 2019 it 213?

Yes, airSlate SignNow supports integrations with a variety of software solutions to complement its 2019 it 213 compliance. This means you can connect your eSigning process with tools like CRM systems or cloud storage applications, making workflow more seamless and efficient.

-

How user-friendly is airSlate SignNow for eSigning under 2019 it 213?

airSlate SignNow is designed with user experience in mind, making it intuitive for anyone to use for eSigning under 2019 it 213. With a simple interface and guided workflows, users can easily send and sign documents without needing technical expertise.

Get more for It213

- 990 b form

- Tax credits information

- Registered agent consent form

- Application for transfer of land form

- Wells fargo affidavit of domicile 100422028 form

- Td bank makes setting up direct deposit easy with this convenient pre filled form

- School contract template form

- School photography contract template form

Find out other It213

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed