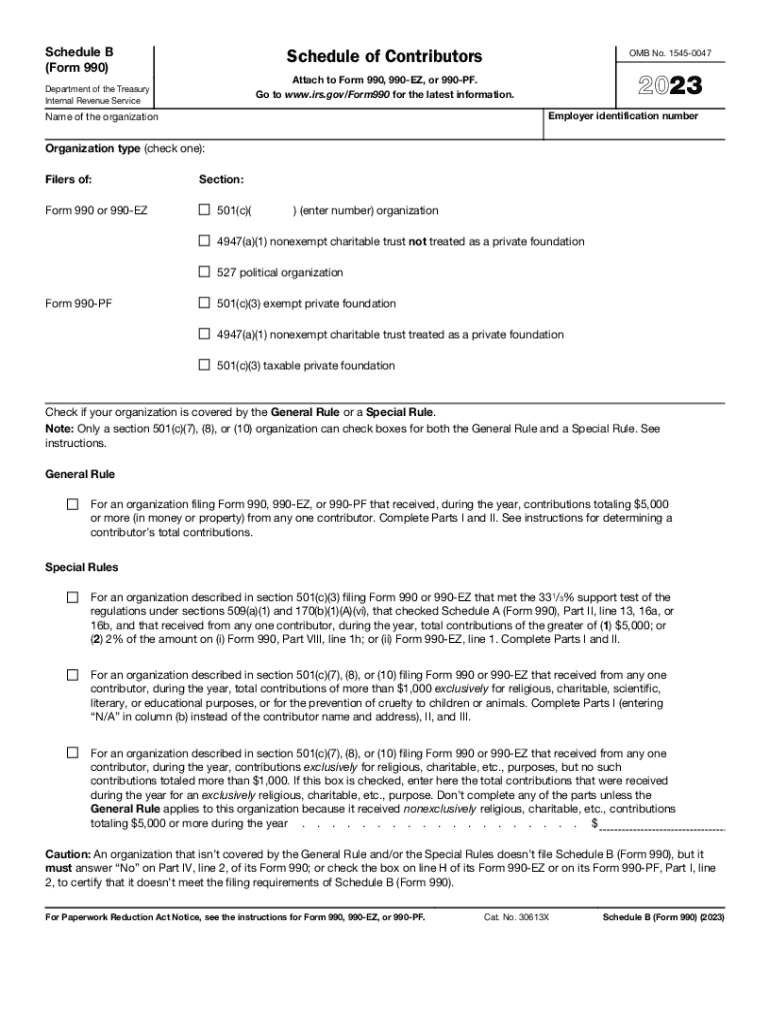

990 B 2023

What is the 990 EZ Schedule O?

The 990 EZ Schedule O is a supplemental form used by certain tax-exempt organizations in the United States to provide additional information about their activities, governance, and financial practices. This form is part of the larger IRS Form 990 series, which is required for organizations earning more than a specific threshold of gross receipts. The Schedule O allows organizations to clarify their responses on the main form, detailing their mission, accomplishments, and any changes in operations.

Key Elements of the 990 EZ Schedule O

The 990 EZ Schedule O includes several important components that organizations must address. These elements typically cover:

- Mission Statement: A concise description of the organization's purpose and objectives.

- Significant Changes: Any major changes in the organization’s operations, governance, or structure that occurred during the tax year.

- Program Accomplishments: Detailed descriptions of the organization’s key programs and their impact on the community.

- Financial Practices: Information about the organization’s financial management, including how funds are allocated to various programs.

Steps to Complete the 990 EZ Schedule O

Completing the 990 EZ Schedule O involves several steps to ensure accuracy and compliance with IRS requirements. The process typically includes:

- Gathering necessary documentation, including financial statements and program descriptions.

- Reviewing the main Form 990 EZ to identify areas that require additional explanation.

- Filling out the Schedule O with clear and concise information that addresses each required section.

- Reviewing the completed Schedule O for accuracy and completeness before submission.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the 990 EZ Schedule O to avoid penalties. Generally, the due date for filing Form 990 EZ, along with its Schedule O, is the 15th day of the fifth month after the end of the organization’s fiscal year. For example, if the fiscal year ends on December 31, the form is due by May 15 of the following year. Extensions may be available, but they must be filed before the original due date.

IRS Guidelines for the 990 EZ Schedule O

The IRS provides specific guidelines for completing the 990 EZ Schedule O, emphasizing clarity and transparency. Organizations are encouraged to provide thorough explanations and to avoid vague language. Adhering to these guidelines helps ensure that the organization meets compliance requirements and provides stakeholders with a clear understanding of its operations and impact.

Penalties for Non-Compliance

Failure to file the 990 EZ Schedule O or inaccuracies in the information provided can result in penalties imposed by the IRS. These penalties may include fines and, in severe cases, the loss of tax-exempt status. Organizations should prioritize timely and accurate submissions to mitigate these risks and maintain their compliance with federal regulations.

Quick guide on how to complete 990 b

Complete 990 B effortlessly on any device

The management of documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides all the resources required to generate, modify, and electronically sign your documents promptly without delays. Manage 990 B on any device utilizing the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign 990 B with ease

- Obtain 990 B and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a customary wet ink signature.

- Review all the details and click on the Done button to save your adjustments.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your device of choice. Edit and electronically sign 990 B and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 990 b

Create this form in 5 minutes!

How to create an eSignature for the 990 b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 990 ez schedule o and how does it work?

The 990 ez schedule o is a simplified tax form that nonprofits use to report their financial activities to the IRS. It is designed for smaller organizations, allowing them to provide essential information while reducing administrative burden. By using the 990 ez schedule o, you can comply with tax regulations more efficiently.

-

How can airSlate SignNow simplify the process of completing the 990 ez schedule o?

airSlate SignNow streamlines the process of completing the 990 ez schedule o by offering easy document editing and eSigning features. You can easily fill out the form, collect signatures from board members, and securely send it to the IRS. This efficiency cuts down on time spent preparing important tax documents.

-

Are there any costs associated with using airSlate SignNow for the 990 ez schedule o?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for nonprofits. These plans ensure that you can access the tools necessary to efficiently manage your 990 ez schedule o without breaking the bank. Plus, the cost-effectiveness of airSlate SignNow provides excellent value for your organization.

-

What features of airSlate SignNow are most beneficial for completing the 990 ez schedule o?

Key features of airSlate SignNow that benefit users handling the 990 ez schedule o include document templates, customizable fields, and audit trails. These tools allow for streamlined document management and ensure compliance with tax reporting standards. Having these features at your disposal can signNowly enhance your filing process.

-

Can I integrate airSlate SignNow with other tools to manage the 990 ez schedule o?

Yes, airSlate SignNow offers various integrations with popular applications that facilitate the management of the 990 ez schedule o. Whether you need to connect with CRM systems or accounting software, airSlate has you covered. These integrations help ensure that all your data is synchronized, saving you time and reducing errors in your filings.

-

What are the main benefits of using airSlate SignNow for the 990 ez schedule o?

Using airSlate SignNow for your 990 ez schedule o offers numerous benefits, including increased efficiency, secure eSigning, and simplified document management. These features not only save time but also ensure compliance with IRS requirements. Overall, airSlate SignNow empowers nonprofits to manage their filings with ease and confidence.

-

Is airSlate SignNow user-friendly for those unfamiliar with the 990 ez schedule o?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible to individuals who may be unfamiliar with the 990 ez schedule o. The intuitive interface guides users through each step of the document preparation and signing process, making it easy for anyone to complete their tax forms correctly.

Get more for 990 B

- Athlete information sheet 5650110

- Training chfs ky gov child care preparedness html dcc 0 nulled form

- Domestic disturbance exam form

- Material withdrawal slip sample form

- Hoa improvement request form orgsitescom

- Fedex billable stamp how to fill out form

- Cs es119 form

- New patient packet michigan rheumatology form

Find out other 990 B

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free